|

#2

December 5th, 2017, 10:08 AM

| |||

| |||

| Re: IDBI Merger with Bank of Baroda

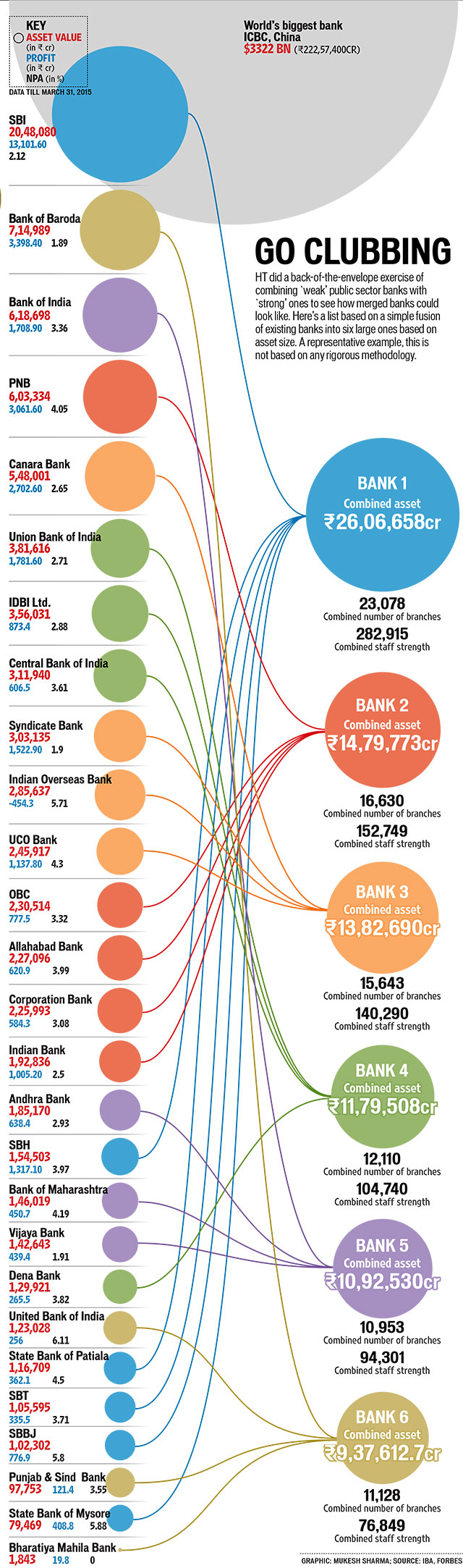

In an offer to lessen the quantity of state-possessed loan specialists and make 3-4 worldwide estimated banks, the legislature is taking a shot at a solidification motivation. The real concentration of the legislature is to make 3-4 worldwide estimated banks like the measure of State Bank of India (SBI) and diminish the quantity of state-possessed moneylenders. In spite of the progressions saw throughout the years, there still exist various difficulties which should be tended to, one such Challenge being the NPA. In the Quarter finishing December 2015, about 11 Public Sector banks revealed misfortune, which even incorporates enormous names like, Bank of Baroda, IDBI Bank, Bank of India and Indian Overseas Bank. The net non-performing resources (NPA), in the managing an account area, have crossed Rs 4.3 lakh crore amid the quarter-finished December 31, 2015. To conquer the difficulties and dangers postured at exhibit and in fore future, and give another course to Banking Reforms, government is thinking about blending the current Public Sector Banks. In this way, the administration's progression to amalgamate 27 banks into six extensive foundations is planned to sufficiently reinforce the state-possessed banks' capital base. Likewise, already Banking Sector has seen Banks, for example, Global Trust Bank and New Bank of India converged with Oriental Bank of Commerce and Punjab National Bank.  Below are the names of Public sector Banks with the Anchor Bank (with which other Banks will get merged). 1. State Bank of India (Anchor Bank) • State Bank of Hyderabad • State Bank of Patiala • State Bank of Travancore • State Bank of Bikaner & Jaipur • State Bank of Mysore 2. Punjab National Bank (Anchor Bank) • Oriental Bank of Commerce • Allahabad Bank • Corporation Bank • Indian Bank 3. Canara Bank (Anchor Bank) • Syndicate Bank • Indian Overseas Bank • UCO Bank 4. Union Bank of India (Anchor Bank) • IDBI Bank Ltd • Central Bank of India • Dena Bank 5. Bank of India (Anchor Bank) • Andhra Bank • Bank of Maharashtra • Vijaya Bank 6. Bank of Baroda (Anchor Bank) • United Bank of India • Punjab & Sind Bank • Bhartiya Mahilla Bank Advantages of Merger 1. It is relied upon to enhance the effectiveness and administration conveyance of Public Sector Banks. 2. The sharing of Infrastructure will give clients a more extensive utilization of the ATM arrange. 3. The charges on cross-bank ATM utilization would diminish impressively. 4. Clients of littler banks will access more extensive utilization of money related instruments like shared assets and protection items, as offered by Big Banks. 5. Huge banks would have a more extensive capital base empowering them to offer expensive advances individually without being a piece of a consortium. Disadvantages of Merger 1. Littler banks will have a tendency to lose nearby attributes, which clients favored due to social liking 2. A couple of huge between connected banks uncover the more extensive economy to more prominent monetary dangers. 3. Human asset issues can be hard to deal with; vocation development of senior administration and different laborers could end up plainly tricky. |