|

#2

July 27th, 2016, 03:28 PM

| |||

| |||

| Re: State Bank of India PSU Mutual Fund

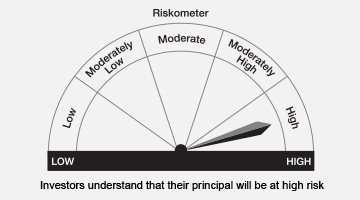

SBI PSU Fund of State Bank of India Mutual Fund invests in stocks of Public Sector Enterprises (PSE). As the reform process progresses over the next few years, PSUs are likely to emerge as more robust and vibrant players across various sectors. Key Benefit -The scheme will invest in Equity, Debts as well as Derivatives and Money Market securities. This product is suitable for investors who are seeking: -Long term investment -Investments in diversified basket of equity stocks and debt of domestic Public Sector Undertakings to provide long term growth in capital with improved liquidity.  Objectives The objective of the scheme would be to provide investors with opportunities for long-term growth in capital along with the liquidity of an open-ended scheme through an active management of investments in a diversified basket of equity stocks of domestic Public Sector Undertakings and in debt and money market instruments issued by PSUs and others. Minimum Application Rs. Rs. 5000/- and in multiples of Rs. 1/- Exit Load For exit within 1 year from the date of allotment - 1 %; For exit after 1 year from the date of allotment - Nil SIP Minimum 1000 & in multiples of 1 thereafter for minimum six months (or) minimum 500 & in multiples of 1 thereafter for minimum one year. Quarterly – Minimum 1500 & in multiples of 1 thereafter for minimum one year. SWP Rs.500/- per month or quarter |