|

#2

September 23rd, 2017, 08:15 AM

| |||

| |||

| Re: IRS EZ Tax Table

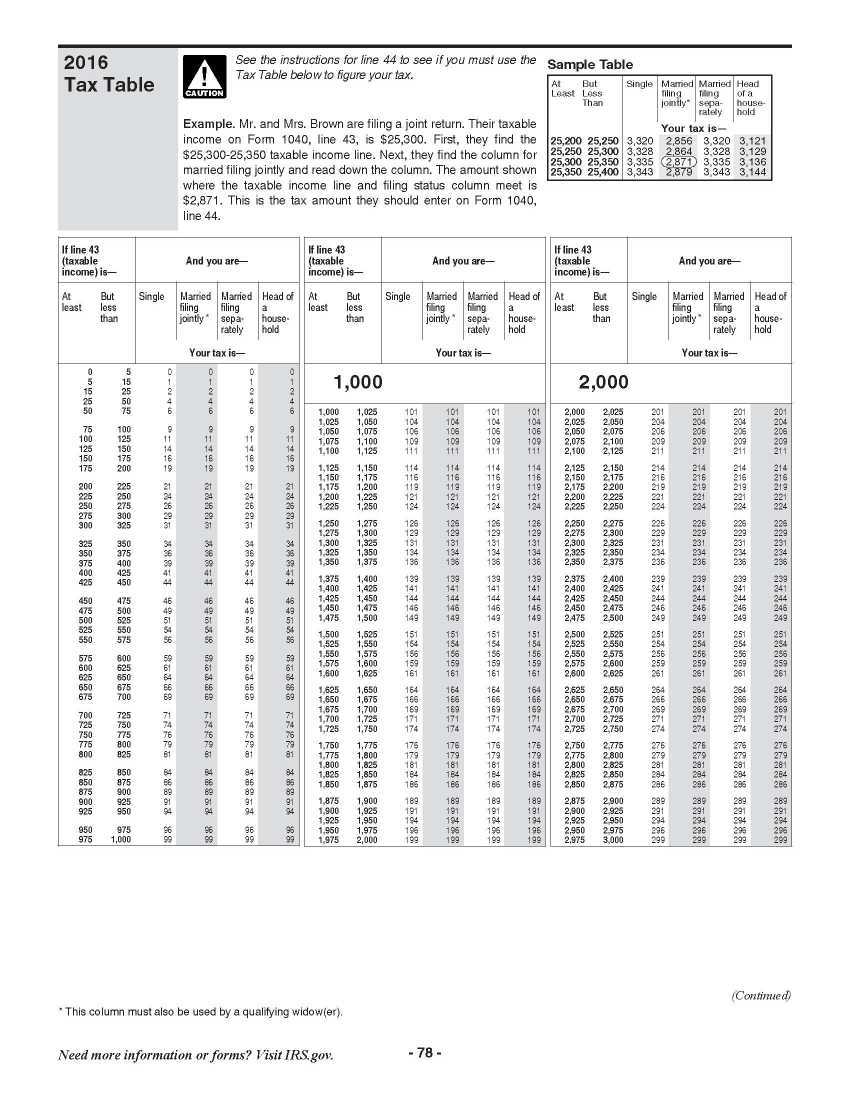

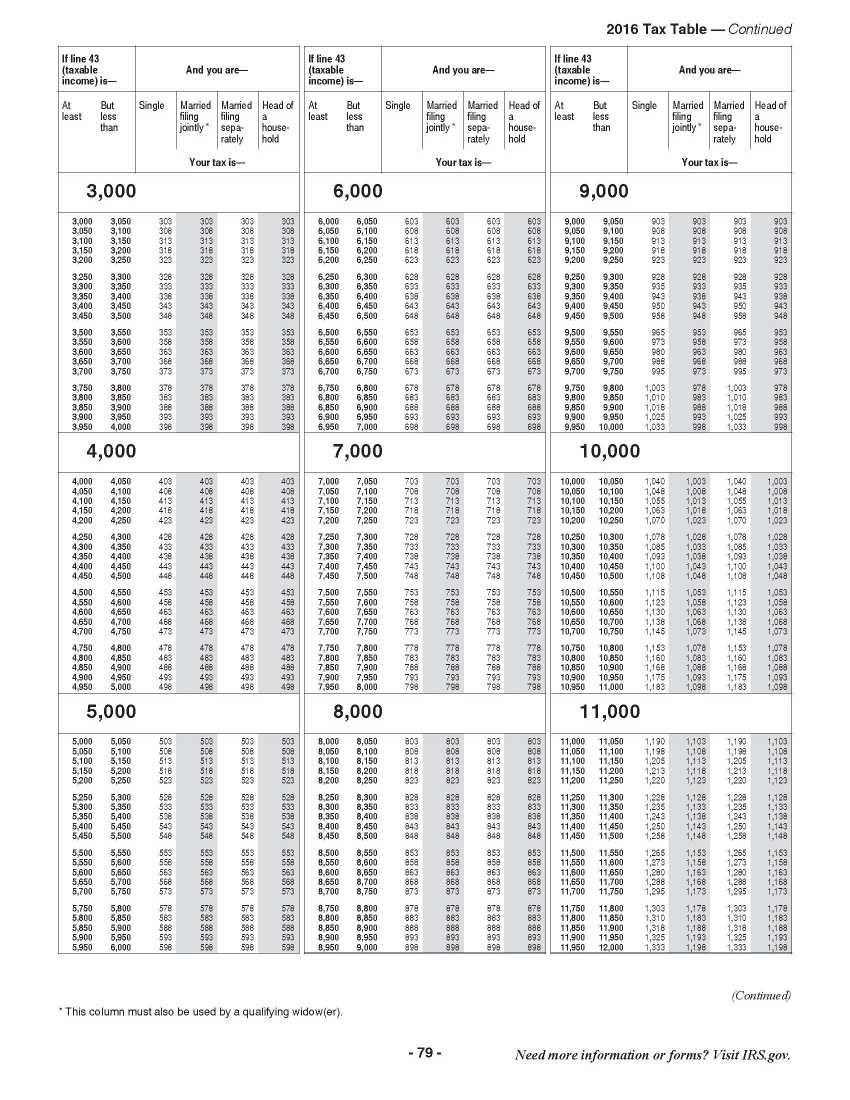

Tax tables or graphs are utilized to figure the expense you owe in light of various factors. Assessment tables are distributed by the Internal Revenue Service (IRS) and by every individual express that gathers pay charge. An ordinary assessment table will indicate breakpoint wage levels, above and beneath which distinctive expense rates will apply. People and organisations that set up their own duties make broad utilization of expense tables. Duty tables are additionally used to ascertain capital increases charges. Assessment tables will change from year to year, and will shift from state to state. People and organizations ought to dependably make certain that they are utilizing the right assessment tables in light of year, their wage and sources and region of living arrangement. U.S. Government Income Tax Tables This article will concentrate on U.S. Government Income Tax Tables as issued yearly by the IRS. The government salary impose you owe depends on various factors, factors, for example, you're recording status (e.g., single), your findings (e.g., medicinal and dental costs), your exclusions (e.g., wards), and the measure of assessable wage you earned in the assessable year. These assessment tables will demonstrate to you the pertinent expense rates and the particular dollar sum you owe in view of all factors. The government assess tables are installed in numerous well known duty arrangement programming bundles, which may influence your expense planning to work considerably less demanding. The most effective method to Read the Tax Tables To begin with, you'll have to realize what your "assessable pay" is. You will then look down through the sections for assessable wage. You will see assessable pay aggregate in scopes of $50. Discover the range that incorporates your assessable pay. At that point look to the column to one side of your assessable wage. Your government salary duty will be appeared by documenting status. Utilize the assessment assume that relates to your recording status in that column. In the event that you need Help In the event that you require help setting up your assessment form, or have inquiries regarding an expense issue, the IRS gives free assets, for example, distributions, structures or guidelines. Getting ready and recording your expense form. Go to IRS.gov and tap on the Filing tab to see your alternatives. Enter "Free File" in the hunt box to see whether you can utilize mark name programming to get ready and e-record your government assessment form for nothing. Enter "VITA" in the inquiry box, download the free IRS2Go application, or call 1-800-906-9887 to discover the closest Volunteer Income Tax Assistance or Tax Counseling for the Elderly (TCE) area with the expectation of complimentary expense readiness. Enter "TCE" in the pursuit box, download the free IRS2Go application, or call 1-888-227-7669 to discover the closest Tax Counseling for the Elderly area with the expectation of complimentary duty arrangement. The Volunteer Income Tax Assistance (VITA) program offers free expense help to individuals who for the most part make $54,000 or less, people with inabilities, the elderly, and constrained English-talking citizens who require help setting up their own assessment forms. The Tax Counseling for the Elderly (TCE) program offers free expense help for all citizens, especially the individuals who are 60 years old and more established. TCE volunteers work in noting inquiries concerning annuities and retirement-related issues interesting to seniors. Booklet containing Tax Tables from the Instructions for Form 1040 only - 2016    |