|

#2

December 14th, 2017, 11:26 AM

| |||

| |||

| Re: Owner of ABN AMRO Bank

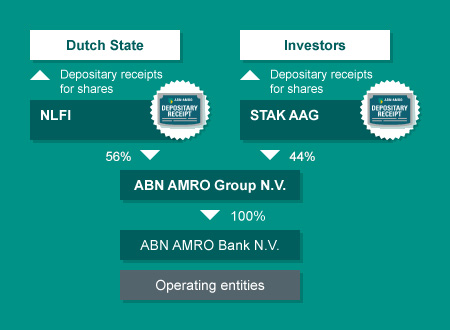

ABN AMRO Bank N.V. is a Dutch keep money with central station in Amsterdam. ABN AMRO Bank is the third-biggest bank in the Netherlands. It was re-built up in its present shape in 2009, after the obtaining and separation of the first ABN AMRO by a keeping money consortium comprising of Royal Bank of Scotland Group, Santander Group and Fortis. Following the crumple of Fortis, who procured the Dutch business, it was nationalized by the Dutch government alongside Fortis Bank Nederland. It was relisted as an open organization again in 2015. In October 2007, a consortium of the Royal Bank of Scotland Group, Fortis and Banco Santander, known as RFS Holdings B.V. gained the bank, in what was the world's greatest bank takeover to date. Thus, the bank was separated into three sections, each possessed by one of the individuals from the consortium. Investor Structure Share All offers in the capital of ABN AMRO Group N.V., are held by two establishments: stichting administratiekantoor beheer financiële instellingen (NLFI) and Stichting Administratiekantoor Continuïteit ABN AMRO Group (STAK AAG). As of now NLFI holds 56% and STAK AAG holds 44% of the offers in the issued capital of ABN AMRO Group N.V. The two establishments have issued depositary receipts for shares in ABN AMRO Group N.V. Just STAK AAG's depositary receipts are issued with the collaboration of ABN AMRO Group N.V. Presently ABN AMRO's investor structure is as demonstrated as follows  STAK AAG STAK AAG is autonomous from ABN AMRO and the holder of offers in ABN AMRO's issued share capital and has issued depositary receipts (certificaten) speaking to such offers and which are exchanged on Euronext Amsterdam. The issuing of depositary receipts is basically utilized as a defensive measure. In typical conditions, holders of depositary receipts will have to a great extent an indistinguishable rights from investors: they may go to general gatherings of investors, vote at such gatherings and have profit rights if and when ABN AMRO Group N.V. conveys profit. On a fundamental level, STAK AAG each time has the commitment to allow an energy of lawyer to the holders of depositary receipts to practice the voting rights appended to the hidden offers and won't practice voting rights on the offers, unless holders of depositary receipts have asked for STAK AAG to do as such. NLFI The Dutch State holds an enthusiasm for ABN AMRO Group N.V. through NLFI. NLFI was set up as a way to keep away from potential clashing duties that the Dutch Minister of Finance may somehow confront, as an investor and as a controller, and also to stay away from undesired political impact being applied. NLFI issued depositary receipts for shares in the capital of ABN AMRO Group N.V. to the Dutch State. NLFI is in charge of dealing with these offers and practicing all rights related with these offers under Dutch law, including voting rights. NLFI’s right of prior approval of: • any issuance of (or granting of rights to acquire) shares in ABN AMRO Group N.V. or in ABN AMRO Bank N.V. for as long as NLFI holds at least 33 1/3% of the shares in ABN AMRO Group N.V.; • (a) for as long as NLFI holds more than 50% of the shares in ABN AMRO Group N.V., any investments as well as divestments by ABN AMRO Group N.V. or any of its subsidiaries with a value of more than 5% of the equity of ABN AMRO Group N.V. and (b) for as long as NLFI holds 50% or less but 33 1⁄3% or more of the shares in ABN AMRO Group N.V., any investment as well as divestments by ABN AMRO Group N.V. or any of its subsidiaries with a value of more than 10% of the equity of ABN AMRO Group N.V.; |