|

#1

July 1st, 2014, 08:34 AM

| |||

| |||

| Process to become Income Tax Officer

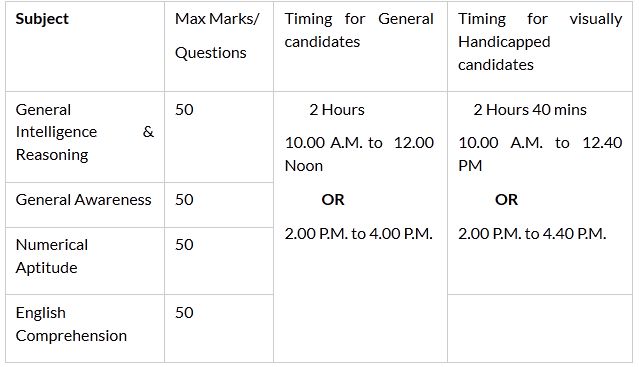

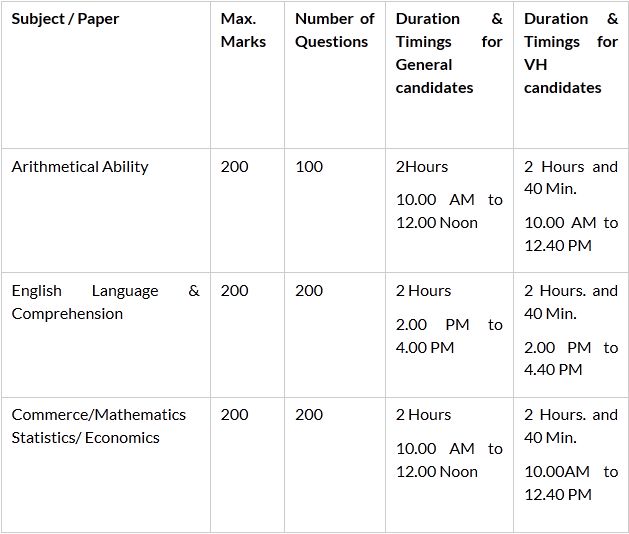

I want to become Income Tax Officer and for that I want to get the details process to become Income Tax Officer and eligibility criteria so can you provide me that as it is very urgent for me? As you want to get the details process to become Income Tax Officer and eligibility criteria so here is the information of the same for you: Educational Qualification: Candidates must have passed graduation in any stream Age limit: Sub Inspectors (Ex) in CPOs: 20-25 years Assistant/Sub Inspector in CBI: 20-27 years. Statistical Investigators Gr.II: Max: 26 years. For all other posts: 18-27 years Nationality/Citizenship A citizen of India or A subject of Nepal or A subject of Bhutan A Tibetan refugee who came over to India, before the 1st January,1962 with the intention of permanently settling in India or A person of Indian origin who has migrated from Pakistan, Burma, Sri Lanka, East African, Countries of Kenya, Uganda, the United Republic of Tanzania, Zambia, Malawi, Zaire, Ethiopia and Vietnam with the intention of permanently settling in India. Candidates who want to become Income Tax Officer will have to give the exam of CGL of SSC CGL Tier I exam pattern:  Candidates who will be decalred qualifies the Tier I exam will have to give the exam of Tier II: CGL Tier II exam pattern:  Syllabus of CGL exam: Syllabus of SSC Combined Graudates Level Exam (Tier II) is: Paper I Arithmetic Ability: This paper will include questions on problems relating to Number Systems, Computation of Whole Numbers, Decimals and Fractions and relationship between Numbers, Fundamental Arithmetical Operations, Percentage, Ratio and Proportion, Average, Interest, Profit and Loss, Discount, Use of Table and Graphs, Mensuration, Time and Distance, Ratio and Time etc. Paper II English Language & Comprehsion: Questions in this components will be designed to test the candidate’s understanding and knowledge of English Language and will be based on error recognition, fill in the blanks (using verbs, preposition, articles etc), Vocabulary, Spellings, Grammar, Sentence Structure, Synonyms, Antonyms, Sentence Completion, Phrases and Idiomatic use of Words, etc. There will be a question on passages and omprehension of passages also. (The standard of the questions will be of 10+2 level). Paper III Commerce/Mathematics/Statistics/Economics for Investigator Grade-II, for Ministry of Statistics & Programme Implementation and Compiler for Registrar General of India, Ministry of Home Affairs. STATISTICS Probability, Probability Distributions, Binomial, Poisson, Normal, Exponential. Compilation, classification, tabulation of Statistical Data, Graphical presentation of data. Measures of central tendency, measures of dispersion, measures of association and contingency, scatter diagram, correlation coefficient, rank correlation coefficient and linear regression analysis ( for two or more variables ) excluding partial correlation coefficients. Concept of Population, random sample, parameters, statistics, sampling distribution of x properties of estimators and estimation of confidence intervals. Principles of sampling, simple random sampling, stratified sampling, systematic sampling etc., Sampling and non-sampling errors, type-I and type-II errors. Concepts of Hypothesis – Null and alternate, Testing of hypothesis for large samples as well as small samples including Chi-square tests ( Z, t, F, c2 tests ). Index Numbers, Time series analysis – components of variation and their estimation. ECONOMICS GENERAL ECONOMICS Demand and Supply Analysis, including Laws and Interaction of Demand and Supply. Production Function and Laws of Returns. Commodity Pricing – Characteristics of various Market Forms and Price Determination under such Market Forms. Theory of Factor Pricing – Rent, Wage, Interest and Profit. Theory of Employment – Classical and Neo-classical Approach. Keynesian Theory of Employment – Principles of Effective Demand. Meaning and Importance of Investment, Relation between Saving and Investment, Multiplier Effect and the process of Income Generation, Post Keynesian Development. Nature and Functions of Money, Value of Money, Fluctuations in the value of Money – Inflation and Deflation, Monetary Policy, Index Number. International Trade-Free Trade and Protection, Theories of International Trade. Foreign Exchange – Determination of the rate of Exchange – Purchasing Power Parity theory and Balance of Payment Theory. Public Finance – Nature. Scope and importance of Public Finance. Taxation – Meaning, Classification and Principles of Taxation, Incidence of Taxation. Deficit Financing. Fiscal Policy. INDIAN ECONOMICS AND GENERAL STATISTICS Statistical Investigation – Meaning and Planning of Investigation. Collection of data and editing of data. Types of sampling. Schedule and questionnaire. Presentation of data – classification, tabulation, etc. Measures of Central Tendency. National Income and Accounting – Estimation of National Income, Trends in National Income, Structural changes in the Indian Economy as seen in National Income Data. Agricultural sector – Agricultural Development during Plan Period, Rural Credit, Agricultural Price Policy, Rural Development Co-operation and Panchayati Raj. Industrial Policy and Industrial Development. Problems of Economic Development – Indian Planning – Objectives, Techniques and its evolution, Five Year Plans and Role of National Development Council. Profile of Human Resources – Population and Economic Development, Demographic Profile of India, Nature of Population Problem – Poverty, Inequality, Unemployment Problem, Labour Problem, Population Control and Government Policy. New Economic Policy and Welfare Schemes. Indian Public Finance – Indian Revenue, Foreign Aid. Indian Banking and Currency system. MATHEMATICS Algebra: Algebra of sets, relations and functions, Inverse of a function, equivalence relation.The system of complex numbers, De Moivere’s Theorem and its simple applications. Relation between roots and co-efficients of a polynomial equation – Evaluation of symmetric function of roots of cubic and biquadratic equation. Algebra of Matrices  eterminants, Simple properties of determinants, Multiplication of determinants of orders two and three, Singular and non-singular matrices. Inverse of a matrix, Rank of a matrix and application of matrices to the solution of linear equations ( in three unknowns ). eterminants, Simple properties of determinants, Multiplication of determinants of orders two and three, Singular and non-singular matrices. Inverse of a matrix, Rank of a matrix and application of matrices to the solution of linear equations ( in three unknowns ). Convergence of sequences, and series, tests of convergence of series with positive terms, Ratio, Root and Gauss tests. Analytic Geometry:Straight lines, Circles, System of circles, parabola, ellipse and hyperbola in standard form and their elementary properties, Classification of curves second degree. Differential Equation:First order differential equation. Solution of Second and higher order linear differential equations with constant coefficients and simple applications. Differential and Integral Calculus: Limit, continuity and differentiability of functions, successive differentiation, derivatives of standard functions, Rolle’s and Mean-value Theorems, Maclaurins and Taylor’s series (without proof) and their applications, Maxima and Minima of functions of one and two variables. Tangents and Normals, Curvature, Partial differentiation, Euler’s theorem for homogeneous function, Tracing of curves. Standard methods of integration, Riemann’s definition of definite integral, fundamental theorem of integral calculus, quadrature, rectification, volumes and surface area of solids of revolution. Statistics: Frequency distributions, Measures of central tendency, measures of dispersion, Skewness and Kurtosis, Random variables and distribution function, Discrete distributions, Binomial and Poisson distribution, continuous distributions, Rectangular, Normal and Exponential distributions, Principles of least squares, correlation and regression, Random Sampling, random numbers, Sampling of attributes, Large Sample tests for mean and proportion, Tests of significance based on t, F and Chi-square distributions. COMMERCE This paper will cover all the subjects of commerce ordinarily taught at the B.Com. or similar degree courses of Indian Universities. Specifically, it will include the following subjects: Accountancy: Conceptual framework, Income measurement, Final accounts, Accounting for partnership firms, Hire-purchase accounting, Corporate accounting ( Issue, forfeiture and re-issue of shares ). Business Organisation: Business objectives, Business environment, Business entrepreneurship ( including location, choice of form of business and growth strategies ), Business operations including finance, production, marketing and human resource development. Management: Concept of management, Planning, Organising, Leading and Controlling. Micro-economics: Price-mechanism, Theory of consumer behaviour, Elasticity of demand, Production function, Theory of costs, Market structures, Price-determination under perfect competition and monopoly. Indian Economics: Issues involved in planning for economic development, Sectoral analysis of Indian economy including agriculture, industry and foreign trade. Business Statistics:Analysis of Univariate data involving measurement of Central tendency and dispersion, correlation and regression analysis, index numbers, analysis of time-series, Theory of probability. Business Law:Indian Contract Act, 1872, Sale of Goods Act, 1930, Partnership Act, 1932 and Negotiable Instruments Act, 1881. Company Law:Kinds of companies, matters involving incorporation of company, shares and share capital and matters relating to issue and transfers of shares, members of a company, management of a company, meetings and resolutions, winding up of a company. Cost accounting: Procedures involved in cost accounting, marginal costing, cost-volume profit analysis, Budgetary control, Standard costing. Auditing:Meaning and objects of auditing, Types of audit, Audit process. Income Tax:Basic concepts, Residence and tax liability, heads of income. Last edited by Neelurk; March 19th, 2020 at 08:36 AM. |