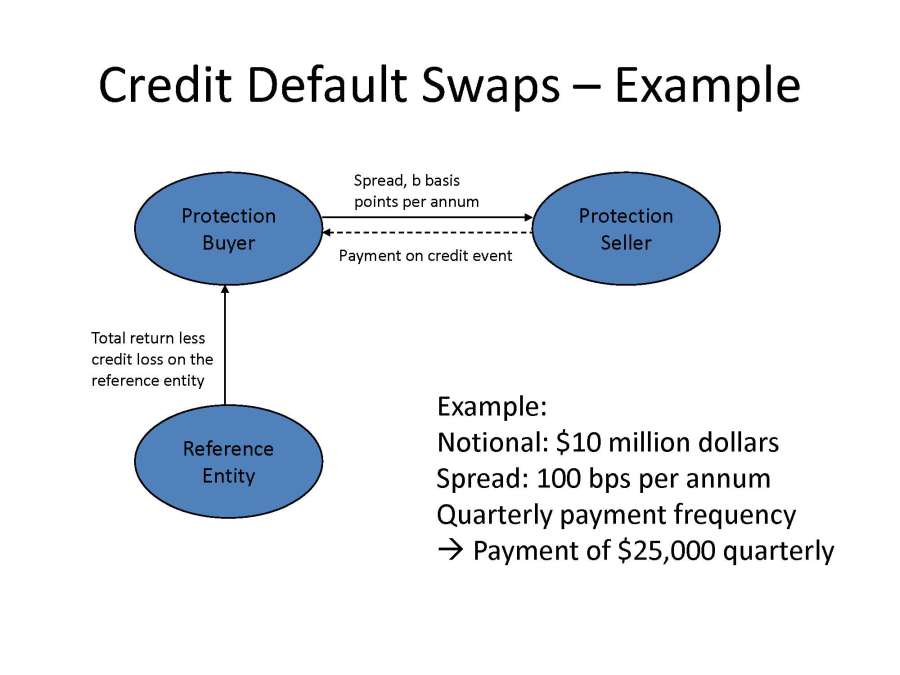

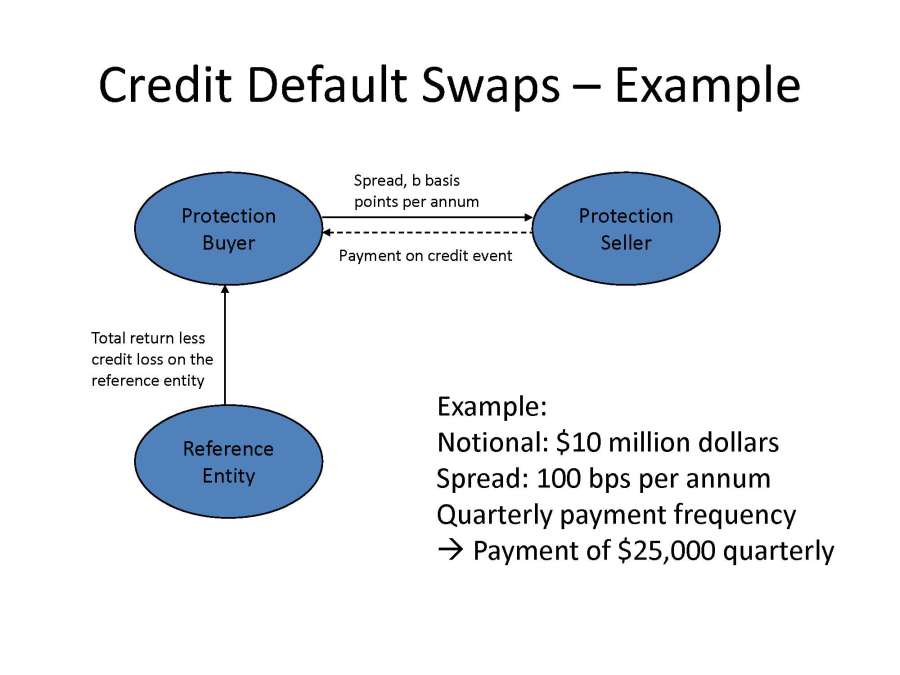

A credit default swap (CDS) is a financial derivative or contract that allows an investor to "swap" or offset his or her credit risk with that of another investor.

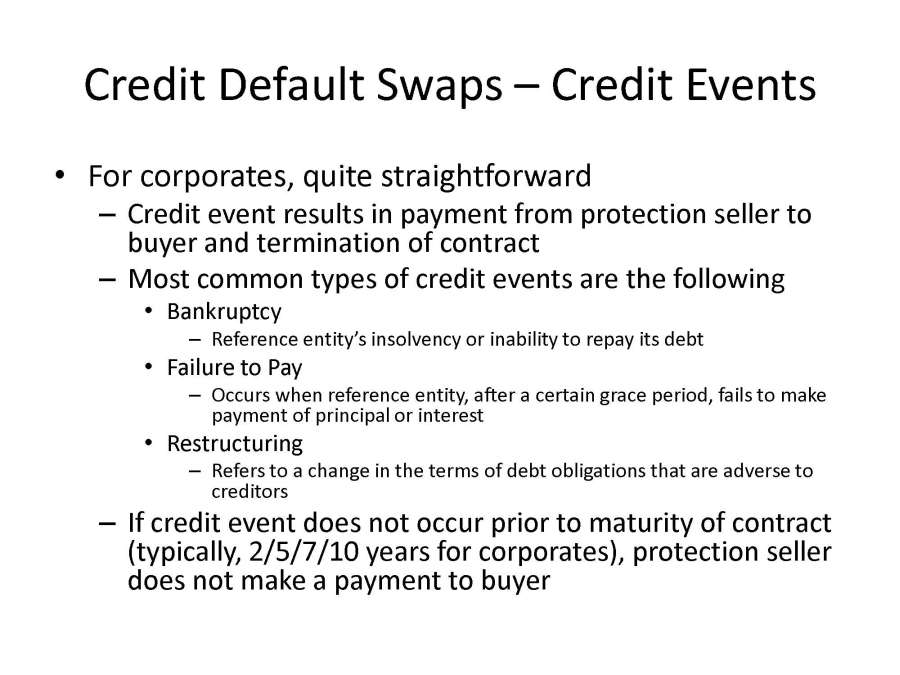

A credit default swap is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default or other credit event.

That is, the seller of the CDS insures the buyer against some reference asset defaulting

CDS traded

CDS contracts are regularly traded, where the value of a contract fluctuates based on the increasing or decreasing probability that a reference entity will have a credit event.

Increased probability of such an event would make the contract worth more for the buyer of protection, and worthless for the seller.

CDS contracts have obvious similarities with insurance contracts, because the buyer pays a premium and, in return, receives a sum of money if an adverse event occurs.

Differences include:

The seller might in principle not be a regulated entity (though in practice most are banks);

The seller is not required to maintain reserves to cover the protection sold (this was a principal cause of AIG's financial distress in 2008; it had insufficient reserves to meet the "run" of expected payouts caused by the collapse of the housing bubble);

Insurance requires the buyer to disclose all known risks, while CDSs do not (the CDS seller can in many cases still determine potential risk, as the debt instrument being "insured" is a market commodity available for inspection, but in the case of certain instruments like CDOs made up of "slices" of debt packages, it can be difficult to tell exactly what is being insured);

Insurers manage risk primarily by setting loss reserves based on the Law of large numbers and actuarial analysis. Dealers in CDSs manage risk primarily by means of hedging with other CDS deals and in the underlying bond markets;

CDS contracts are generally subject to mark-to-market accounting, introducing income statement and balance sheet volatility while insurance contracts are not;

Hedge accounting may not be available under US Generally Accepted Accounting Principles (GAAP) unless the requirements of FAS 133 are met. In practice this rarely happens.

Please find the below attached file for the CDS Trading details:

CDS Trading details