|

#1

July 19th, 2016, 12:38 PM

| |||

| |||

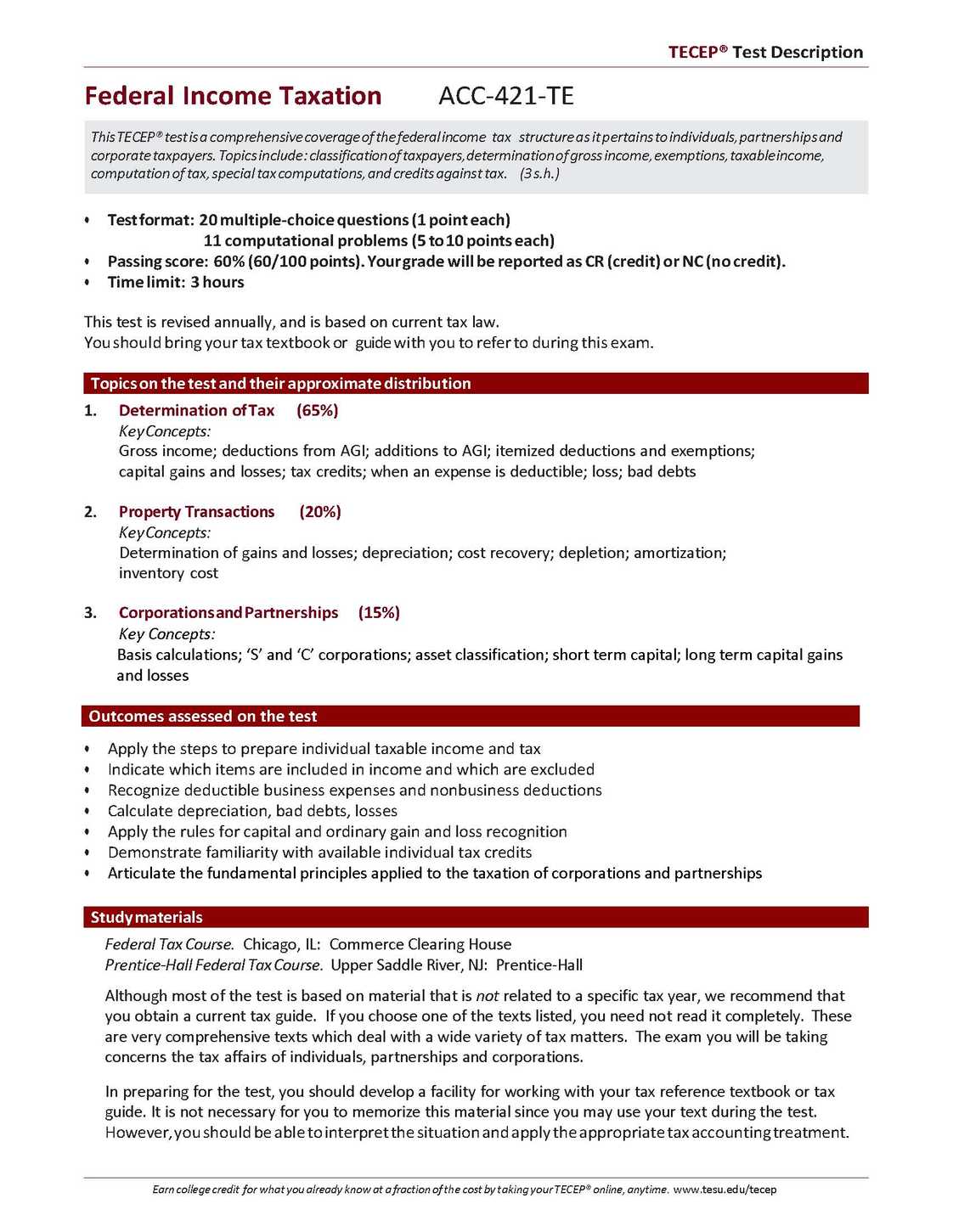

| Federal Income Tax Final Exam

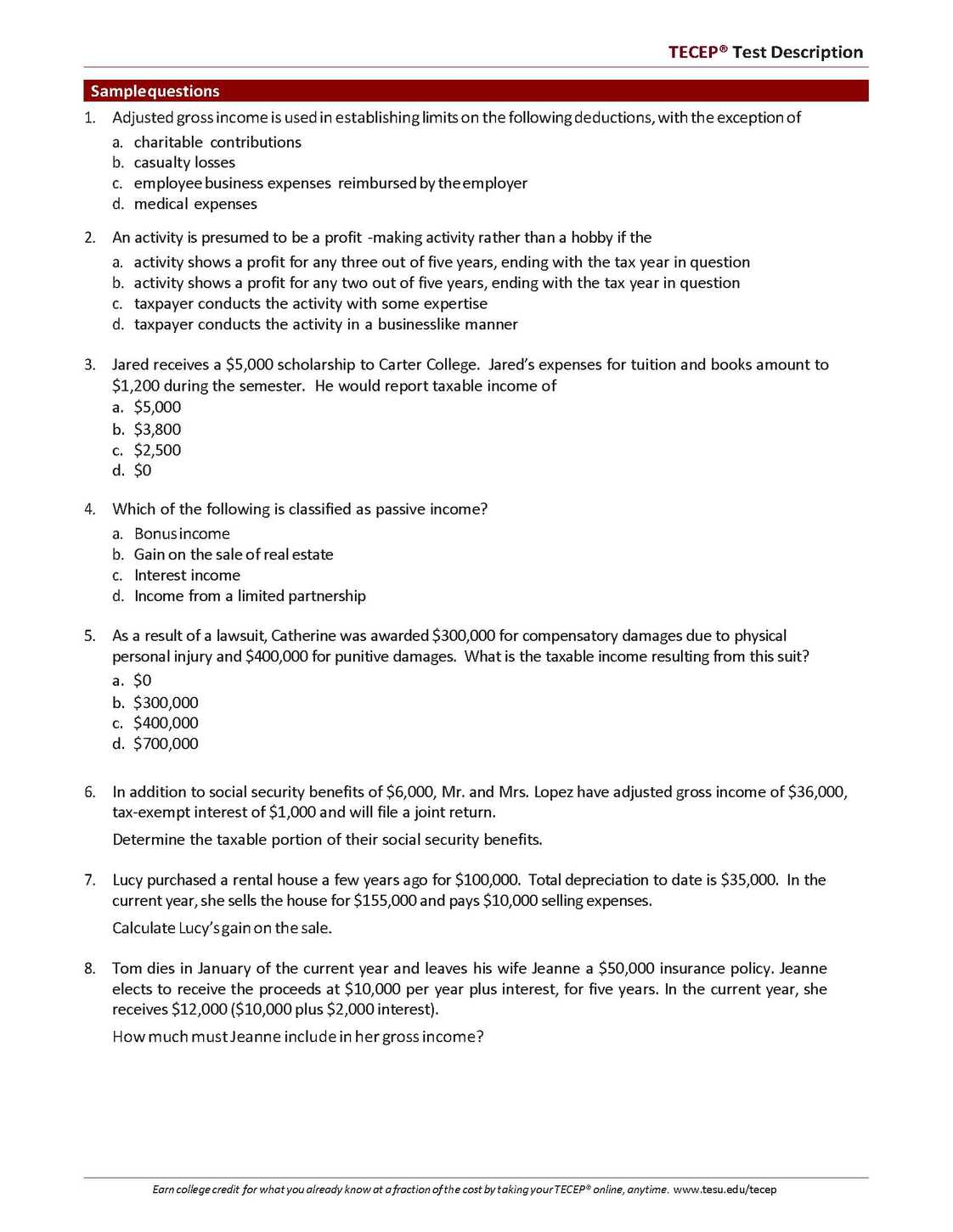

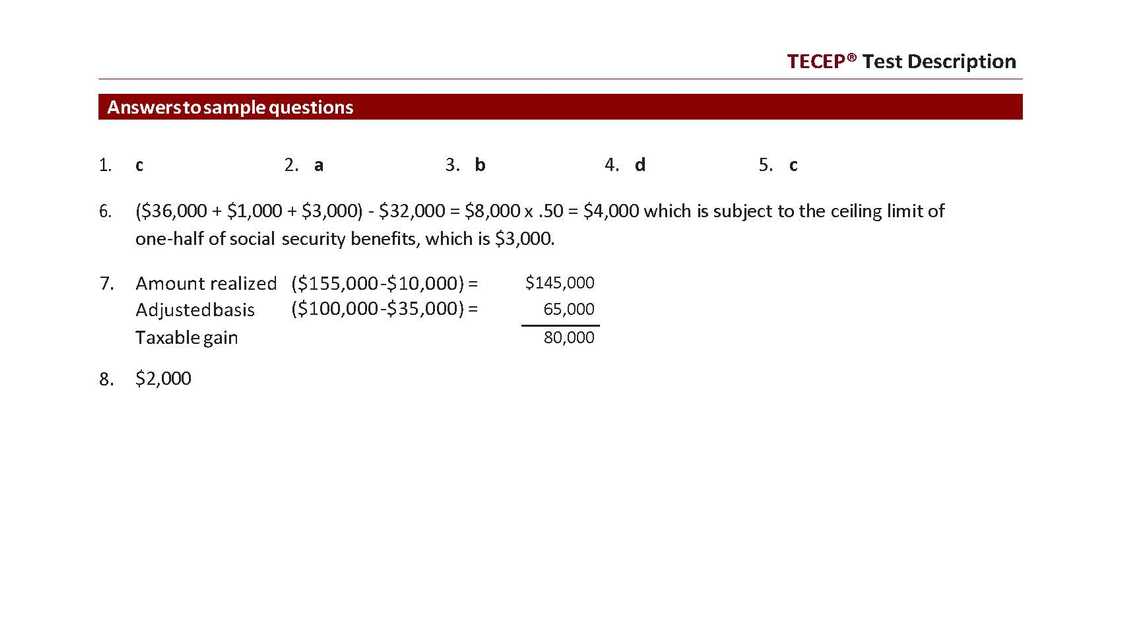

I’m looking for sample question on Federal Income Tax Final Exam here can you please get some information so that I can prepare hard? No problem I will let you know sample question on Federal Income Tax Final Exam so that you can get idea and prepare hard. Here are the Sample Question 1.Adjusted gross income is used in establishing limits on the following deductions, with the exception of a. charitable contributions b. casualty losses c. employee business expenses reimbursed by the employer d. medical expenses 2.An activity is presumed to be a profit -making activity rather than a hobby if the a. activity shows a profit for any three out of five years, ending with the tax year in question b. activity shows a profit for any two out of five years, ending with the tax year in question c. taxpayer conducts the activity with some expertise d. taxpayer conducts the activity in a businesslike manner 3.Jared receives a $5,000 scholarship to Carter College. Jared’s expenses for tuition and books amount to$1,200 during the semester. He would report taxable income of a.$5,000 b.$3,800 c.$2,500 d.$0 4.Which of the following is classified as passive income? a.Bonus income b.Gain on the sale of real estate c.Interest income d.Income from a limited partnership Sample Question On Federal Income Tax Final Exam     Last edited by Neelurk; May 18th, 2020 at 12:22 PM. |