|

#2

November 2nd, 2017, 03:00 PM

| |||

| |||

| Re: Home Loan Interest Rate in Oriental Bank of Commerce

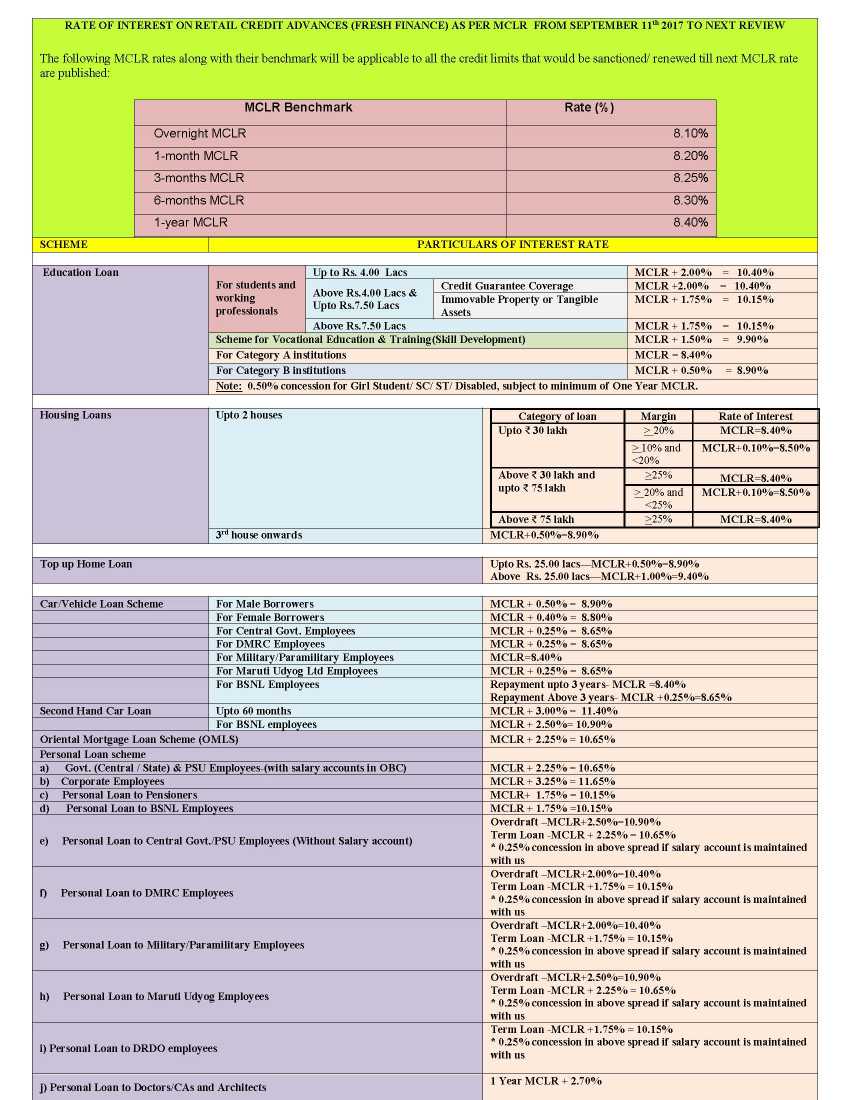

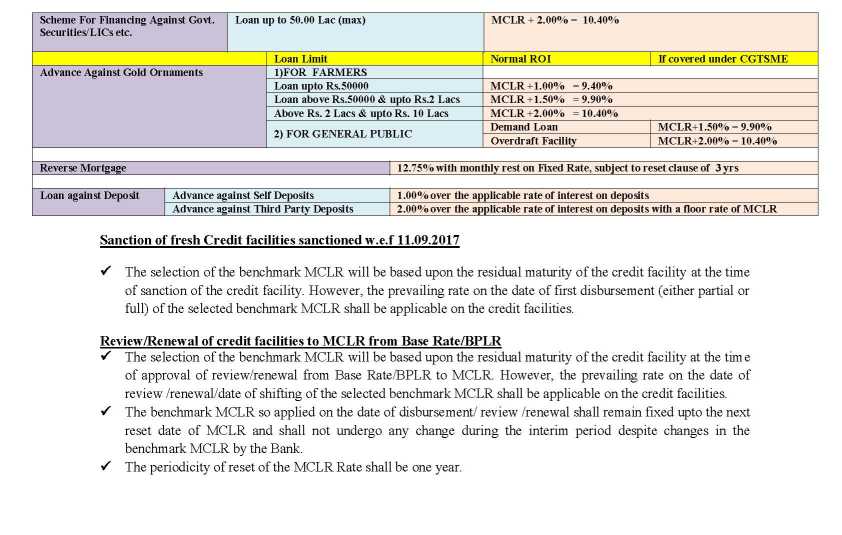

Home Loan is provided for the purchase of land and construction of a house thereon; construction of house, where in the plot/land already owned by the applicant; to buy built up / semi built up house or flat; to Extend/improve/repair, the existing house or flat; for Home furnishing, furniture / fixtures embedded to structure or otherwise; to buy a flat under construction or proposed to be constructed and takeover of housing loan from other banks/ financial institutions. Eligibility Criteria Individuals or group of specified individuals (co-borrowers) who has an assured source of regular income viz. salaried / self-employed persons, professionals, businessmen, farmers etc.(including Staff & NRIs ) Interest Rate   Minimum Age 18 years as on date of application Maximum Age For salaried (with pension) & other Individuals upto 70 years For Salaried (Non Pensionable) upto 60 years or superannuation, which is earlier Maximum Loan Limit Housing Loan --- there is no upper ceiling. The maximum permissible Bank finance is calculated on the basis of income of individual and joint borrower, as the case may be. Home furnishing Loan --Maximum Rs. 15.00 Lacs (restricted to 30% value of existing house), Repayment Period For Home Loan –Up to 360 months, including the moratorium period of 18 months subject to age of dwelling unit Age of dwelling unit less than 10 Years -Maximum 30 Years Age of dwelling Unit Older than 10 Years -Maximum 25 Years For Home Furnishing Loan-Maximum 120 months |