|

#1

July 9th, 2014, 02:01 PM

| |||

| |||

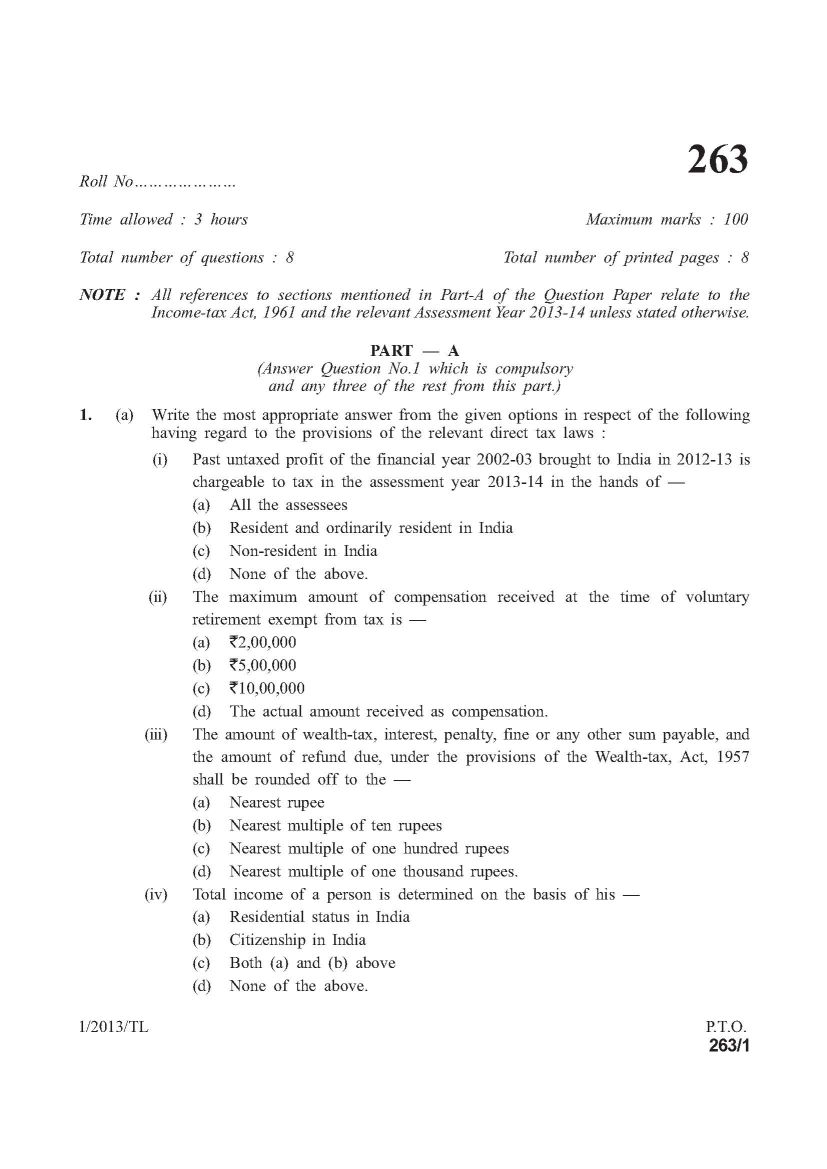

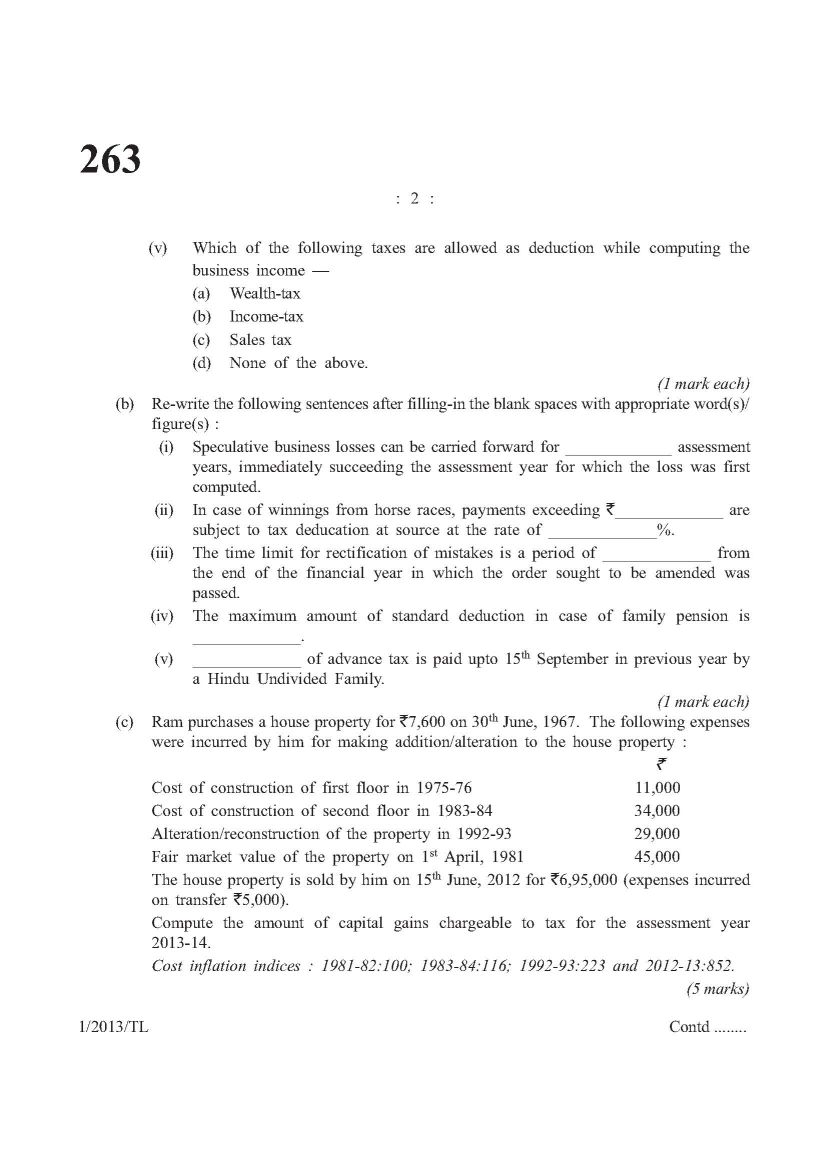

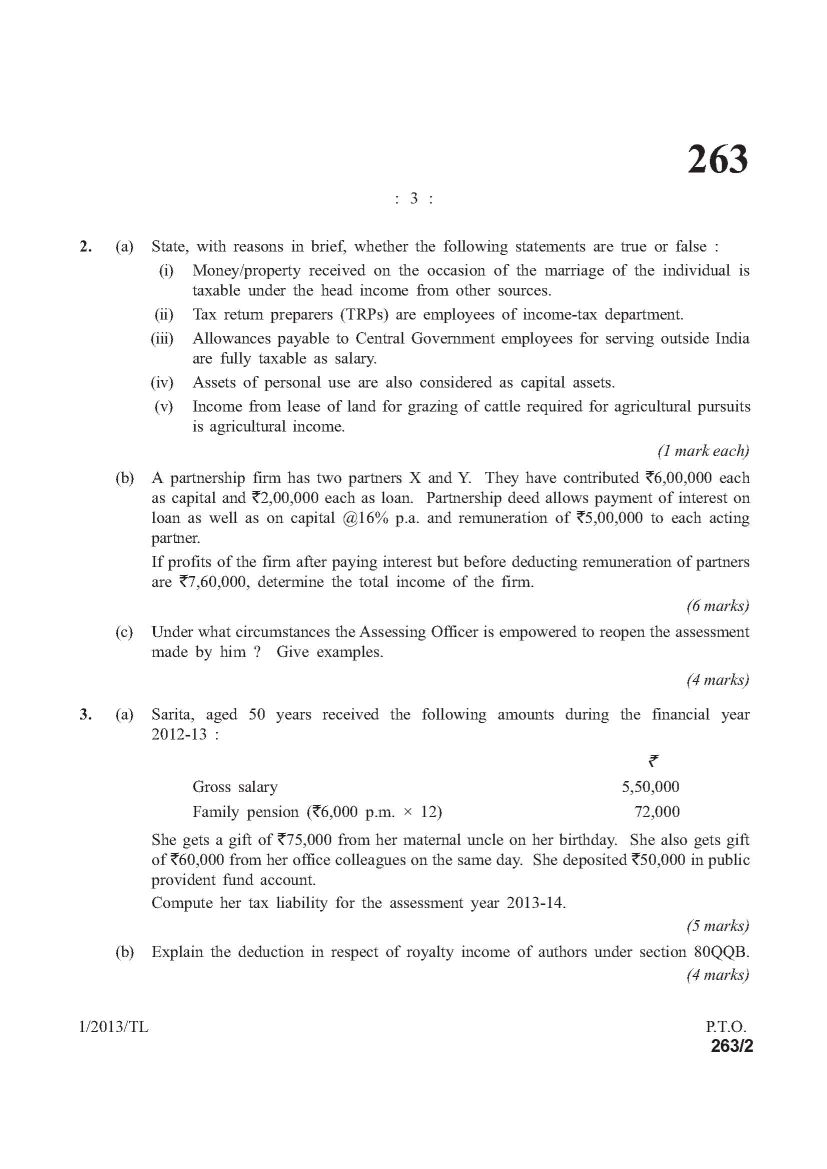

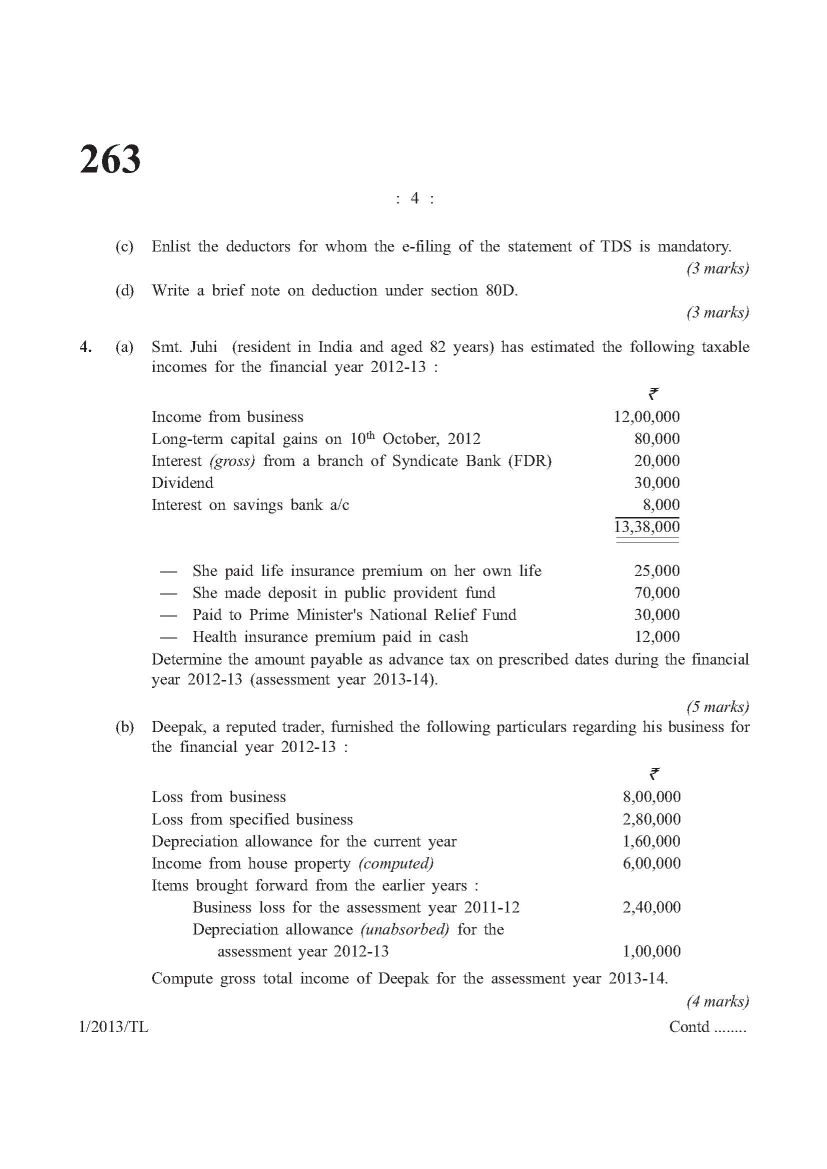

| CS Executive Programme Tax Laws last year paper

Please provide me question paper for CS Executive Programme Tax Laws examination in a PDF file format ? Here I am giving you question paper for CS Executive Programme Tax Laws examination in a PDF file attached with it so you can get it easily. 1. (a) Write the most appropriate answer from the given options in respect of the following having regard to the provisions of the relevant direct tax laws : (i) Past untaxed profit of the financial year 2002-03 brought to India in 2012-13 is chargeable to tax in the assessment year 2013-14 in the hands of — (a) All the assessees (b) Resident and ordinarily resident in India (c) Non-resident in India (d) None of the above. (ii) The maximum amount of compensation received at the time of voluntary retirement exempt from tax is — (a) `2,00,000 (b) `5,00,000 (c) `10,00,000 (d) The actual amount received as compensation. (iii) The amount of wealth-tax, interest, penalty, fine or any other sum payable, and the amount of refund due, under the provisions of the Wealth-tax, Act, 1957 shall be rounded off to the — (a) Nearest rupee (b) Nearest multiple of ten rupees (c) Nearest multiple of one hundred rupees (d) Nearest multiple of one thousand rupees. (iv) Total income of a person is determined on the basis of his — (a) Residential status in India (b) Citizenship in India (c) Both (a) and (b) above (d) None of the above. (v) Which of the following taxes are allowed as deduction while computing the business income — (a) Wealth-tax (b) Income-tax (c) Sales tax (d) None of the above. (1 mark each) (b) Re-write the following sentences after filling-in the blank spaces with appropriate word(s)/ figure(s) : (i) Speculative business losses can be carried forward for _____________ assessment years, immediately succeeding the assessment year for which the loss was first computed. (ii) In case of winnings from horse races, payments exceeding `_____________ are subject to tax deducation at source at the rate of _____________%. (iii) The time limit for rectification of mistakes is a period of _____________ from the end of the financial year in which the order sought to be amended was passed. (iv) The maximum amount of standard deduction in case of family pension is _____________. (v) _____________ of advance tax is paid upto 15th September in previous year by a Hindu Undivided Family. (1 mark each)     Last edited by Neelurk; March 25th, 2020 at 02:32 PM. |