|

#2

June 6th, 2016, 12:36 PM

| |||

| |||

| Re: Union Bank of India Tax

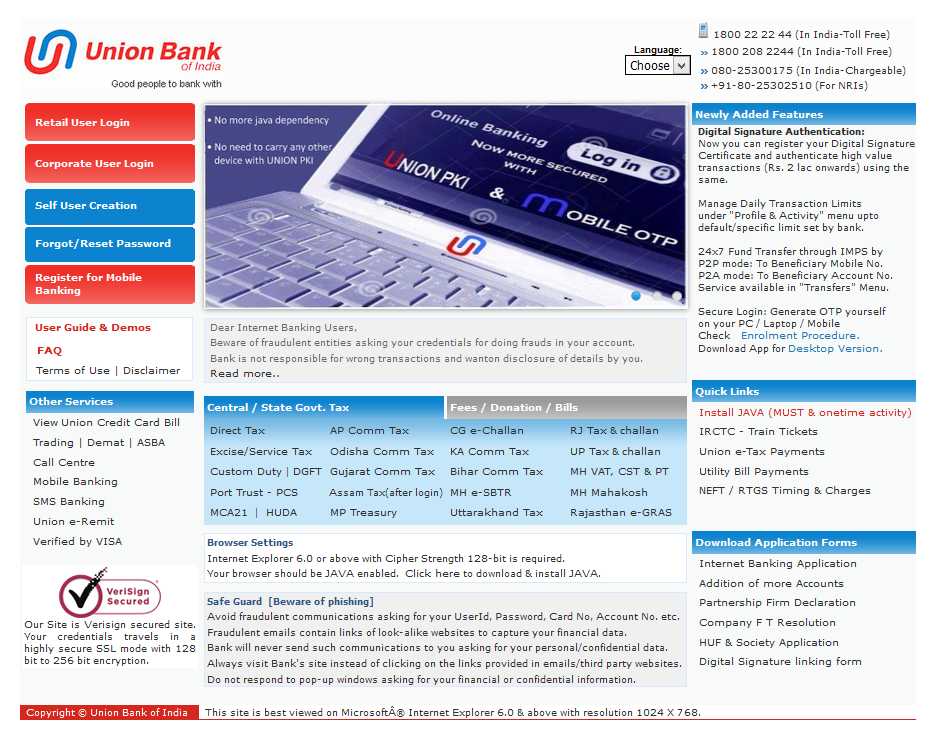

Union eTax installment stage is the least difficult approach to make your assessment installments. It empowers you to make immediate and aberrant duty installments at your doorstep. 1. Highlights and Benefits Moment online duty installments, Accessible 24x7 Charge installment demos for clients, Devoted letter box etax@unionbankofindia.com for determination of duty installment issues. 2. Qualification This office is accessible to all Internet keeping money clients with exchange office. 3. The most effective method to apply: This office is accessible as a matter of course for accessible to all exchange empowered e keeping money clients. 4. Administration Charges: This office is accessible totally for nothing out of pocket Online Tax installment is the office which permits the bank's client to pay their Taxes on the web. Take after the progressions to produce copy challans for Direct Tax or Central Excise/Service Tax installments. Direct Tax Payment To get the e-Challan take after the guidelines underneath. Go to our Internet Banking website  Login to Internet Banking Service through your User Id and Password. Go to "Duty Payment" menu. Click "See Direct Tax Payments" join under this menu. Enter substantial date reach to get your e-Challan. Central Excise and Service Tax Payment To get the e-Challan take after the guidelines underneath. Go to our Internet Banking website Login to Internet Banking Service through your User Id and Password. Go to "Expense Payment" menu. Click "View Indirect Tax Payments" join under this menu. Enter substantial date range and Tax sort to get your e-Challan. |