|

#2

September 1st, 2016, 08:14 AM

| |||

| |||

| Re: Central Bank of India NRI Account

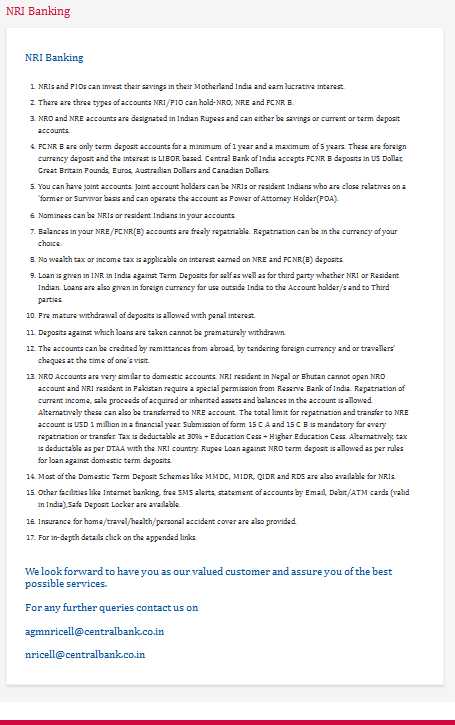

The NRI (Non Residential Indian) Banking Policies as declared by CBI or Central Bank of India are as follows: 1. NRIs and PIOs can invest the savings in India and earn rewarding interest. 2. There are three types of accounts NRI/PIO can hold-NRO, NRE and FCNR B. 3. NRO and NRE accounts are can either be savings or current or term deposit accounts. 4. The NRO and NRE Accounts are designated in Indian Rupees. 5. FCNR B is only term deposit accounts for a minimum of 1 year and a maximum of 5 years. These are foreign currency deposit and the interest is LIBOR based. Bank accepts FCNR B deposits in US Dollar, Great Britain Pounds, Euros, Austrailian Dollars and Canadian Dollars. 6. One can have joint accounts. Joint account holders can be NRIs or resident Indians who are close relatives on a ‘former or Survivor basis and can operate the account as Power of Attorney Holder(POA). 7. Nominees can be NRIs or resident Indians in accounts. 8. Balances in NRE/FCNR (B) accounts are freely repatriable and can be in the currency of choice. 9. No wealth tax or income tax is applicable on interest earned on NRE and FCNR (B) deposits. 10. Loan is given in INR in India against Term Deposits for self and for third party whether NRI or Resident Indian. Loans are also given in foreign currency for use outside India to the Account holder/s and to Third parties. 11. Pre mature withdrawal of deposits is allowed with penal interest. 12. Deposits against which loans are taken cannot be prematurely withdrawn. Central Bank of India NRI Account Opening Policy  |