|

#2

June 10th, 2016, 02:55 PM

| |||

| |||

| Re: SBI Form 15h

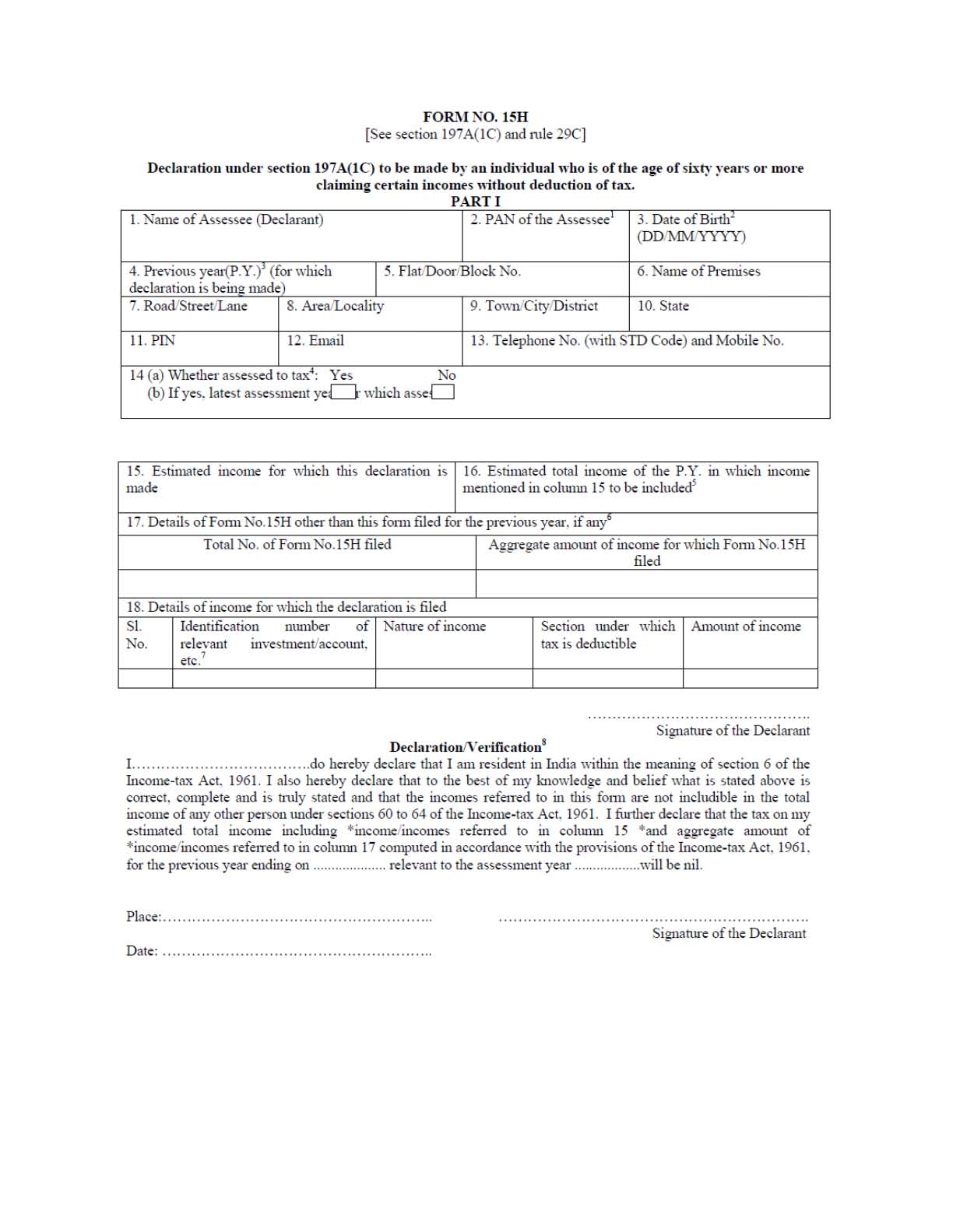

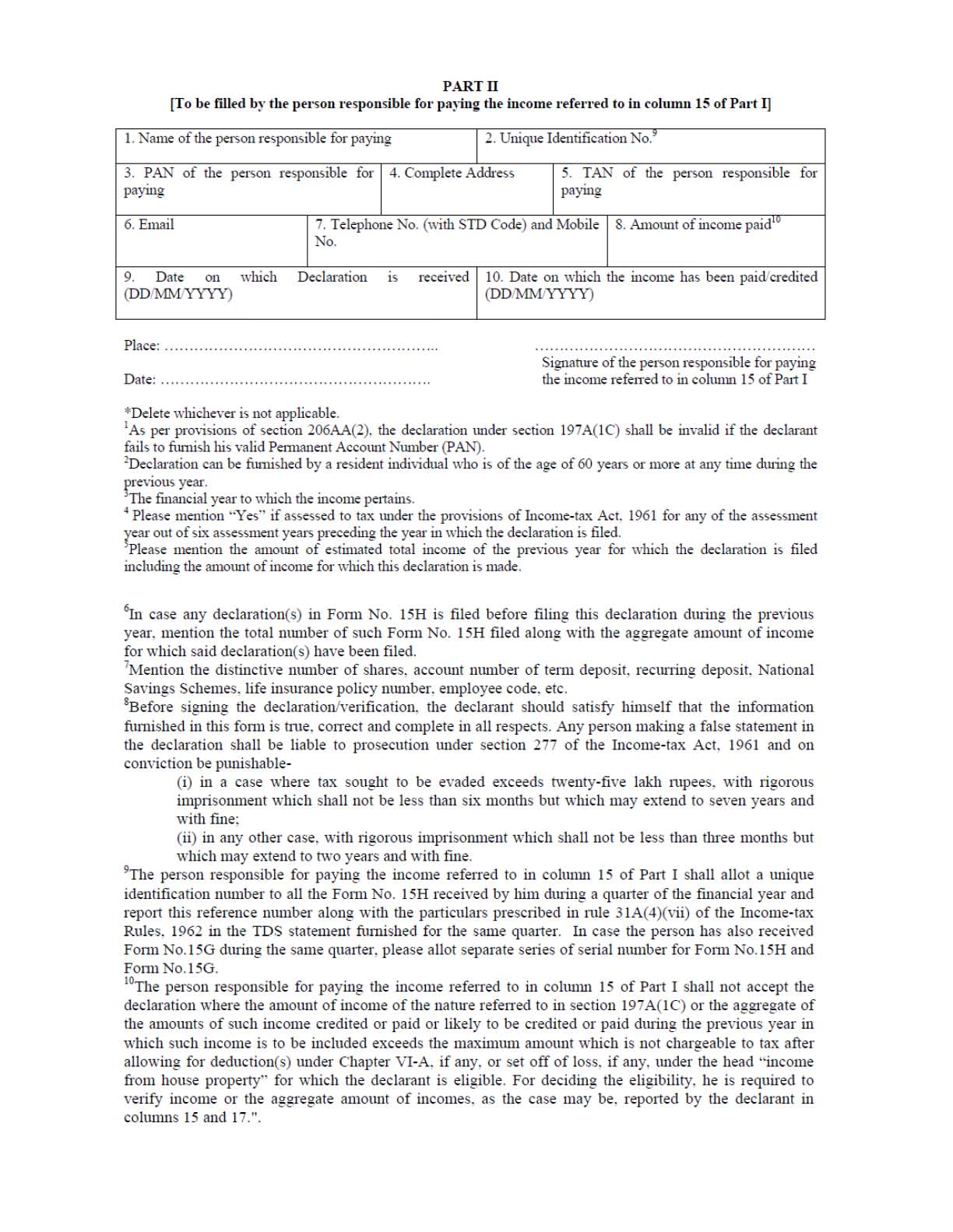

State Bank of India (SBI) is an Indian multinational, public sector banking and financial services company. State Bank of India (SBI) is a government-owned corporation with its headquarters in Mumbai, Maharashtra. As you asking for State Bank of India (SBI) form 15th so on your demand here I am providing same for you State Bank of India (SBI) form 15th   Key Fact about this form Form 15H can be submitted only by Individual above the age of 60 years. Estimated tax for the previous assessment year should be nil. That means he did not pay any tax for the previous year because his income is not coming under the taxable limit. This form should be submitted to all the deductors to whom you advanced a loan. For example you have deposit Rs.1 lac each in three SBI bank branches than you must submit the Form 15H to each branch. Submit this form before the first payment of your interest. It is not mandatory but it will avoid the TDS deduction. In case of the delay, the bank may deduct the TDS and issue TDS certificate at the end of year. You need to submit form 15H to banks if interest from one branch of a bank exceeds Rs.10,000/- in a year. You need to submit form 15H if interest on loan, advance, debentures, bonds or say Interest income other than interest on bank exceeds Rs.5,000/- in a year. |