|

#2

June 20th, 2016, 12:22 PM

| |||

| |||

| Re: Bank of America 401k MFS International Growth

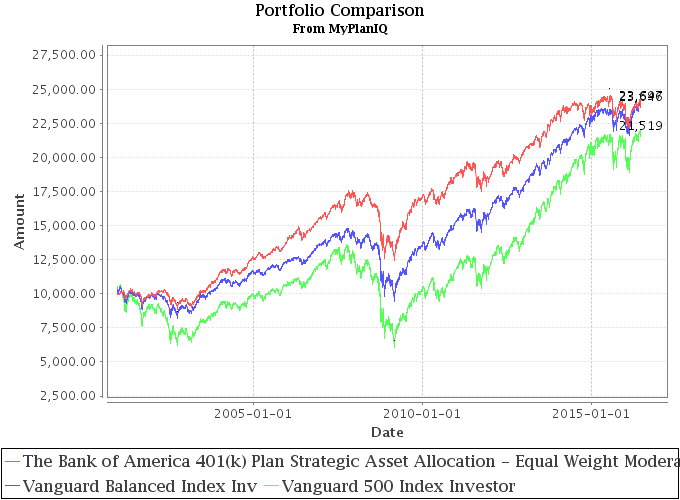

Bank of America Corporation, a money related holding organization, gives managing an account and nonbanking budgetary administrations and items to individual purchasers, little and center business sector organizations, expansive enterprises, and governments in the United States and universally. The arrangement comprises of 30 assets. It covers 3 noteworthy resource classes and 22 minor resource classes. The real resource classes it spreads are US Equity, Foreign Equity and Fixed Income. The assignments are expanded by putting resources into the 3 noteworthy resource classes: US Equity, Foreign Equity, Fixed Income that are secured in The Bank of America 401(k) Plan. It then chooses maybe a couple reserves for each of the 3 noteworthy resource classes. 1.Risk allotment: the danger profile of this portfolio 40. The aggregate allotment of the altered pay resources ought to be no less than 40%. 2.Asset weights: hazard resources chose are similarly weighted as a matter of course. 3.Fund choice: around maybe a couple top performing reserves among 30 accessible assets in the arrangement are decided for every advantage chose. They are normally similarly weighted inside the benefit of course. 4.Rebalance recurrence: the portfolio is evaluated by the methodology program month to month and the above strides are rehashed. Resource weights are rebalanced back to target portion in the event that it is vital. 5. Reproduction: Performance information before this portfolio opened up to the world is acquired from chronicled reenactment. They are speculative.  |