|

#2

January 18th, 2018, 02:05 PM

| |||

| |||

| Re: Bike Loan Interest Rates In Indian Bank

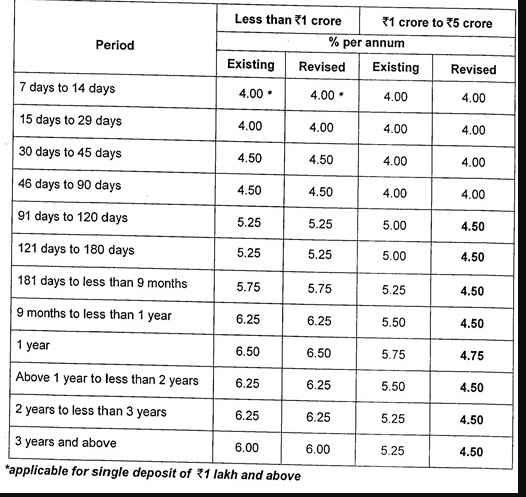

The Indian Bank offers Vehicle Loan for purchase of New Two Wheeler or New / Used Four Wheeler (Used four wheeler should not be more than 3 years and should be certified by reputed automobile engineer / valuer) Indian Bank Interest Rates Revision of Interest rate on Savings Bank Deposits wef 16.08.2017 Interest Rates on Domestic Term Deposits % p.a (w.e.f. 10.02.2017) (% per annum)  Applicable for single deposit of Rs.1 lakh and above For Deposit of above Rs 5 crore, acceptance of such deposits will be at the approval of the Treasury Branch IB Vehicle Loan Eligibility Minimum Gross monthly income for purchase of a car should be Rs.20,000/- p.m. For Salaried Class: 20 times of Gross monthly Salary (Income of spouse may be included). Net Take Home Pay after deducting proposed Loan EMI, must be ensured at 40% of Gross Pay. For professionals and Businessmen: 20 Months Income – to be calculated based on their average income earned in the last 2 years and Capacity / ability to repay the loan. Amount of Loan Maximum loan ceiling: Two Wheelers: Rs. 10 Lakhs Four Wheelers: Rs. 200 Lakhs Margin * 15% for New Vehicle * 40% for used vehicle (Four wheeler) Processing fee 0.229% on loan amount with a max. of Rs.10191/- Contact- Corporate Office - Postal Address Indian Bank, Corporate Office, PB No: 5555, 254-260, Avvai Shanmugam Salai, Royapettah, Chennai - 600 014 Corporate Office - Phone Number 044 28134300 |