|

#2

May 9th, 2016, 09:15 AM

| |||

| |||

| Re: State Bank of Bikaner and Jaipur Deposit Interest Rates

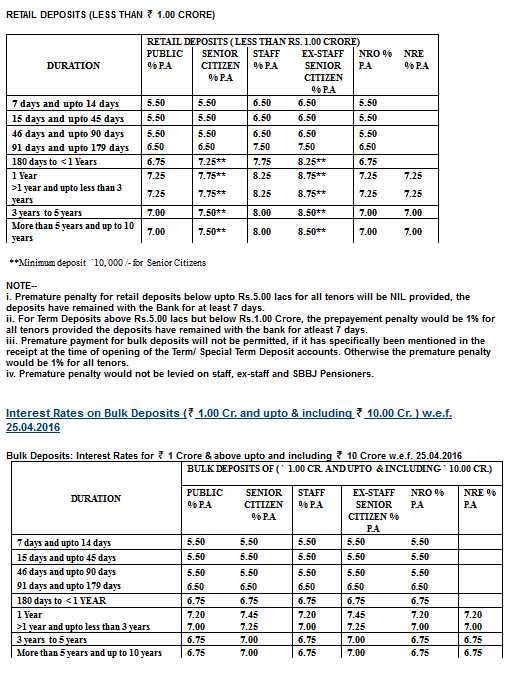

The State Bank of Bikaner and Jaipur (SBBJ) is an open division organization with operations all through the nation. SBBJ gives settled stores to all clients fulfilling a base criteria. The altered stores are accessible for shifting tenors going from 7 days (short term) up to 10 years (long haul). SBBJ Short Term FD rates The bank offers interest rates somewhere around 5.50% and 7.50% for stores of under 1 year tenor. The most elevated loan cost of 7.50% is given to tenors between 180 days and 364 days (6 months up to a year). Rates begin from 5.50% for most limited chunk of 7 days to 45 days, which increments by 1.25% to 6.75% for 45 days to 90 days tenor. 91 days to 179 days tenor FDs are likewise a decent decision as a medium term item with 7% financing cost, intensified every year. SBBJ medium and long haul FD rates A high financing cost of 8.50% is material on FDs of tenors somewhere around 1 and 5 years. It is by and by an exacerbated rate with viable yield toward the end of tenor entirely higher than the 8.50% cited in the item. SBBJ Senior subject FD rates Senior subjects are given uncommon financing costs to stores up to Rs 1 crore. The exceptional rates are relevant on all store tenors at the very least 1 year. 0.25% extra hobby is given to such clients when contrasted with non-senior candidates.  |