|

#2

August 4th, 2017, 12:03 PM

| |||

| |||

| Re: Entrance Syllabus Kashmir University

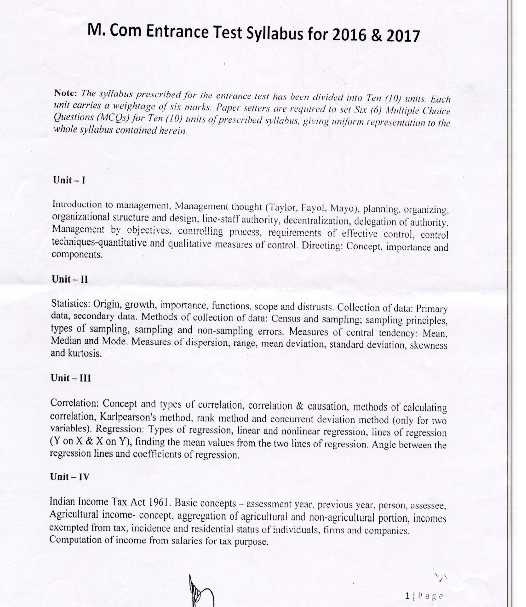

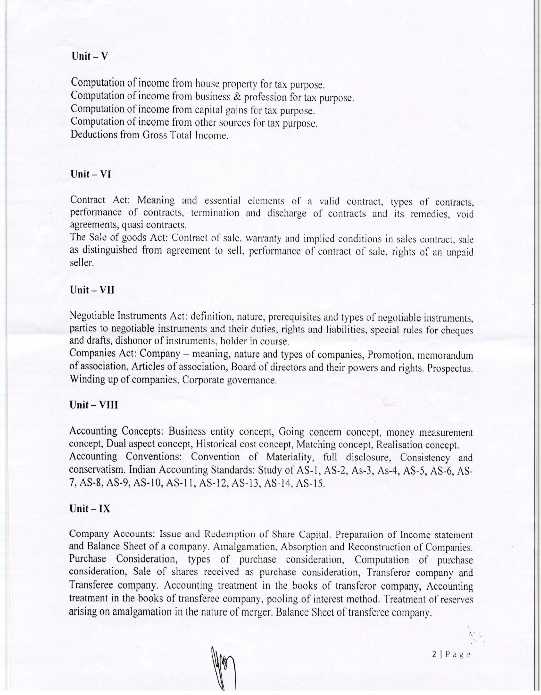

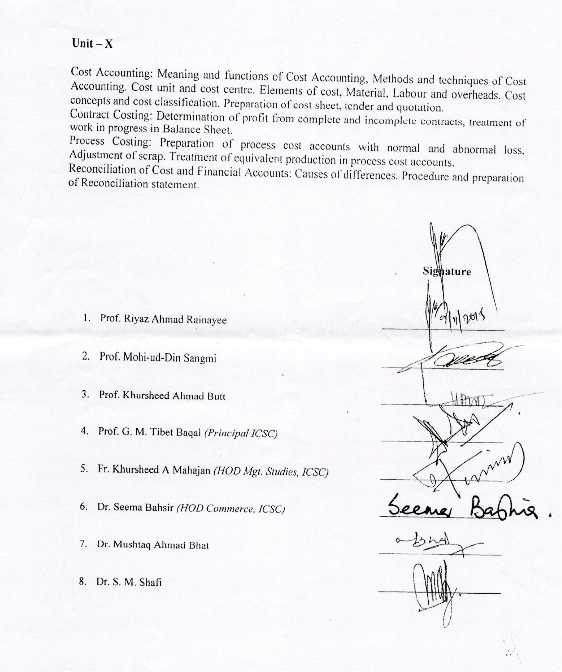

Ok, I am providing you the syllabus of Kashmir University M.Com Entrance Exam Kashmir University M.Com Entrance Exam syllabus    Unit — V Computation of income from house property for tax purpose. Computation of income from business & profession for tax purpose. Computation of income from capital gains for tax purpose. Computation of income from other sources for tax purpose. Deductions from Gross Total Income. Unit — VI Contract Act. Meaning and essential elements of a valid contract, types of contracts, performance of contracts, termination and discharge of contracts and its remedies, void agreements, quasi contracts. The Sale of goods Act: Contract of sale, warranty and implied conditions in sales contract, sale as distinguished from agreement to sell, performance of contract of sale, rights of an unpaid seller. Unit — VII Negotiable Instruments Act: definition, nature, prerequisites and types of negotiable instruments, parties to negotiable instruments and their duties, rights and liabilities, special rules for cheques and drafts, dishonor of instruments, holder in course. Companies Act: Company – meaning, nature and types of companies, Promotion, memorandum of association, Articles of association, Board of directors and their powers and rights. Prospectus. Winding up of companies, Corporate governance. Unit — VIII Accounting Concepts: Business entity concept, Going concern concept, money measurement concept, Dual aspect concept, Historical cost concept, Matching concept, Realisation concept. Accounting Conventions: Convention of Materiality, full disclosure, Consistency and conservatism. Indian Accounting Standards: Study of AS-1, AS-2, AS-3, AS-4, AS-5, AS-6, AS- 7, AS-8, AS-9, AS-10, AS-11, AS-12, AS-13, AS-14, AS-15. Unit — IX Company Accounts: Issue and Redemption of Share Capital. Preparation of Income statement and Balance Sheet of a company. Amalgamation, Absorption and Reconstruction of Companies. Purchase Consideration, types of purchase consideration, Computation of purchase consideration, Sale of shares received as purchase consideration, Transferor company and Transferee company. Accounting treatment in the books of transferor company, Accounting treatment in the books of transferee company, pooling of interest method. Treatment of reserves arising on amalgamation in the nature of merger, Balance Sheet of transferee company. Unit — X Cost Accounting: Meaning and functions cf Cost Accounting, Methods and techniques of Cost Accounting. Cost unit and cost centre. Elements of cost, Material, Labour and overheads. Cost concepts and cost classification. Preparation of cost sheet, tender and quotation. Contract Costing: Determination of profit from complete and incomplete contracts, treatment of work in progress in Balance Sheet. Contact- University of Kashmir Hazratbal, Srinagar, Jammu and Kashmir 190006 |