|

#2

December 29th, 2016, 04:04 PM

| |||

| |||

| Re: Equity Linked Notes Citibank

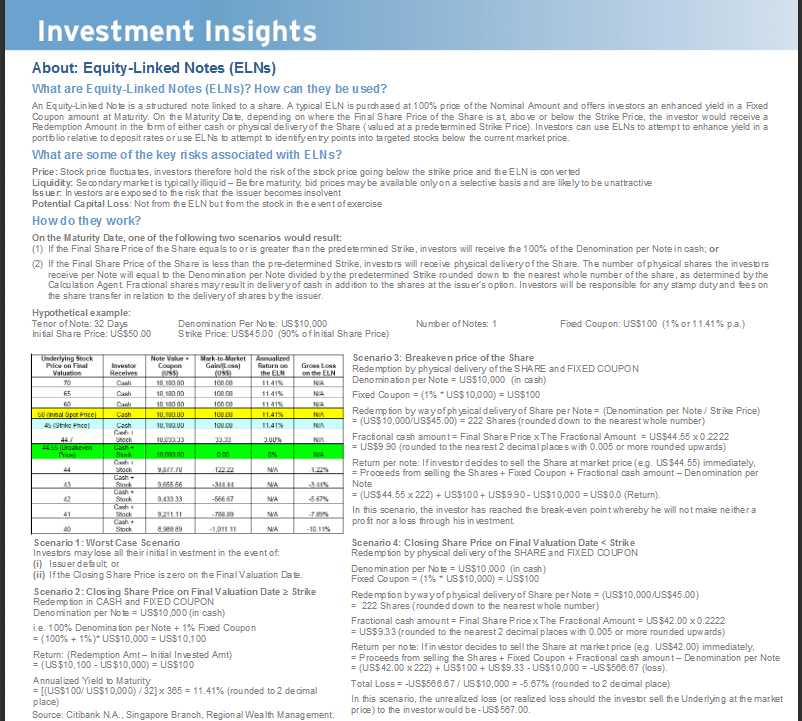

An Equity-Linked Note is a structured note linked to a share. A typical ELN is purchased at 100% price of the Nominal Amount and offers investors an enhanced yield in a Fixed Coupon amount at Maturity. Investors can use ELNs to attempt to enhance yield in a portfolio relative to deposit rates or use ELNs to attempt to identify entry points into targeted stocks below the current market price. How do they work? If the Final Share Price of the Share equals to or is greater than the predetermined Strike, investors will receive the 100% of the Denomination per Note in cash; or If the Final Share Price of the Share is less than the pre-determined Strike, investors will receive physical delivery of the Share. Hypothetical example: Tenor of Note: 32 Days Denomination Per Note: US$10,000 Number of Notes: 1 Fixed Coupon: US$100 (1% or 11.41% p.a.) Initial Share Price: US$50.00 Strike Price: US$45.00 (90% of Initial Share Price)  |