|

#2

September 17th, 2016, 03:17 PM

| |||

| |||

| Re: Iffco-Tokio Micro Insurance

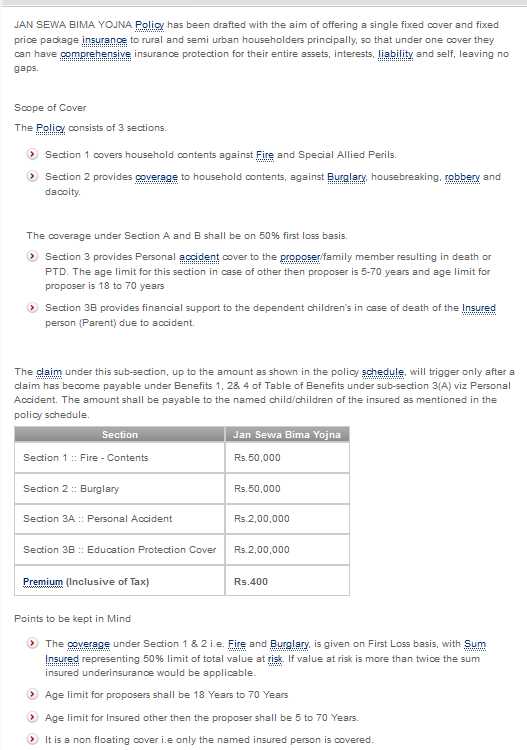

Iffco Tokio's micro-insurance initiatives are driven by the vision of its parent company IFFCO which seeks to improve the quality of life of the Indian farmer. Jan Sewa Bima Yojna Policy It is sketched for offering a single fixed cover and fixed price package insurance to rural and semi urban householders mainly, so that under one cover one can have complete insurance protection for the entire assets, interests, liability and self, leaving no gaps. Scope of Cover It consists of 3 sections. • Section 1 covers household contents against Fire and Special Allied Perils. • Section 2 provides coverage to household contents, against Burglary, housebreaking, robbery and dacoity. The coverage under Section A and B is on 50% first loss basis. • Section 3 provides Personal accident cover to the proposer/family member resulting in death or PTD. The age limit for it in case of other then proposer is 5-70 years and age limit for proposer is 18 to 70 years • Section 3B provides financial support to the dependent children’s in case of death of the Insured person (Parent) due to accident. The amount is payable to the named child/children of the insured as mentioned in the policy schedule. Section Jan Sewa Bima Yojna Section 1 :: Fire - Contents Rs.50,000 Section 2 :: Burglary Rs.50,000 Section 3A :: Personal Accident Rs.2,00,000 Section 3B :: Education Protection Cover Rs.2,00,000 Premium (Inclusive of Tax) Rs.400 Iffco-Tokio Micro Insurance   |