|

#2

September 15th, 2017, 10:11 AM

| |||

| |||

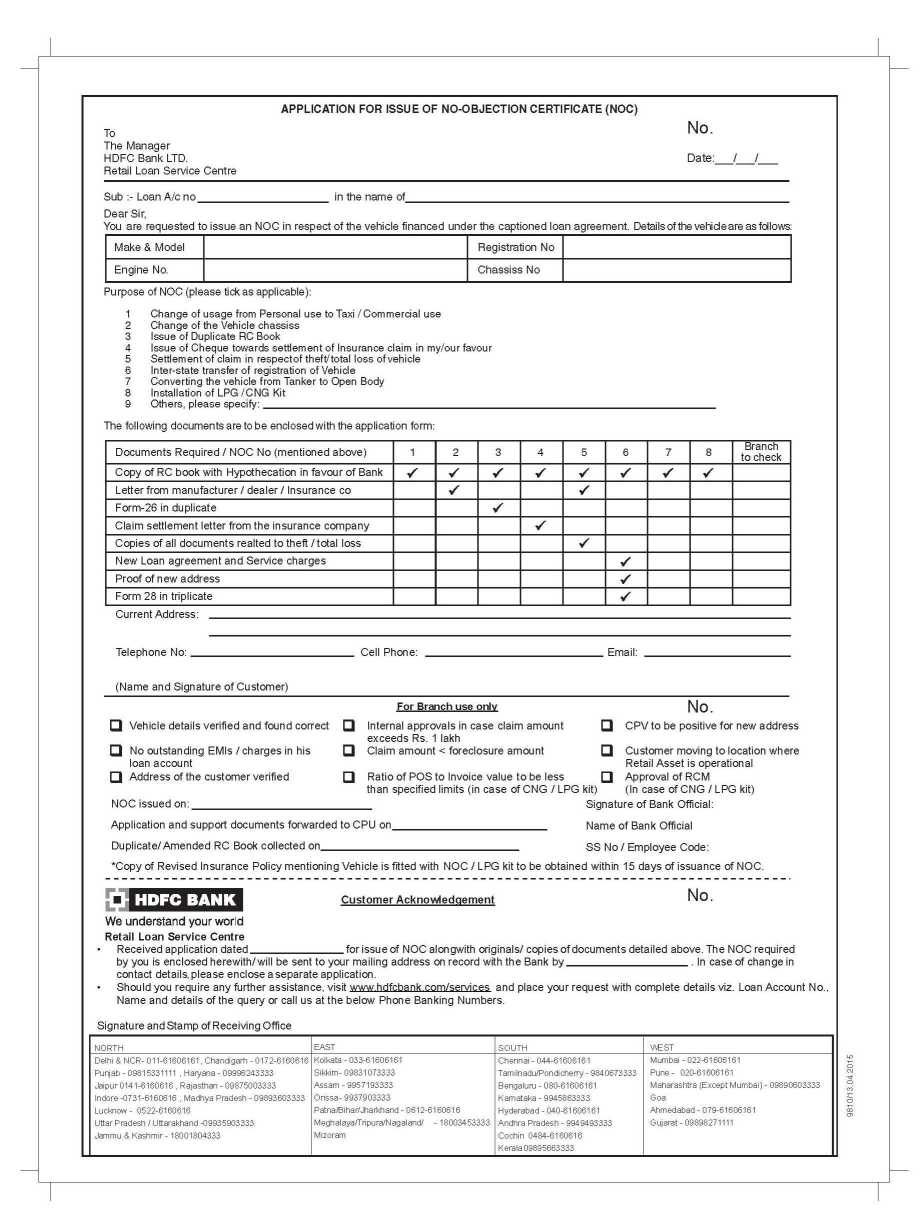

| Re: HDFC Bank Two Wheeler Loan NOC

All that you need from a Two-wheeler advance, is appropriate here. Get up to 100% financing alternatives, simple and quick disbursals, take amicable rates, and a 5-minute qualification check to round it off. Benefits Two Wheeler Loan 2% Lower Interest Rates 2% Lower Interest Rates Bike Loan Flexible Repayment Tenure Adaptable Repayment Tenure Bike Loan Speedy Loan Approval Quick Loan Approval Bike Loan Savings up to Rs. 2,375/ - Reserve funds up to Rs. 2,375/ - Qualification The accompanying individuals are qualified to apply for a Two Wheeler Loan:A salaried or independently employed person: People who are at least 21 years old at the season of applying for the advance, and no more established than 65 toward the finish of the advance tenureThose who procure a base gross salary of Rs. 84,000 every year for a salaried profile, and Rs. 72,000/ - every year for an independently employed profileIndividuals who have been living at the given home for at least 1 year (in the event of exchange from another area with under 1 year at the present area, sympathetically give pertinent archives to the bank amid advance endorsement stage)Those who have been working for at least 1 yearIndividuals who have a phone/office landline association How would I acquire a NOC from the bank if my Registration Certificate is damaged and wish to apply for a copy Registration Certificate book for a vehicle under fund with HDFC Bank? You may acquire the NOC for a copy Registration Certificate book for your vehicle credit, by going by any of our Retail Loan Service Center and presenting the accompanying records: Demand frame for applying for the required NOC. Self bore witness to duplicate of the Registration Certificate book, appropriately self verified by you, alongside the Original Registration Certificate book for approval. Appropriate expense of Rs. 500/ - vide a check/payorder/request draft favoring "HDFC Bank Ltd Loan Account No. << >>". In the event that a carrier presents the demand for your benefit, a conveyor authorisation alongside KYC documents(self confirmed duplicate and unique for approval) of the carrier, i.e. Character and Signature Proof like PAN Card, Aadhar Card, Driving License or Passport Copy will likewise should be given. Application for Issue of No-Objection Certificate (NOC)  |