|

#2

November 22nd, 2017, 10:16 AM

| |||

| |||

| Re: BRK B Intrinsic Value

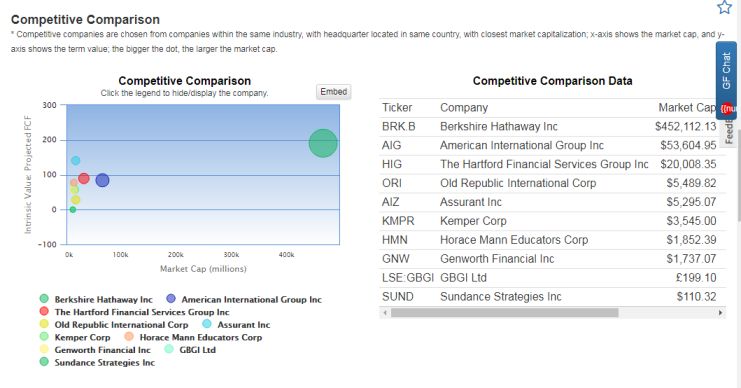

Since the inborn esteem figurings in light of Discounted Cash Flow Intrinsic Value: DCF (FCF Based), or Discounted Earnings Intrinsic Value: DCF (Earnings Based) can't be connected to organizations without steady income and profit, the built up a valuation show in view of standardized Free Cash Flow and Book Value of the organization. The subtle elements of how it figures the natural estimation of stocks are portrayed. Berkshire Hathaway Inc's anticipated FCF characteristic esteem is $191.13. The stock cost of Berkshire Hathaway Inc is $189.39. Consequently, Berkshire Hathaway Inc's Price to Intrinsic Value: Projected FCF Ratio of today is 1.0. BRK.B' s Price-to-Intrinsic-Value-Projected-FCF Range Over the Past 10 Years Min: 0.8 Max: 2.12 Current: 0.99 During the past 13 years, the highest Price to Intrinsic Value: Projected FCF Ratio of Berkshire Hathaway Inc was 2.12 as well as the lowest was 0.80 and the median was 1.08. BRK.B's Price-to-Intrinsic-Value-Projected-FCF is ranked lower than 64% of the 67 Companies as compared to the Global industry. Competitive Comparison Data Ticker Company Market Cap Intrinsic Value: Projected FCF BRK.B Berkshire Hathaway Inc $467,054.40 191.13 Competitive Comparison  Calculation Since the characteristic esteem estimations in view of Discounted Cash Flow Intrinsic Value: DCF (FCF Based), or Discounted Earnings Intrinsic Value: DCF (Earnings Based) can't be connected to organizations without reliable income and profit, GuruFocus built up a valuation show in light of standardized Free Cash Flow and Book Value of the organization. The points of interest of how the value is ascertained in the characteristic estimation of stocks are depicted in detail here. This strategy smooths out the free income in the course of the last 6-7 years, duplicates the outcomes by a development different, and includes a segment of aggregate value. Esteem = ((Growth Multiple)*Free Cash Flow(6 year avg) + 0.8*Total Equity(most late))/Shares Outstanding (Diluted Average) On account of negative aggregate value, the accompanying equation is utilized (see the Total Equity area for the reason): Esteem = ((Growth Multiple)*Free Cash Flow(6 year avg) + Total Equity(most later)/0.8)/Shares Outstanding (Diluted Average) Here Berkshire Hathaway Inc's FCF(6 year avg) is compute as Berkshire Hathaway Inc Quarterly Data total_freecashflow Include all the Free Cash Flow together and partition 6 will get Berkshire Hathaway Inc's FCF(6 year avg) = $17,805.17. |