|

#2

June 30th, 2016, 12:12 PM

| |||

| |||

| Re: State bank of Patiala Form 15H

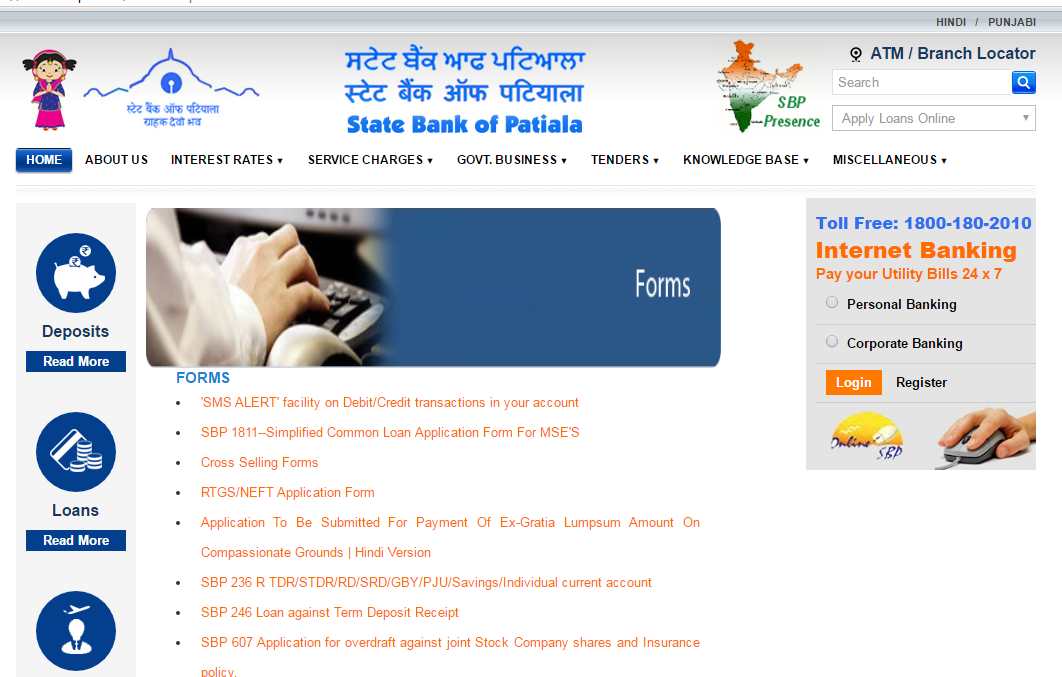

Hey as per my idea at present there is no availability of State bank of Patiala Form 15h and here I am giving you its details Here I am giving you process of getting form Go to official website of State bank of Patiala After that at left corner you will get option of form Under that you will get notification of Form 15H  About Form 15H Form 15H can be submitted only by Individual above the age of 65 years. Estimated tax for the previous assessment year should be nil. That means he did not pay any tax for the previous year because his income is not coming under the taxable limit. This form should be submitted to all the deductors to whom you advanced a loan. Submit this form before the first payment of your interest. It is not mandatory but it will avoid the TDS deduction. In case of the delay, the bank may deduct the TDS and issue TDS certificate at the end of year. You need to submit form 15H to banks if interest from one branch of a bank exceeds 10000/- in a year. You need to submit for 15H If interest on loan ,advance, debentures , bonds or say Interest income other then interest on bank exceeds 5000/-. |