| November 23rd, 2013 07:48 AM | |

| shobhaupreti94@gmail.com | du ques papes Plz can i get previous year ques papers of du zoology hnrs 3rd sem previous year ques papers |

| May 19th, 2013 09:22 PM | |

| Unregistered | Re: DU Question Papers I am student of b.com(pass) of Delhi university. I need the question paper of English of semester-2 for 2012 year. |

| March 16th, 2013 12:15 PM | |

| pravin.bhoota | DU Question Papers Sir, Please provide me the Question paper of DU B.Com(H) First year (Financial Acc.) |

| January 28th, 2013 01:10 PM | |

| Harsh Pandit | Re: DU Question Papers You required the Delhi University BA 1st year Political Science question paper, here I am uploading a file, from where you can download the Delhi University BA 1st year Political Science question paper. The paper has 10 questions, the maximum mark of the paper is 75, and the paper is of 3 hours. DU BA PS Question paper aatachment |

| January 24th, 2013 05:21 PM | |

| dineshkumar | DU Question Papers I am a student of BA 1st year Political Science of Delhi University and I will be giving the exams of BA so I wanted the previous years question papers of the same so I ask about this so please give me the information |

| March 20th, 2012 03:51 PM | |

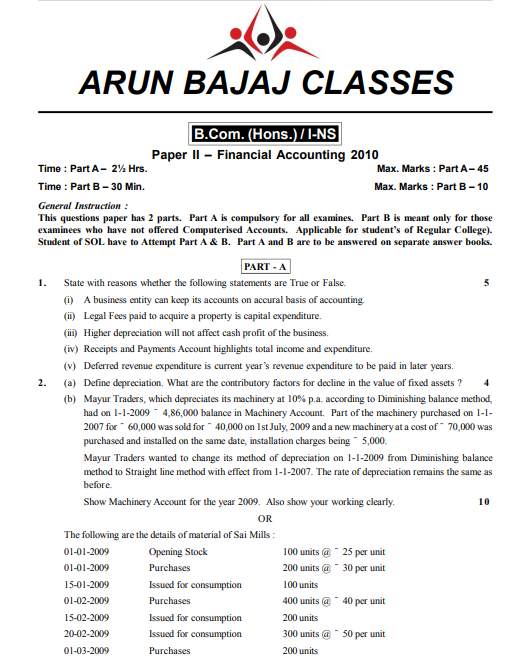

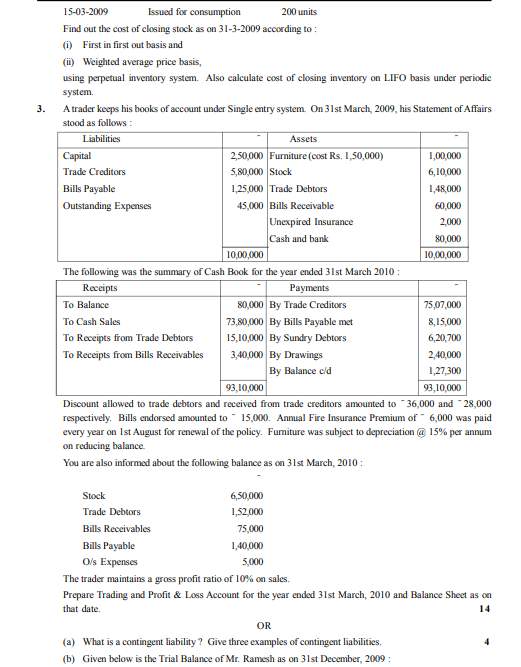

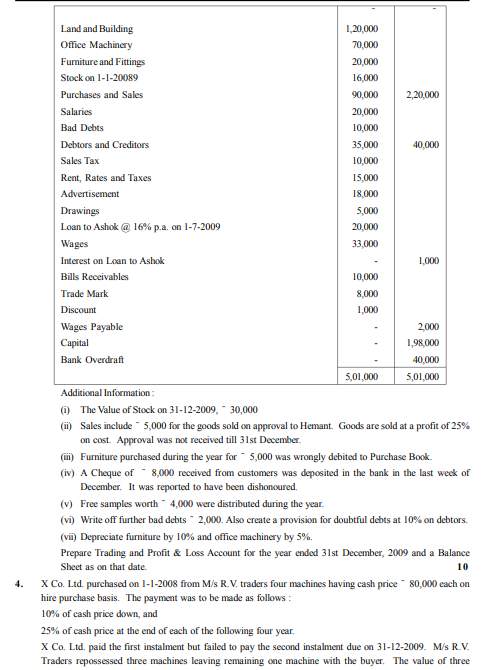

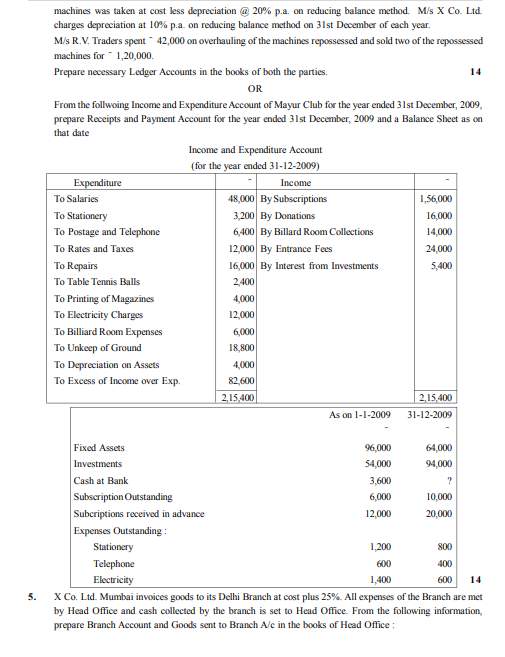

| Priyanka Goyal | DU Question Papers I am in Delhi university B.com. my exams are coming near. Please tell me from where I can download the previous year question papers for this course. If you can give me those question papers I will be very grateful for you. Or else you can just give me the link also. Here I am giving the Question paper of DU B.Com(H) First year (Financial Acc.) Q. State with reasons whether the following statements are True or False. (i) A business entity can keep its accounts on accural basis of accounting. (ii) Legal Fees paid to acquire a property is capital expenditure. (iii) Higher depreciation will not affect cash profit of the business. (iv) Receipts and Payments Account highlights total income and expenditure. (v) Deferred revenue expenditure is current year’s revenue expenditure to be paid in later years Q. State with reason whether the statements are True or False : (i) Depreciation is decrease in the market value of a fixed asset. (ii) Revenue and income are one and the same thing. (iii) According to accrual concept, revenues are recognised only when cash is actually received. (iv) Assets represent expired while expenses are unexpired costs. (v) Outstanding rent account is a personal account. Q. State with reasons whether the following statements are True or False. (i) Expenses incurred to keep the machine in working condition is capital expenditure. (ii) Accrual concept implies accounting on cash basis. (iii) Depreciation cannot be provided in case of loss in a financial year. (iv) Prudence is a concept to recognise unrealised profits and not losses. (v) The receipts and payments account records receipts and payments of revenue nature only. Q. (a) Distinguish between capital expenditure and revenue expenditure. 4 (b) M/s S.S Traders commenced business on 1st January, 2005, when they purchased machinery of ˆ.7,00,000. They adopted a policy of (i) charging depreciation at 15% p.a. on diminishing balance basis,and (ii) charging full years depreciation on additions made during the year. Over the year, the purchases of machinery have been  ate ˆ ate ˆ1-8-2006 1,50,000 30-9-2006 2,00,000 On 1st January, 2008, it was decided to change the method of depreciation and rate of depreciation to10% on straight line basis with retrospective effect from 1-1-2005, the adjustment being made in theaccounts for the year ending 31st December, 2008. Prepare Machinery Account and Provision for Depreciation Account for the year 2008.     |