|

#2

January 23rd, 2017, 02:33 PM

| |||

| |||

| Re: Rating Of Oriental Bank Of Commerce

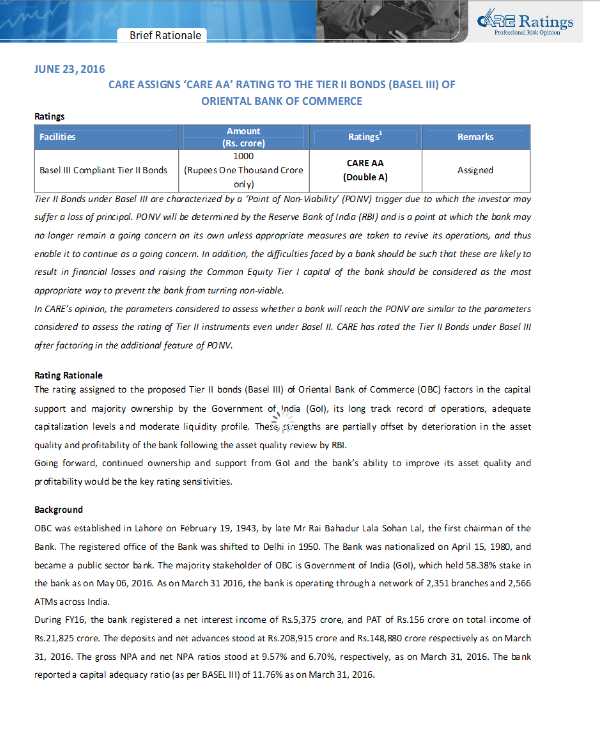

As you Asking for the CARE ASSIGNS Tier II Bond Rating of the Oriental Bank Of Commerce the Rating is given below CARE ASSIGNS Tier II Bond Rating Tier II Bonds under Basel III are characterized by a ‘Point of Non-Viability’ (PONV) trigger due to which the investor maysuffer a loss of principal. PONV will be determined by the Reserve Bank of India (RBI) and is a point at which the bank mayno longer remain a going concern on its own unless appropriate measures are taken to revive its operations, Rating Facilities Amount(Rs. crore Ratings Basel III Compliant Tier II Bonds1000 Crore CARE AA (Doubl e A) Rating Rational The rating assigned to the proposed Tier II bonds (Basel III) of Oriental Bank of Commerce (OBC) factors in the capitalsupport and majority ownership by the Government of India (GoI), its long track record of operations, adequate capitalization levels and moderate liquidity profile During FY16, the bank registered a net interest income of Rs.5,375 crore, and PAT of Rs.156 crore on total income ofRs.21,825 crore. The deposits and net advances stood at Rs.208,915 crore and Rs.148,880 crore respectively as on March31, 2016. The gross NPA and net NPA ratios stood at 9.57% and 6.70%, respectively, as on March 31, 2016. CARE ASSIGNS Tier II Bond Rating of the Oriental Bank Of Commerce    |