| July 9th, 2018 08:20 PM | |

| Unregistered | Re: Maharashtra Gramin Bank Online Account Opening how can open online account opening in maharasta gramin bank |

| November 2nd, 2017 03:23 PM | |

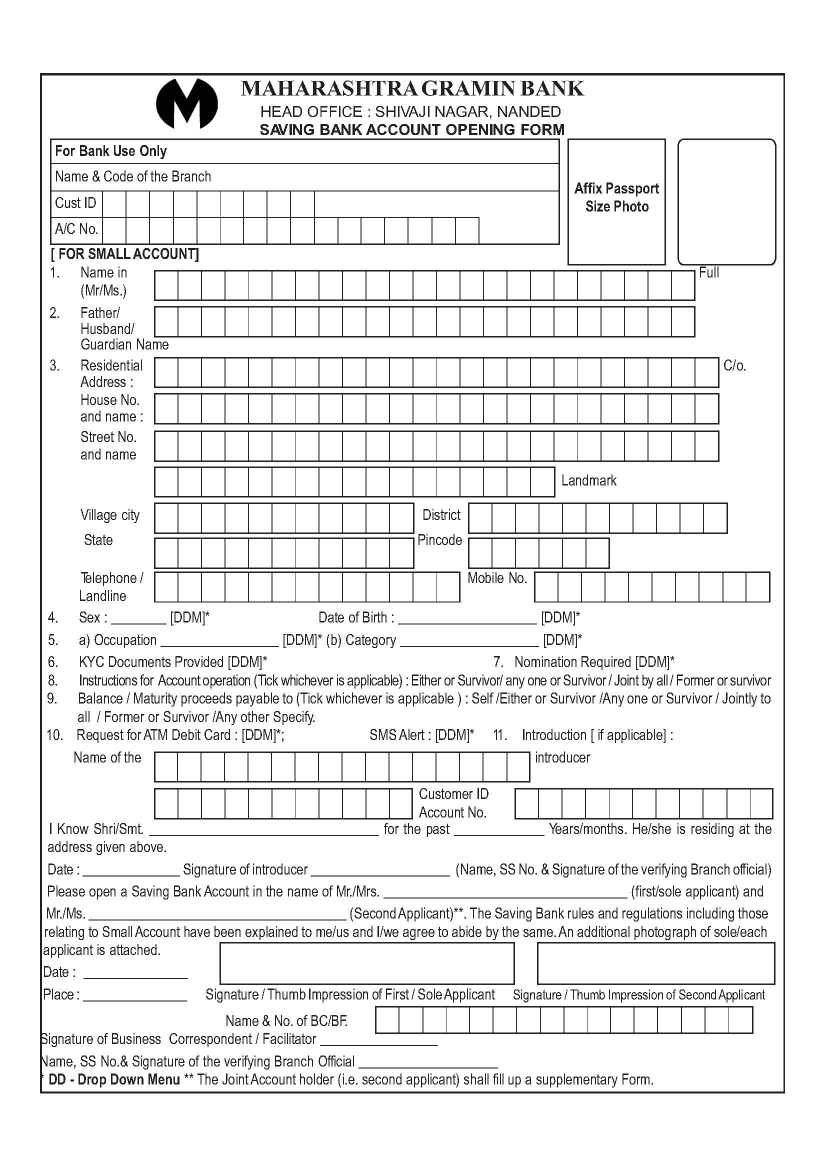

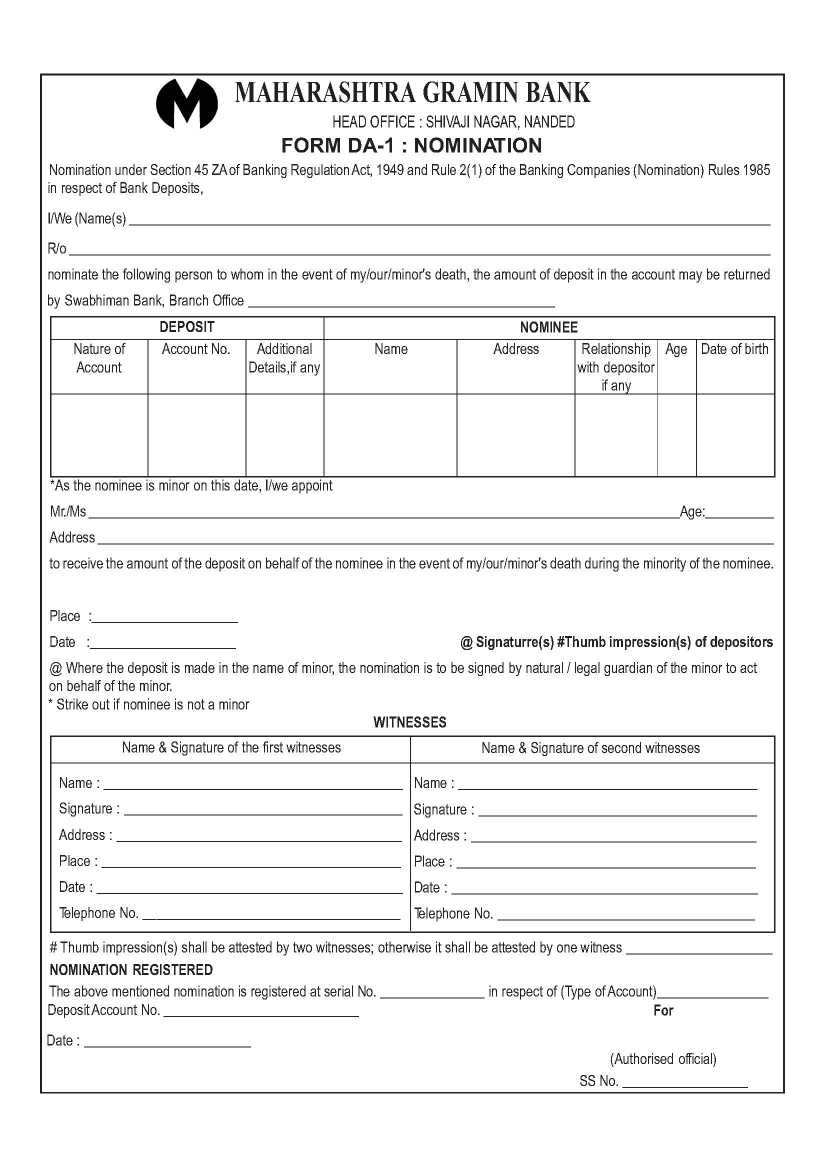

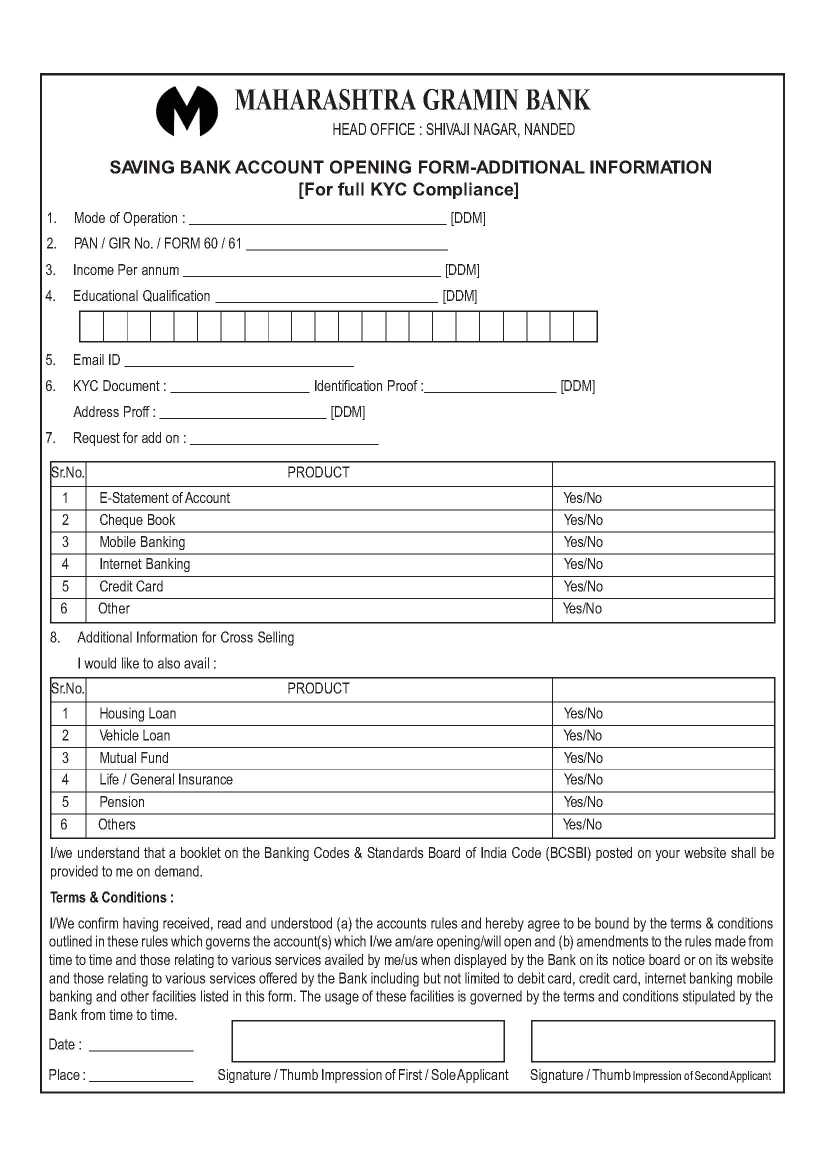

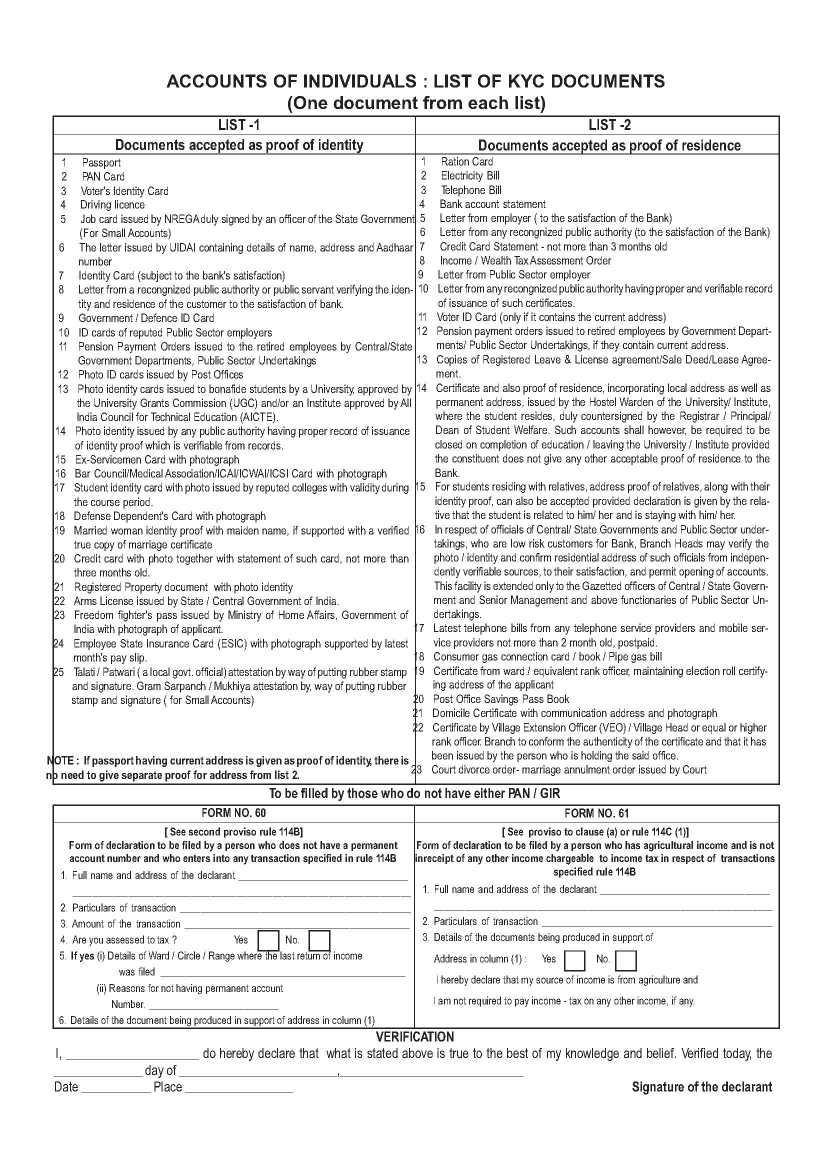

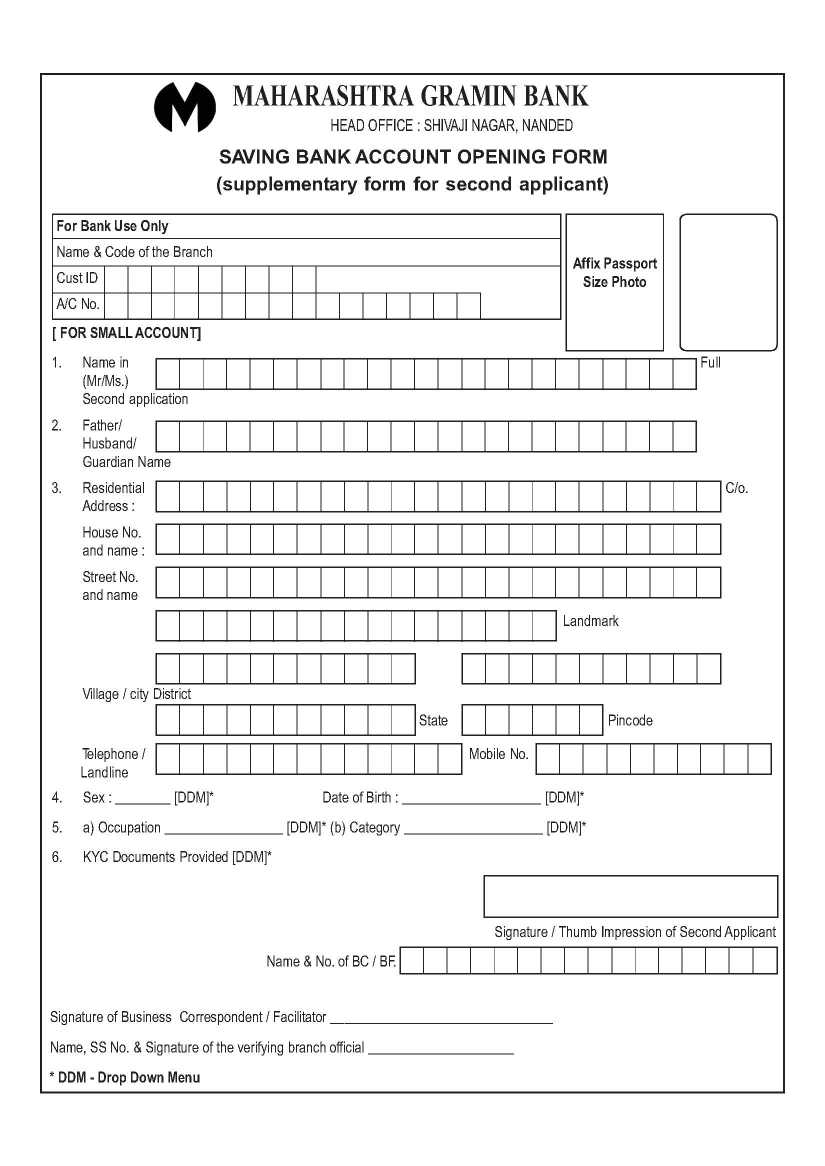

| Garima Chauhan | Maharashtra Gramin Bank Online Account Opening HI I would like to know about the formation of Maharashtra Gramin Bank as well as the details of the Saving Account Scheme and also the application form for opening Savings Account with the Bank? The RRBs were built up in India under RRB Act 1976 [23(1)]. Amid the period from 1976 to 2006 keeping money industry had experienced different changes and RRBs were no special case. Considering the requirement for auxiliary changes in RRBs in perspective of progressively changing financial situation, Govt. of India vide its notice dt. 25.03.2008 amalgamated the two RRBs i.e. Aurangabad Jalna Gramin Bank and Thane Gramin Bank into a solitary RRB named Maharashtra Godavari Gramin Bank. Maharashtra Gramin Bank came in to presence on twentieth July 2009 after amalgamation of recent Maharashtra Godavari Gramin Bank and Marathawada Gramin Bank according to the notice issued by Government of India, Ministry of Finance, Department of Financial Services ref No F.No. 1/4/2006-RRB(II) dated 20July 2009 with its head office at Nanded. The Bank is supported by Bank of Maharashtra. The offer capital of the Bank is contributed by Government of India, Government of Maharashtra and Bank of Maharashtra in extent of 50:15:35 Saving Account Scheme: Qualification Any individual can open reserve funds financial balance separately or mutually. SB Account of minors can be opened together with regular watchman/legitimate gatekeeper. The candidate ought to outfit character and address evidence as given in account opening structure (CIF for people), two photos and PAN number/Form No. 60/61 while opening new record. In the event that the client can't give any narrative confirmation of personality and address, as per the general inclination of the bank, the record can be opened with the presentation from existing record holder who has been subjected to full KYC system and having agreeable operations in the record more than a half year. Least banlance in the record Rs.100/ - without check book office Rs.500/ - with check book office Selection Selection office is accessible. Interest Interest is paid once in a year at endorsed rates. At exhibit 3.5% p.a. basic. Different Benefits The investor can give standing directions for exchange of assets starting with one record then onto the next record, RD account and so forth, Insc. Premium, credit portions. NO TDS Deposit Insurance Cover upto Rs.1.00 lac. Saving Account Form      |