|

#1

July 15th, 2014, 10:04 AM

| |||

| |||

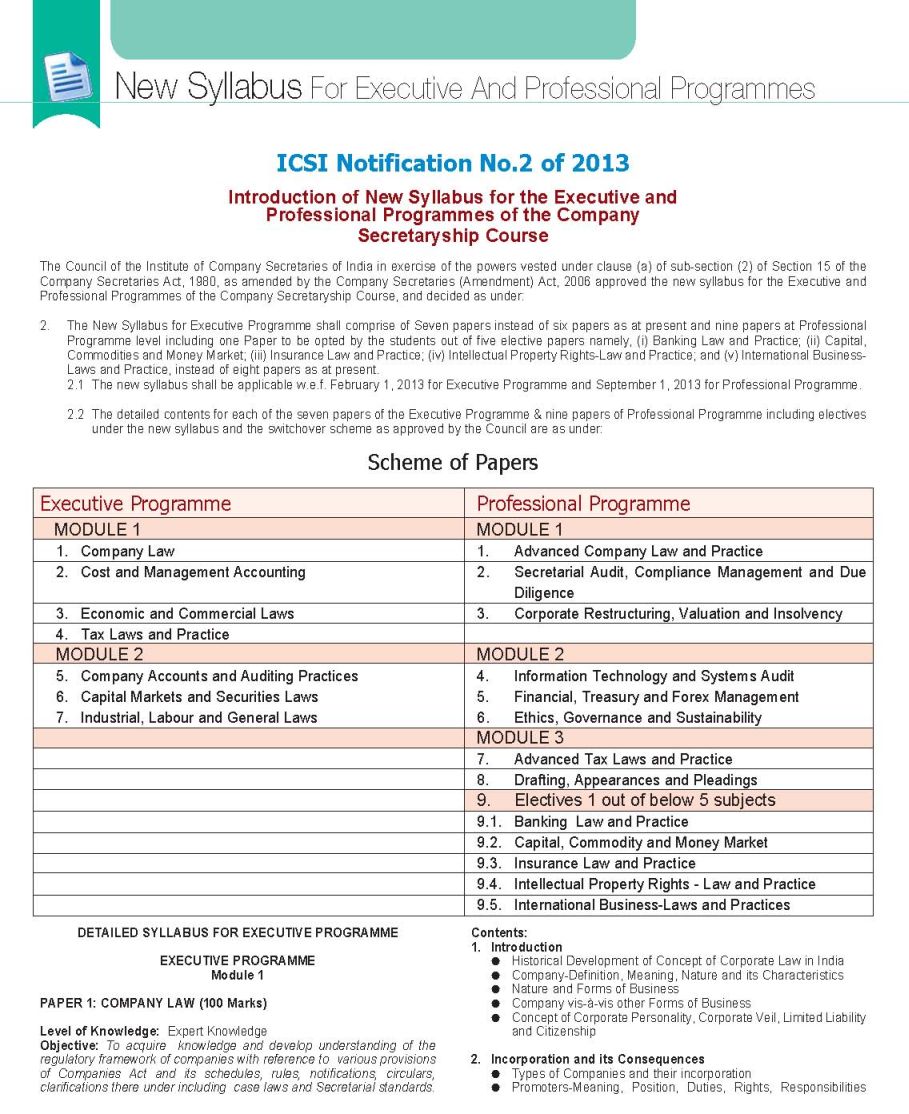

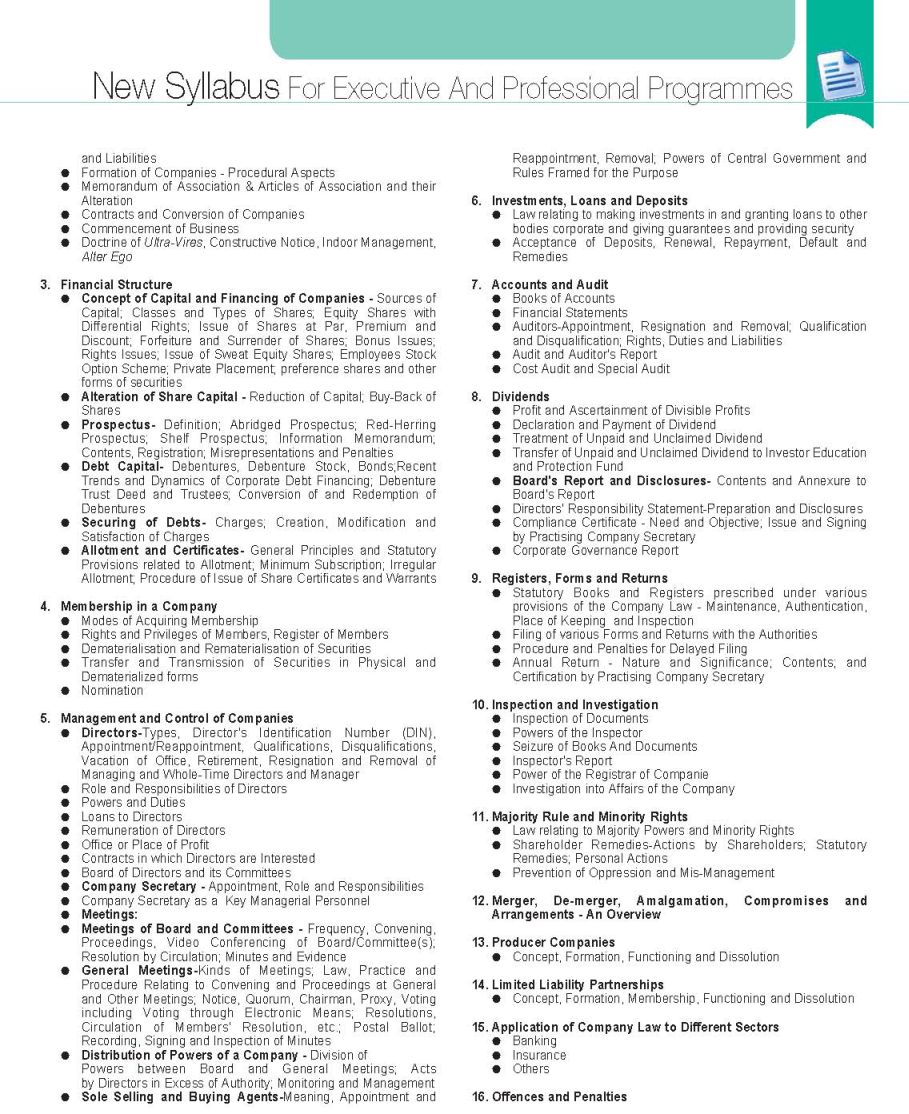

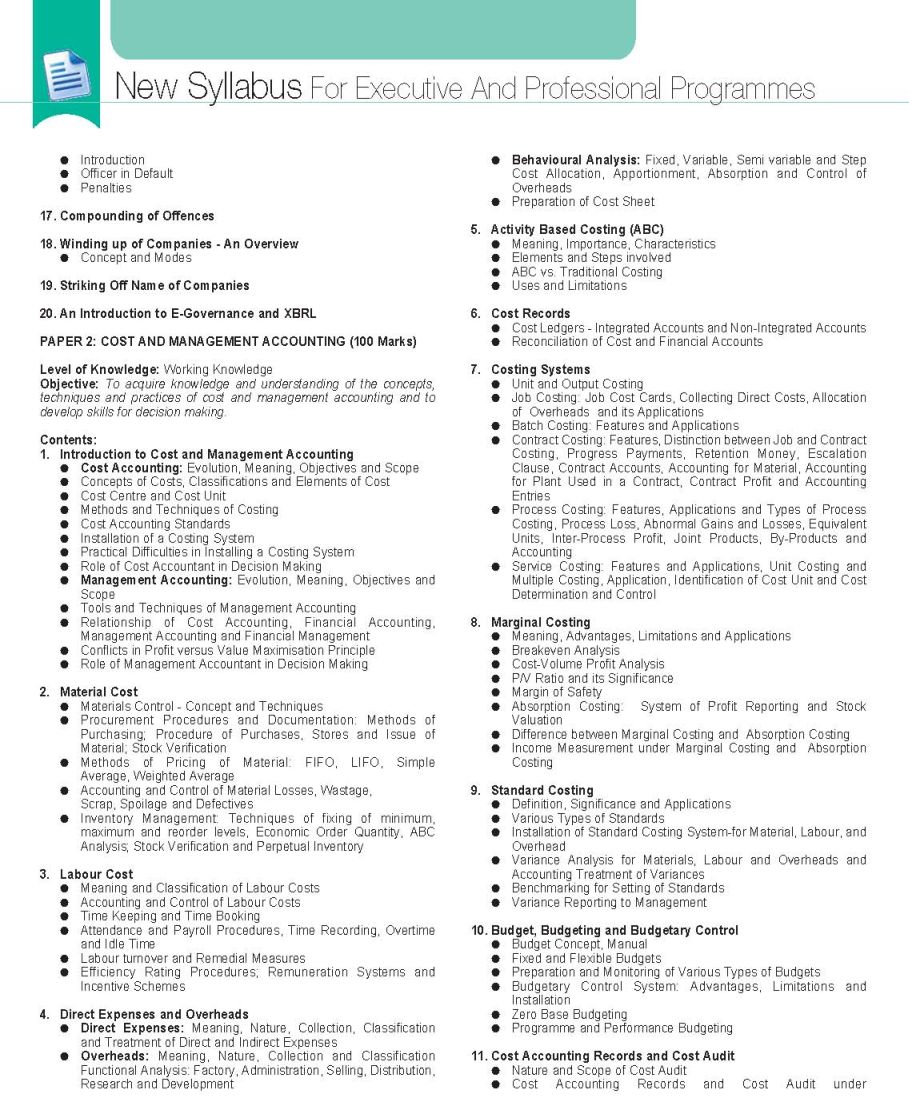

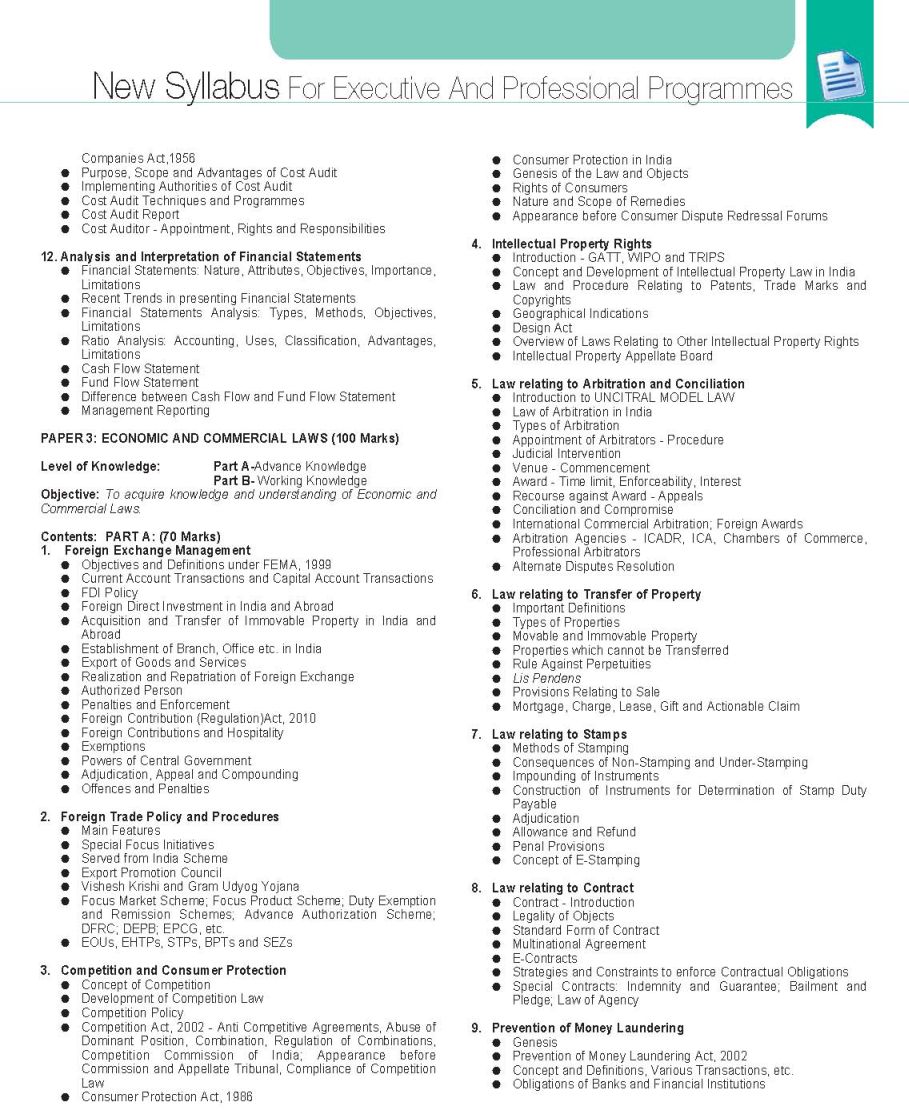

| CS Executive study material

Can you give me syllabus for Company Secretary foundation stage of Institute of Company Secretaries of India (ICSI) in a PDF format ? Here I am giving you syllabus for Company Secretary foundation stage of Institute of Company Secretaries of India (ICSI) in a PDF file attached with it . Executive Programme Module I 1. General and Commercial Laws 2. Company Accounts, Cost and Management Accounting 3. Tax Laws Module II 4. Company Law 5. Economic and Labour Laws 6. Securities Laws and Compliances Professional Programme Module I 1. Company Secretarial Practice 2. Drafting, Appearances and Pleadings Module II 3. Financial, Treasury and Forex Management 4. Corporate Restructuring and Insolvency Module III 5. Strategic Management, Alliances and International Trade 6. Advanced Tax Laws and Practice Module IV 7. Due Diligence and Corporate Compliance Management 8. Governance, Business Ethics and Sustainability 4. The implementation of the new syllabus will be as follows : EXECUTIVE PROGRAMME MODULE I PAPER 1 : GENERAL AND COMMERCIAL LAWS Level of knowledge : Working knowledge Objective : To provide to the students basic understanding of some of the general and commercial laws which have a bearing on the conduct of the corporate affairs. Detailed contents : 1. Constitution of India Broad framework of the Constitution of India; fundamental rights; directive principles of state policy; ordinance making powers of the President and the Governors; legislative powers of the Union and the States; freedom of trade, commerce and intercourse; constitutional provisions relating to State monopoly; judiciary; writ jurisdiction of High Courts and the Supreme Court; different types of writs - habeas corpus, mandamus, prohibition, quo warranto and certiorari; Concept of delegated legislation. 2. Interpretation of Statutes Need for interpretation of a statute; general principles of interpretation - internal and external aids to interpretation; primary and other rules. 3. An Overview of Law relating to Specific Relief; Arbitration and Conciliation; Torts; Limitation and Evidence. 4. Law relating to Transfer of Property Important definitions; movable and immovable property; properties which cannot be transferred; rule against perpetuities; lis pendens; provisions relating to sale, mortgage, charge, lease, gift and actionable claim. 5. Law relating to Stamps Methods of stamping; consequences of non-stamping and understamping; impounding of instruments; construction of instruments for determination of stamp duty payable; adjudication; allowance and refund; penal provisions. 6. Law relating to Registration of Documents Registrable documents - compulsory and optional; time and place of registration; consequences of non-registration; description of property; miscellaneous provisions. 7. Information Technology Law - An Overview Important terms under Information technology legislation; digital signatures; electronic records; certifying authority; digital signature certificate; Cyber Regulation Appellate Tribunal; offences and penalties. 8. Code of Civil Procedure Elementary knowledge of the structure of civil courts, their jurisdiction, basic understanding of certain terms - order, judgement and decree, stay of suits, res judicata, suits by companies, minors, basic understanding of summary proceedings, appeals, reference, review and revision. 9. Criminal Procedure Code Offences; mens rea, cognizable and non-cognizable offences, bail, continuing offences, searches, limitation for taking cognizance of certain offences. 10. Law relating to Right to Information Salient features of the Right to Information (RTI) Act, 2005; Objective; Public Authorities & their obligations ; Designation of Public Information Officers (PIO) and their Duties; Request for obtaining information; Exemption from disclosure; Who is excluded; Information Commissions (Central & State) and their powers; appellate authorities; penalties; jurisdiction of Courts; Role of Central/State Governments. PAPER 2 : COMPANY ACCOUNTS, COST AND MANAGEMENT ACCOUNTING Level of knowledge : Working knowledge. Objectives : (i) To provide working knowledge of accounting principles and procedures for companies in accordance with the statutory requirements. (ii) To acquaint the students with cost and management accounting techniques and practices. Detailed contents : Part A : Company Accounts (50 Marks) 1. Accounting standards - relevance and significance; national and international accounting standards. 2. Accounting for share capital transactions - issue of shares at par, at premium and at discount; forfeiture and re-issue of shares; buy-back of shares; redemption of preference shares; rights issue. 3. Issue of debentures - accounting treatment and procedures; redemption of debentures; conversion of debentures into shares. 4. Underwriting of issues ; acquisition of business ; profits prior to incorporation ; treatment of preliminary expenses. 5. Preparation and presentation of final accounts of joint stock companies as per company law requirements; bonus shares. 6. Holding and subsidiary companies - accounting treatment and disclosures; consolidation of accounts. 7. Valuation of shares and intangible assets. Part B : Cost And Management Accounting (50 Marks) 8. Cost accounting – objectives of costing system; cost concepts and cost classification; management accounting – nature and scope; role of management accountant, tools and techniques of management accounting; distinction between financial accounting, cost accounting and management accounting. 9. Elements of cost : (i) Material cost – purchase procedures, store keeping and inventory control, fixing of minimum, maximum and re-order levels, ABC analysis, pricing of receipts and issue of material and accounting thereof; accounting and control of wastage, spoilage and defectives. (ii) Labour cost – classification of labour costs, payroll procedures, monetary and non-monetary incentive schemes; labour turnover and remedial measures; treatment of idle time and overtime. (iii) Direct expenses – nature, collection and classification of direct expenses and its treatment. (iv) Overheads – nature, classification, collection, allocation, apportionment, absorption and control of overheads.      Last edited by Neelurk; March 11th, 2020 at 02:37 PM. |