|

#2

November 7th, 2017, 04:26 PM

| |||

| |||

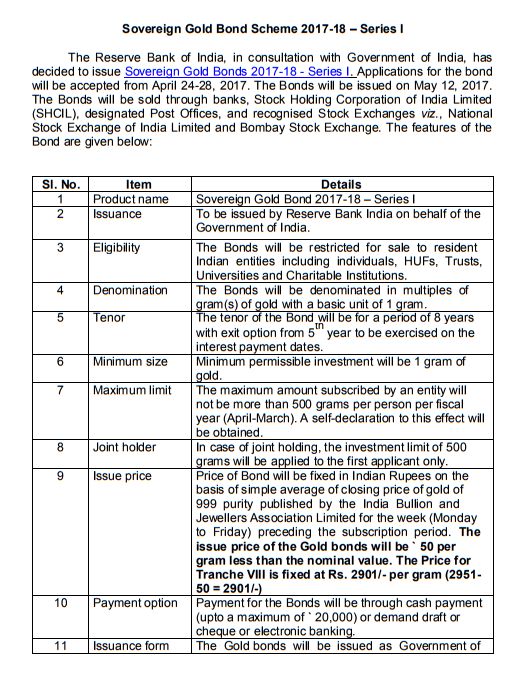

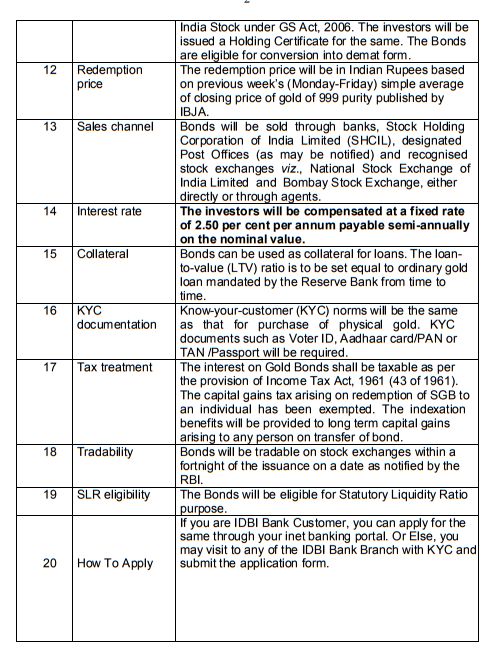

| Re: Buy Gold IDBI

The Reserve Bank of India in consultation with Government of India, has decided to issue Sovereign Gold Bonds 2017-18 - Series I. Applications for the bond will be accepted from April 24-28, 2017. The Bonds will be issued on May 12, 2017. Sovereign Gold Bond Scheme 2017-18 – The Bonds will be sold through banks, Stock Holding Corporation of India Limited (SHCIL), designated Post Offices, and recognised Stock Exchanges viz., National Stock Exchange of India Limited and Bombay Stock Exchange. Issuance To be issued by Reserve Bank India on behalf of the Government of India. Eligibility The Bonds will be restricted for sale to resident Indian entities including individuals, HUFs, Trusts, Universities and Charitable Institutions. Denomination The Bonds will be denominated in multiples of gram(s) of gold with a basic unit of 1 gram. Tenor The tenor of the Bond will be for a period of 8 years with exit option from 5th year to be exercised on the interest payment dates. Minimum size - Minimum permissible investment will be 1 gram of gold. Maximum limit The maximum amount subscribed by an entity will not be more than 500 grams per person per fiscal year (April-March). A self-declaration to this effect will be obtained. Joint holder - In case of joint holding, the investment limit of 500 grams will be applied to the first applicant only. Issue price Price of Bond will be fixed in Indian Rupees on the basis of simple average of closing price of gold of 999 purity published by the India Bullion and Jewellers Association Limited for the week (Monday to Friday) preceding the subscription period. The issue price of the Gold bonds will be ` 50 per gram less than the nominal value. The Price for Tranche VIII is fixed at Rs. 2901/- per gram (2951-50 = 2901/-) Payment option Payment for the Bonds will be through cash payment (upto a maximum of ` 20,000) or demand draft or cheque or electronic banking.   |