|

#2

December 9th, 2017, 08:08 AM

| |||

| |||

| Re: Risk Management IIBF

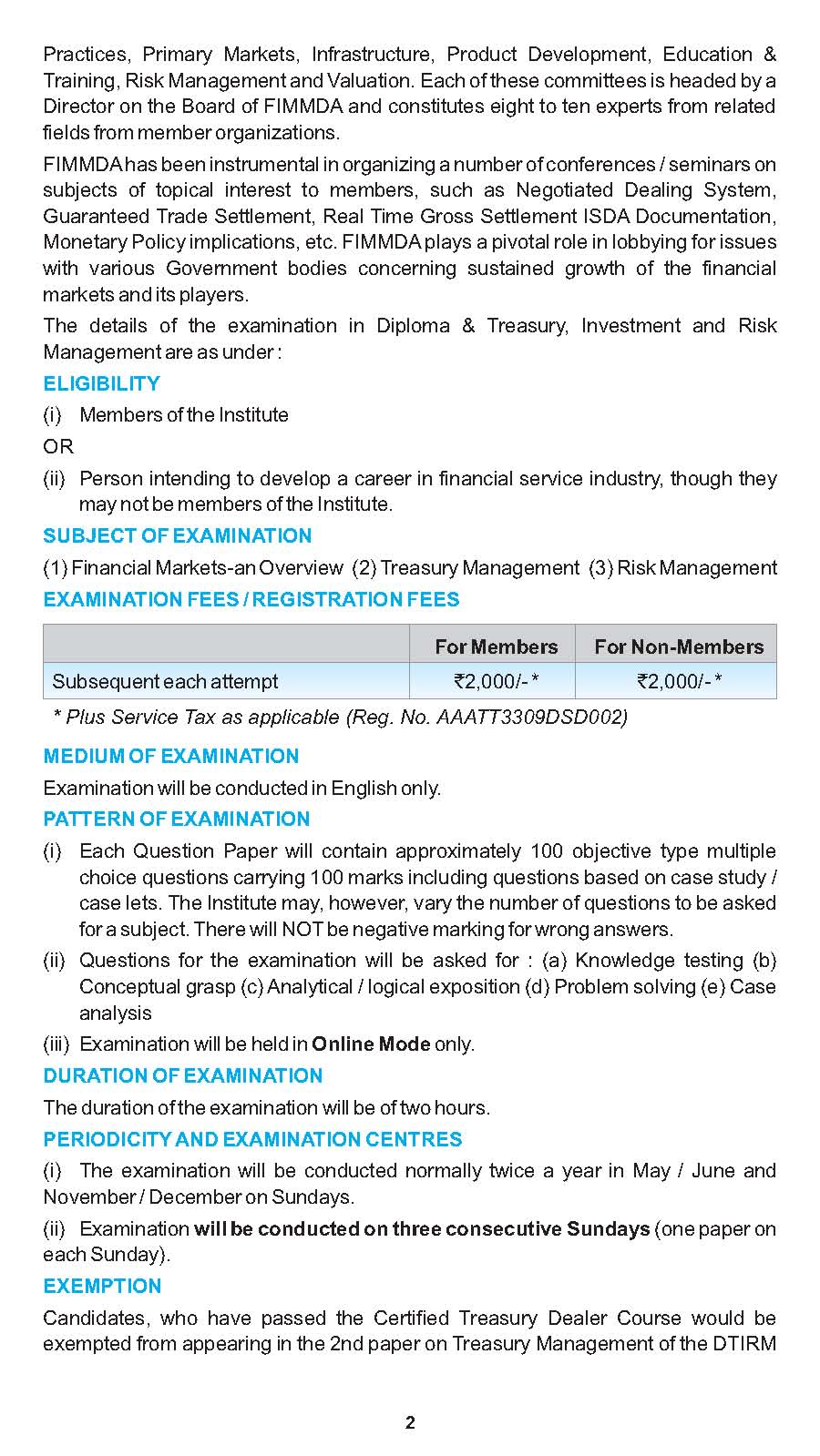

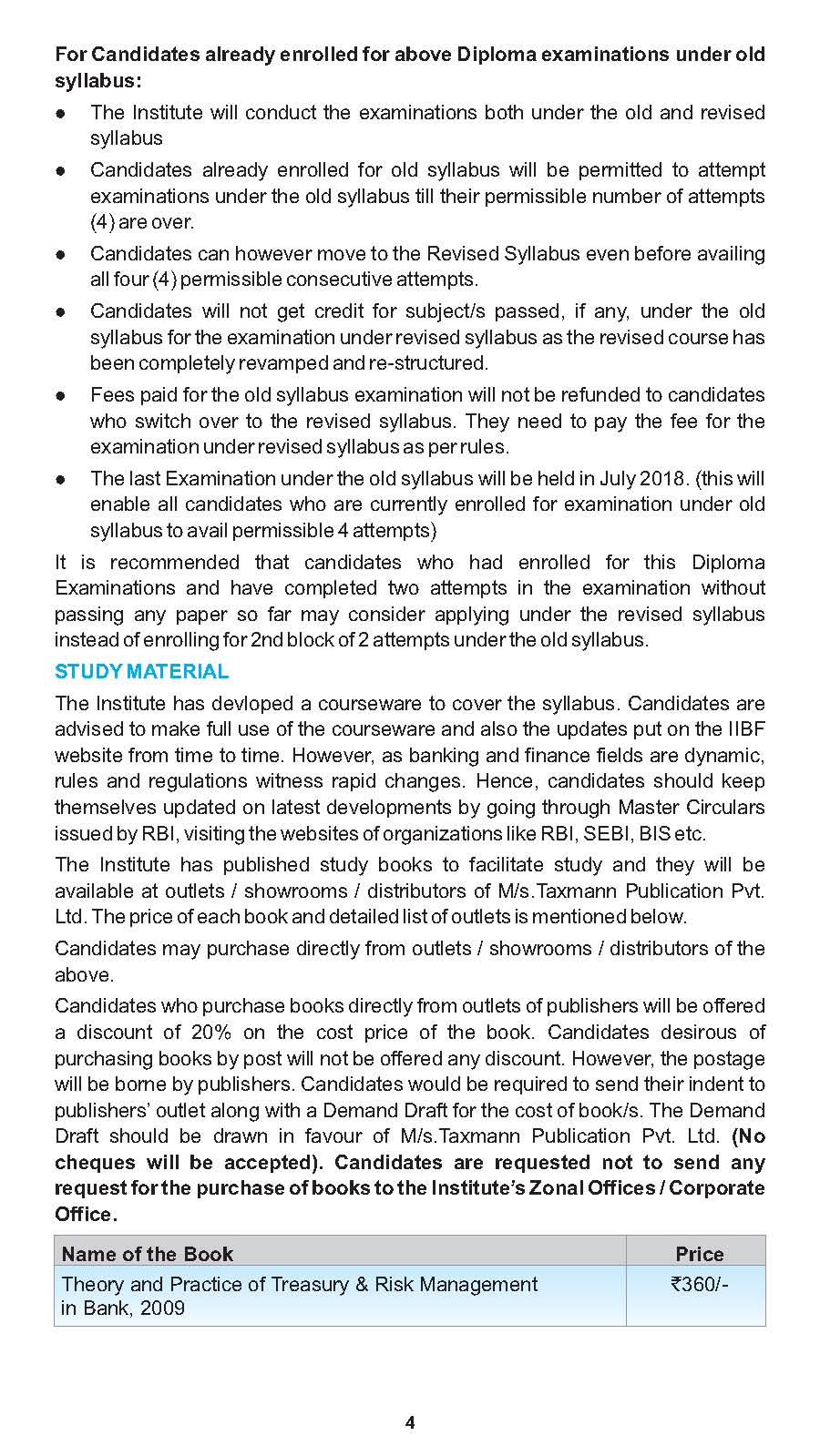

Built up in 1928 as a Company under Section 25 of the Indian Companies Act, 1913, Indian Institute of Banking and Finance (IIBF), in the past known as The Indian Institute of Bankers (IIB), is an expert assortment of banks, money related foundations and their workers in India. With its participation. Diploma in Treasury Investment and Risk Management With the appearance of market arranged way to deal with managing an account, globalization, money related area changes and rivalry in the monetary part, back/keeping money proficient confront the test to consistently advance and enhance their items and administrations. This calls for magnificence in the execution and specialization. One of the regions which is pivotal to banks execution and benefits is Treasury, which Bank needs to teach and prepare various staff. The Institute has subsequently presented the Certificate and Treasury, Investment and Risk Management to help the staff of budgetary foundations to secure the required ability. This recognition is outlined in a joint effort with FIMMDA to empower the contender to procure propelled learning in the field of Treasury and Risk Management. Subsequent to passing this recognition examination, the competitor will be in a position (i) To comprehend and value the instruments and complexities of operation in the currency showcase, capital market and outside trade advertise including hazard administration. (ii) To obtain capability in administration of assets in connection to here and now, medium term and long haul venture operations with liquidity/development arranging. (iii) To oversee outside trade (front and back workplaces) with regards to administrative system and late advancement and self-rule given to banks. (iv) To obtain abilities for Asset Liability Management with regards to hazard, control and supporting operations DIPLOMA IN TREASURY, INVESTMENT AND RISK MANAGEMENT EXAMINATION - Jan 2018 REGULAR OPEN PERIOD FOR REGISTRATION (3-11-2017 TO 3-12-2017) - With Normal Examination fees EXTENDED PERIOD FOR REGISTRATION (4-12-2017 TO 11-12-2017) - With Normal Examination fees plus LATE FEES of Rs 200/- (Plus taxes as applicable) ONLINE MODE EXAMINATION DATE TIME SUBJECTS 07-01-2018 Sunday Will be given in the admit Letter Financial Markets - An Overview. 21-01-2018 Sunday Will be given in the admit Letter Treasury Management. 28-01-2018 Sunday Will be given in the admit Letter Risk Management. No registration for fresh candidates since new Syllabus introduced from May 17. (EXAMINATION ELIGIBLE FOR MEMBERS AND NON MEMBERS) SR. NO. NAME OF THE EXAM ATTEMPTS FOR MEMBERS (RS.) FOR NON-MEMBERS (RS.) 1 Diploma In Treasury, Inv & Risk Mgmt Subsequent each attempt 2,000* 2,000* * Plus GST as applicable IIBF Publication List Examination: Diploma in Treasury Investment and Risk Management (Old Syllabus) SR. NO. EXAMINATION MEDIUM NAME OF THE BOOK EDITION PUBLISHED BY PRICE (RS.) 1 Diploma in TreasuryInvestment and Risk Management (Old Syllabus) English Theory and Practice of Treasury & Risk Management in Banks 2012 M/s Taxmann Publications Private Ltd. Rs. 360/- Diploma in Treasury, Investment and Risk Management Rules & Syllabus 2017     Contact: Indian Institute of Banking & Finance (An ISO 9001 - 2008 CERTIFIED ORGANISATION) nd Kohinoor City, Commercial-II, Tower-1, 2 Floor, Kirol Road, Kurla (West), Mumbai - 400 070 |