|

#2

October 7th, 2017, 09:38 AM

| |||

| |||

| Re: Home Loan Standard Chartered Bank

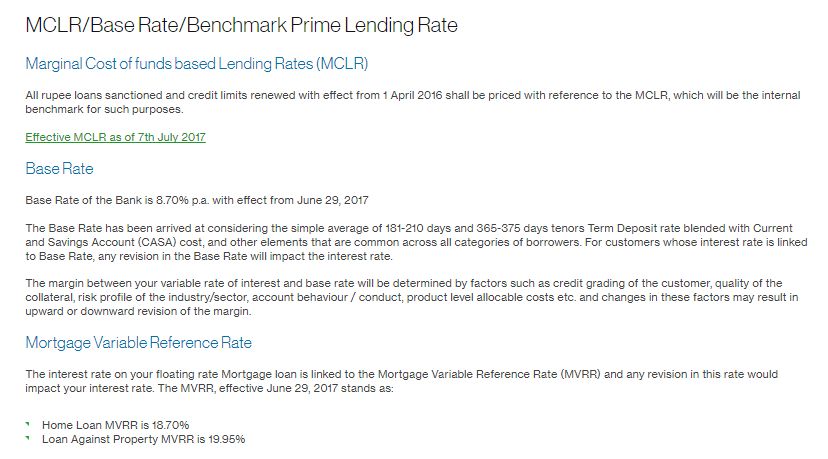

Standard Chartered Home Loan encourages you purchase your fantasy home with a simple financing arrangement highlighting low loan fees and unrivaled levels of administration Highlights Extraordinary reserve funds It offers variable and semi-settled rate lodging advances with only a one-time handling charge. No shrouded charges. Customized to your requirements You have a necessity, it has an item! Advances accessible for prepared/under development level or house, home expansion and remodel. Adaptable residencies Standard Chartered offers home advances for salaried and independently employed clients with an extensive variety of residency Renegotiating alternatives Stayed with a High Interest home advance? Exchange your current advance to a lower premium Standard Chartered Bank Home Loan and spare cash Points of interest Standard Chartered offers advances for salaried and independently employed people with an extensive variety of residency, from 5 years to 25 years Advantages Insurance Products Home Loan Protector Home Loan Protector is an item, which shields your family from the weight of reimbursement of the home credit in the tragic occasion of your demise. Home Protector HHP design joins property and home substance protection in one strategy. You can take protection for mixes of these segments or for a solitary part. Home substance offers protection for the things of the client inside the house. Home Protector covers the property from harm because of common catastrophes. Renegotiate your advance Exchange your current high premium advance to a lower premium Standard Chartered Bank home advance (according to the material current rates) and save money on premium. We will likewise back the prepayment charges in the event that you so wish. Tax breaks Intrigue paid on the Home Loan, According to Sec 24(b) of the Income Tax Act, 1961 a finding up to Rs. 200,000/ - towards the aggregate intrigue payable on the home credit towards buy/development of house property can be asserted while figuring the wage from house property. (The derivation sum is Rs 30,000/ - if there should arise an occurrence of advances taken preceding March 1, 1999). The intrigue payable for the pre-obtaining or pre-development period would be deductible in five equivalent yearly portions beginning from the year in which the house has been gained or built. If there should arise an occurrence of self-possessed property, this derivation is permitted just for one such self-involved property. The enthusiasm towards home advance taken for procurement, development, repairs, reestablishment or remaking of house property is qualified for finding under area 24(b). Important reimbursement of the Home Loan According to Section 80C read with area 80CCE of the Income Tax Act, 1961 the essential reimbursement up to Rs. 150,000 on your home advance will be permitted as a derivation from the gross aggregate salary subject to satisfaction of endorsed conditions. Top Up Loan A Home Loan with Standard Chartered Bank gives you a chance to accomplish something other than purchase a home. We additionally offer our current Home Loan clients a Top Up Loan, which is an advance office well beyond their current advance. In this way, in the event that you have brought a Home Loan with us and are currently needing extra financing, a Top Up Loan is the response for you. Regardless of whether you need to purchase another home theater framework, revamp your home, or fund your kid's instruction, a best up on your Home Loan enables you to address your issues at appealing financing costs. Highlights A Home Loan client who has been making reimbursements for over a half year is qualified to apply for a best up You can apply for a best up of up to 100% of the first advance sum disbursed* The best up residency can be up to the remarkable residency on your current home advance Points of interest Lower Costs: Compared to different choices, for example, individual advances, a best up gives you a superior arrangement with regards to financing costs and handling expenses, so you can use your current home advance to enable you to spare expenses Advantageous Repayment Plan: A Top Up Loan enables you to reimburse over a more drawn out residency contrasted with an individual credit, helping you to keep your month to month surge low. You likewise have the choice of exchanging your current advance to Standard Chartered Bank and benefiting a Top Up Loan alongside the exchange. Call our telephone keeping money lines now to take in more. MCLR/Base Rate/Benchmark Prime Lending Rate  |