|

#2

October 16th, 2017, 02:35 PM

| |||

| |||

| Re: Kotak Mahindra Bank Vehicle Loan

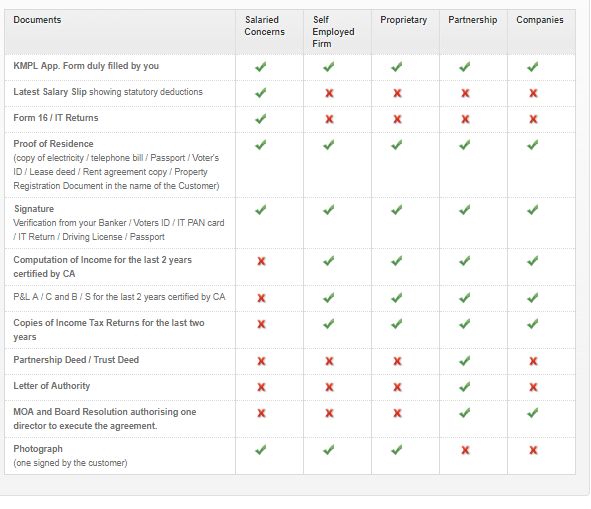

Kotak Mahindra Bank Ltd offers car loan of Kotak Mahindra Prime Ltd to its customers. These car loan offerings come with easy processing and flexible schemes. Kotak Mahindra Prime Ltd. is a subsidiary of Kotak Mahindra Bank Ltd. Car Loan of Kotak Mahindra Bank Ltd has finance options for wide range of cars; attractive interest rates; tailored made finance schemes; speedy loan processing and tenure Upto 7 years. Eligibility o All Indian residents. o Minimum income of Rs. 15000 per month. o Minimum residence stability of 1 year. o Minimum employment stability of 1 year. o Age minimum 21 years. Charges & Fees Cheque Dishonour Charges per Cheque 750 Prepayment interest outstanding 5.21% + service tax Issue of Duplicate copy of Agreement / Duplicate NOC / NOC for Duplicate Registration Certificate 750 Issue of Duplicate Security Deposite Receipt per Receipt 250 Cancellation of Contract (other than foreclosure and prepayment interest) at specific request of the Borrower and agree by the Lender 2000 Delayed Payment / Late Payment Charges / Compensation / Additional Finance Charges (Monthly) 3% Collection Charges for non PDC cases (per cheque) for non-payment on due date 500 PDC swap Charges 500 per swap Repayment Schedule / Account Outstanding Break up statement 250 LPG / CNG NOC 2000 Statement of Account 500 NOC for Interstate Transfer 1000 NOC for Commercial to personal use 2000 Dishonour charges per instance 750 NOC to convert from private to commercial 5000 (Subject to approval) Kotak Mahindra Bank Car Loan Documentation  |