|

#2

November 4th, 2017, 03:57 PM

| |||

| |||

| Re: Federal Bank of India Credit Card

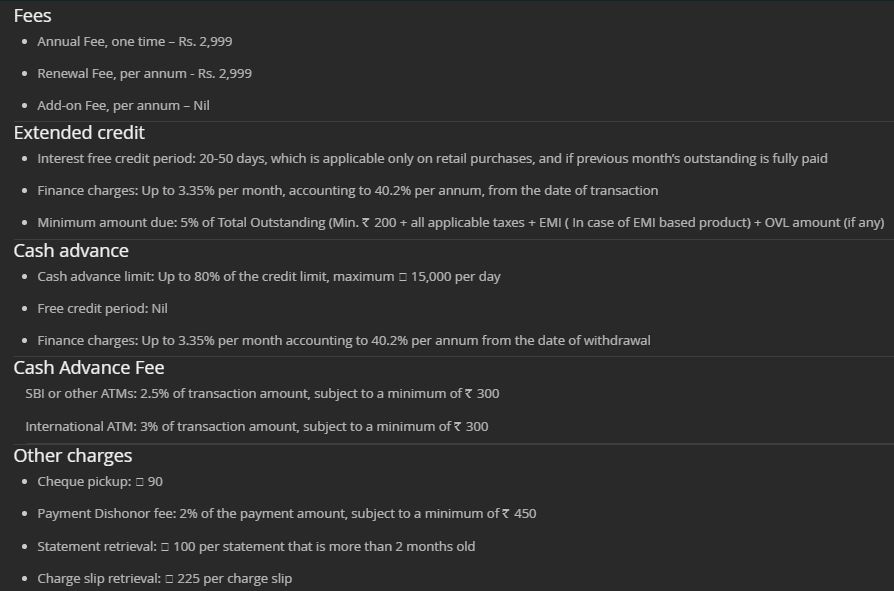

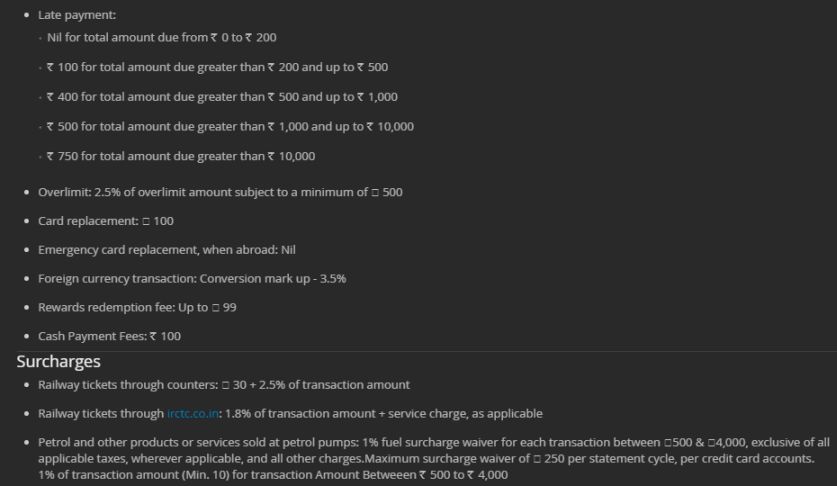

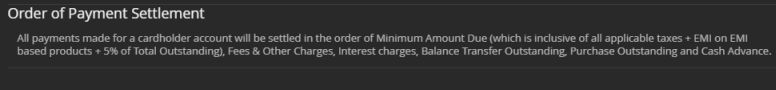

Federal Bank offers you globally acknowledged Credit cards co-marked with State Bank of India, in relationship with VISA. You can utilize these cards in a huge number of POS terminals and in addition internet business sites everywhere throughout the world for shopping and different installments. ' Federal Bank SBI Visa Platinum Credit Card Federal Bank SBI co-marked Mastercard with most extreme credit restrict up to Rs. 5 Lakh, that offers you alluring exceptional offers, fuel additional charge waiver, International airplane terminal parlor access and parcel of extra offers. Highlights Most extreme Credit Limit up to Rs 5,00,000 Joining charge Rs 2,999 as it were Yearly Fee Rs 2,999 as it were Joining Gift Blessing voucher worth Rs. 3,000 from accomplice shippers Reward Points 2 Reward Points for every Rs. 100 spent 5X Reward focuses (10 focuses) at Dining, Departmental and International Spends (1 point is equivalent to Rs. 0.25) Extraordinary Offer Procure 500 reward focuses by shopping utilizing Federal Bank Platinum Card for Rs. at least 1000 out of a solitary exchange inside 30 days. Fuel additional charge waiver Appreciate the flexibility from paying 2.5% fuel additional charge over all petroleum pumps (Fuel additional charge waiver is substantial for exchange sum going from Rs. 500 – Rs. 4000 , most extreme additional charge waiver of Rs. 250/ - per explanation cycle. Development Rewards Global Airport relax Access , Golf Course Access , Bonus offers like Free Air ticket Or Gift vouchers on accomplishing spends of 4 lakh and 5 lakh. Travel Offers Markdown at different lodgings the nation over Fees and Charges Fees Yearly Fee, one time – Rs. 2,999 Reestablishment Fee, per annum - Rs. 2,999 Extra Fee, per annum – Nil Extended Credit Intrigue free credit period: 20-50 days, which is material just on retail buys, and if earlier month's remarkable is completely paid Fund charges: Up to 3.35% every month, bookkeeping to 40.2% for every annum, from the date of exchange Least sum due: 5% of Total Outstanding (Min. Rs. 200 + all relevant charges + EMI ( if there should be an occurrence of EMI based item) + OVL sum (assuming any) Cash Advance Loan confine: Up to 80% of as far as possible, greatest ₹ 15,000 every day Free credit period: Nil Fund charges: Up to 3.35% every month bookkeeping to 40.2% for every annum from the date of withdrawal Cash Advance Fee SBI or different ATMs: 2.5% of exchange sum, subject to at least Rs. 300 Worldwide ATM: 3% of exchange sum, subject to at least Rs. 300 Other charges & Surcharges Details    |