|

#2

October 28th, 2017, 02:52 PM

| |||

| |||

| Re: National Bank Pakistan Housing Loan

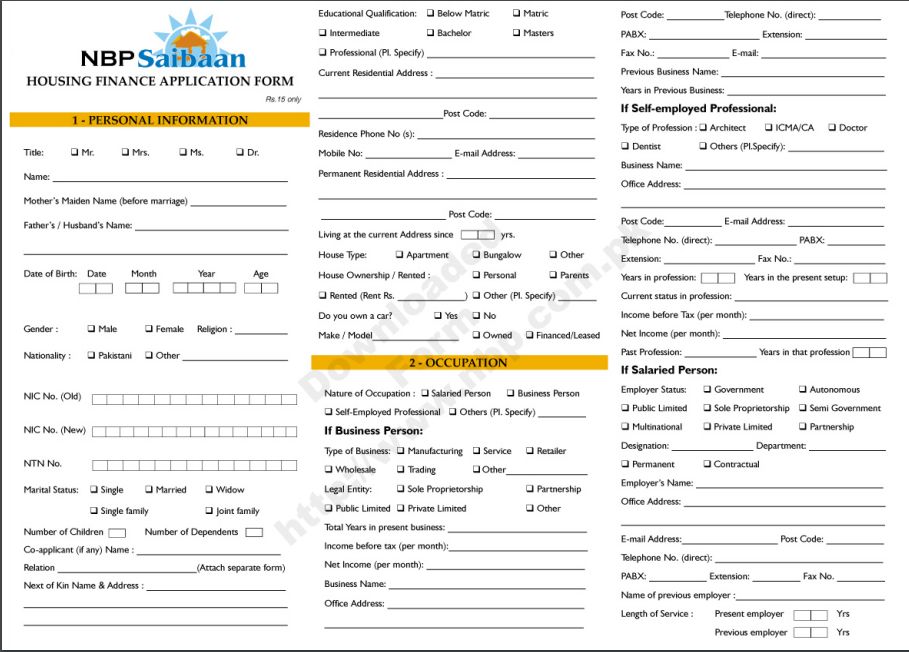

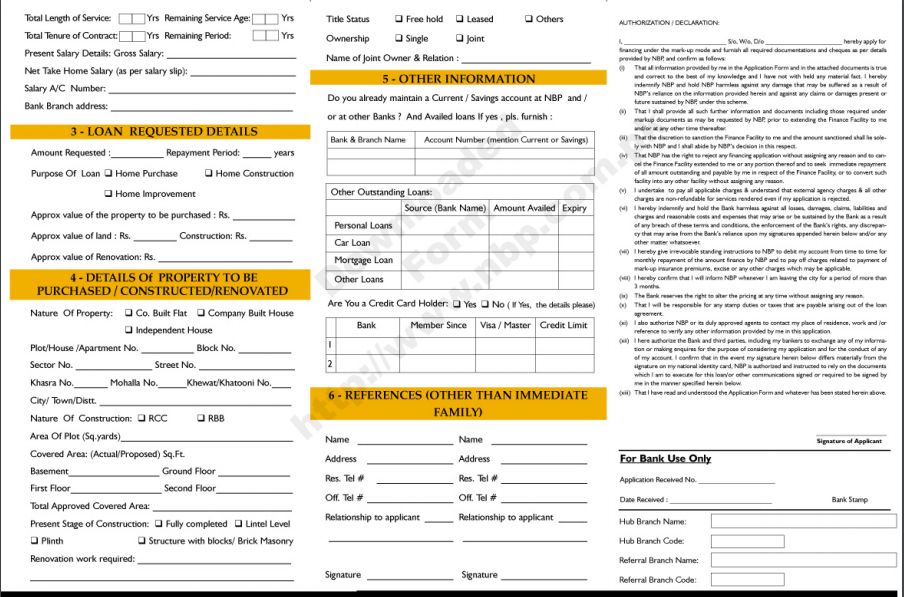

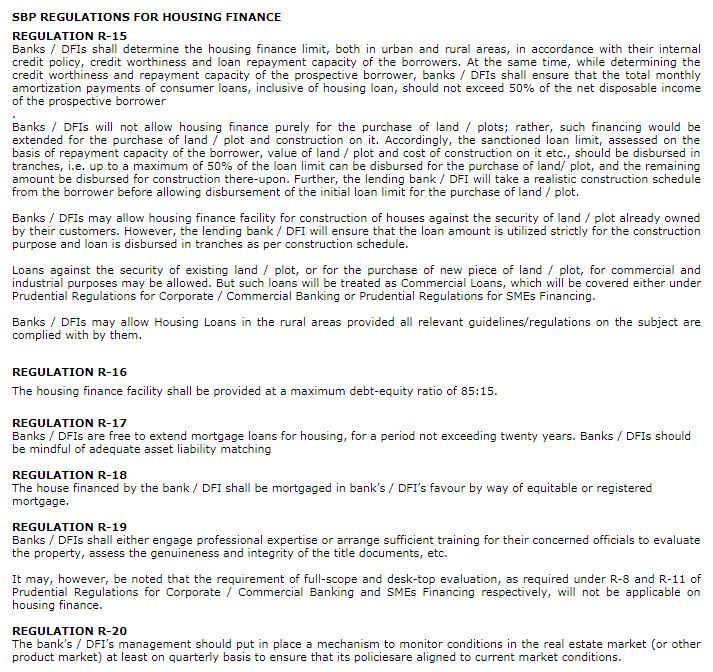

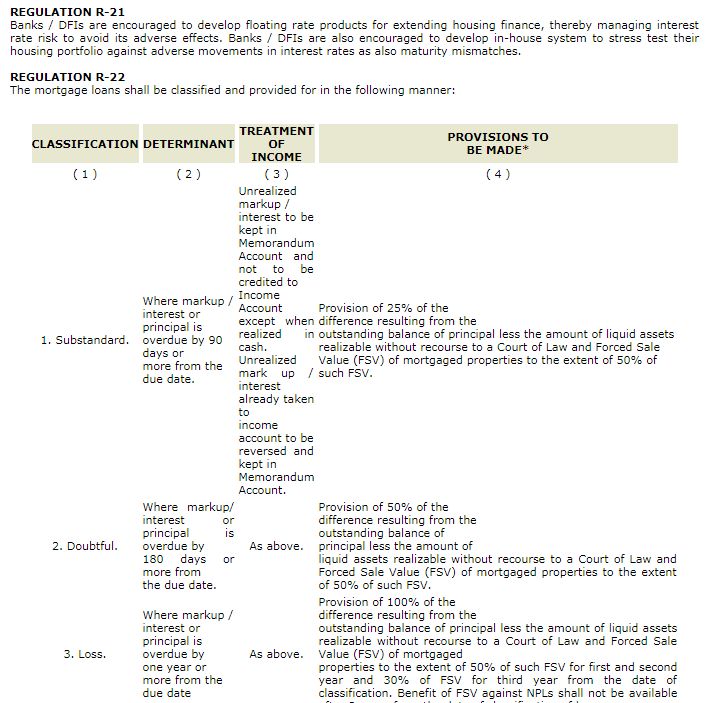

NBP Saibaan is an absolutely private plan for Pakistani occupant nationals holding CNIC and clean e-CIB report and looking after pay/current A/c (if not, at that point A/c to be opened at NBP branch before back dispensing). Clients: Classification A - 1: Incorporates lasting workers of Federal Govt., Semi-Govt., Autonomous, Semi-self-sufficient, Local and Other Bodies whose pay rates are/might be dispensed through NBP Branch and their association is prepared to give Employer Undertaking on NBP's arrangement. Classification A - 2: Incorporates are other salaried class working with Multinational Companies, Schedule Banks or Organizations endorsed by NBP Qualification Must be Pakistani Resident (National) Matured in the vicinity of 21 and 65 years at the season of utilization/payment of advance. Salaried Person, Self-utilized experts and businesspeople. Least pay prerequisite Rs. 5000 for Govt. Workers, Rs. 10,000 for other salaried people and Rs. 15,000 for self employeed and agents. Property situated in NBP endorsed territories. Administration term: Two years for salaried class Three years for independently employed/business class. Instructions to Apply Guidelines for finishing the Application Form: Fill-in the form completely Print the "completely filled" form Get it marked by Referees Sign it yourself Attach the Required Documents what's more, submit "In PERSON" to NBP Saibaan Team National Bank Pakistan Housing Loan – Saibaan Details Purpose & Details Home Purchase Home Construction Home Renovation Purchase of Land + Construction Balance Transfer Facility (BTF) Home Purchase (House or Apartment) Financing Amount Upto 35 Million Financing Period 3 to 20 Years Debt to Equity 85:15 (Maximum) Home Construction Financing Amount Upto 35 Million Financing Period 3 to 20 Years Debt to Equity 85:15 (Maximum) Home Construction - Product Detail Financing Amount Upto 35 Million Financing Period 3 to 20 Years Debt to Equity 85:15 (Maximum) Home Renovation Financing Amount Upto 15 Million Financing Period 3 to 15 Years Debt to Equity 80:20 (Maximum) Purchase of Land and for Construction thereon Financing Amount Upto 35 Million Financing Period 3 to 20 Years Debt to Equity 80:20 (Maximum) Re-Financing (Balance Transfer Facility (BTF)) If you have a Home Finance Facility outstanding with another bank you can have it transferred to NBP through a hassle-free procedure. Saibaan Application Form   Required Documents with Applications Form • Two attested passport size photographs • Two attested copies of your National Identity Card • Cheque for the processing charges • Property Documents: Any title document available (other documents may be required) And 1) FOR SALARIED PERSONS, WHOSE SALARIES ARE DISBURSED THROUGH NBP BRANCH • Employer Undertaking for remittance of salary at relevant NBP branch for credit to customer's account (to be provided at a later stage, format available at relevant branch) • Employee ID Copy attested by NBP Branch (where applicable) • Attested copies of last three (3) months salary slips • Attested copies of last three (3) months bank statements 2) FOR SALARIED PERSONS OF MNCs AND NBP APPROVED COMPANIES • Employer Undertaking duly attested by relevant NBP Branch, where applicable (to be provided at a later stage, format available at relevant branch) • Attested copies of last three (3) months Salary Slips • Letter of Verification of Employment on Company Letterhead mentioning the date of joining • Attested copies of last three (3) months bank statements 3) FOR OTHER SALARIED PERSONS • Letter of Verification of Employment on Company Letterhead mentioning the date of joining • Attested copies of last three (3) months Salary Slips • Attested copies of last twelve (12) months bank statements • Attested copies of last three (3) months paid bills for electricity and telephone OR copies of last (12) twelve months credit card bills (which ever is available) 4) FOR BUSINESS PERSONS • Bank Certificate stating applicant maintaining Business Account and the date of account opening • Attested copy of latest Form 29 in case of Private or Public Limited Company • Attested copy of Partnership Deed (where applicable) 5) FOR SELF-EMLPLOYED PERSONS • Attested copy of current professional association membership/practicing certificate. Adequate proof of professional engagement like bank certificates • Attested copy of Partnership Deed (where applicable) Any other document may be required on case to case basis by the bank SBP Regulations for Housing Finance   |