|

#2

June 7th, 2016, 12:13 PM

| |||

| |||

| Re: RMA Short Sale Bank of America

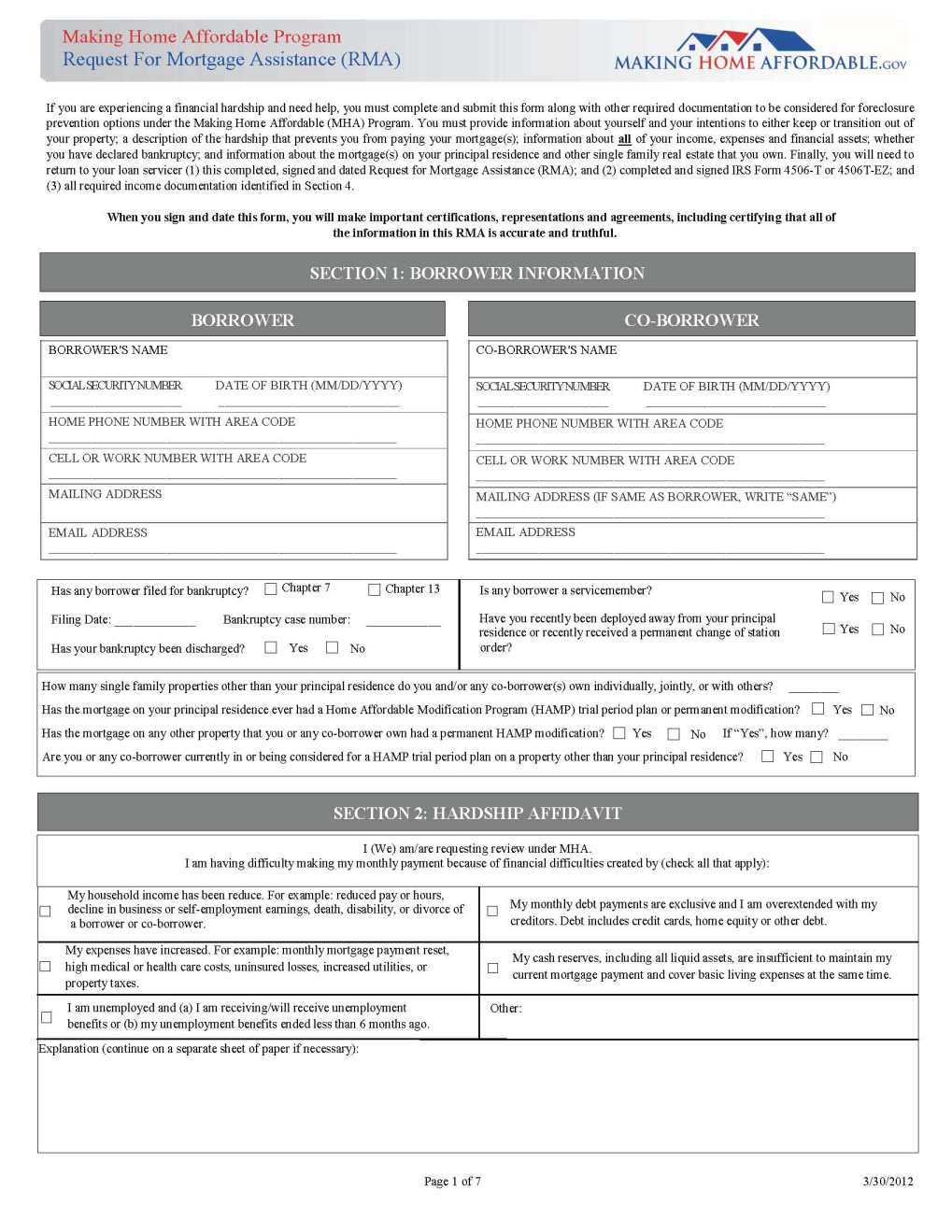

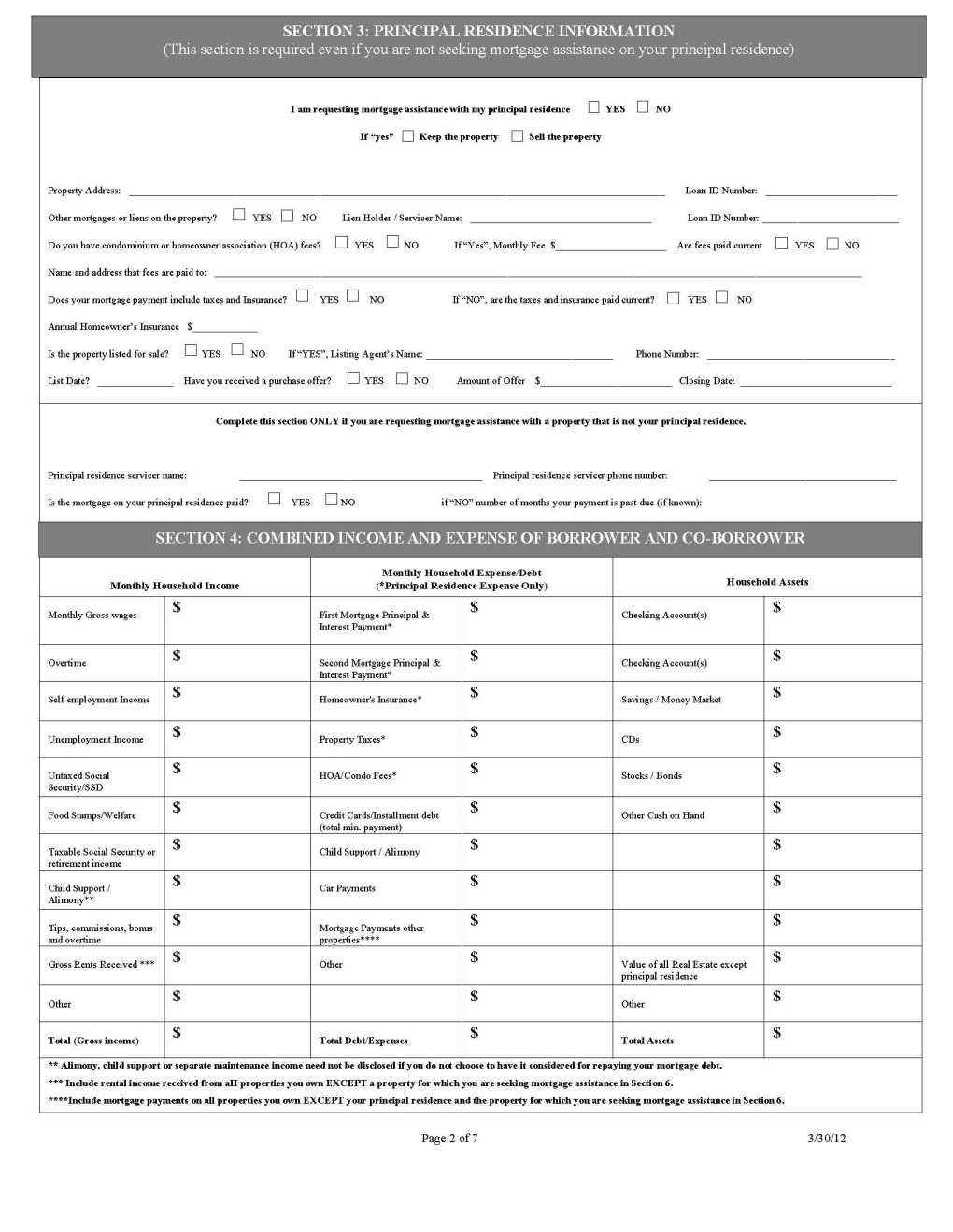

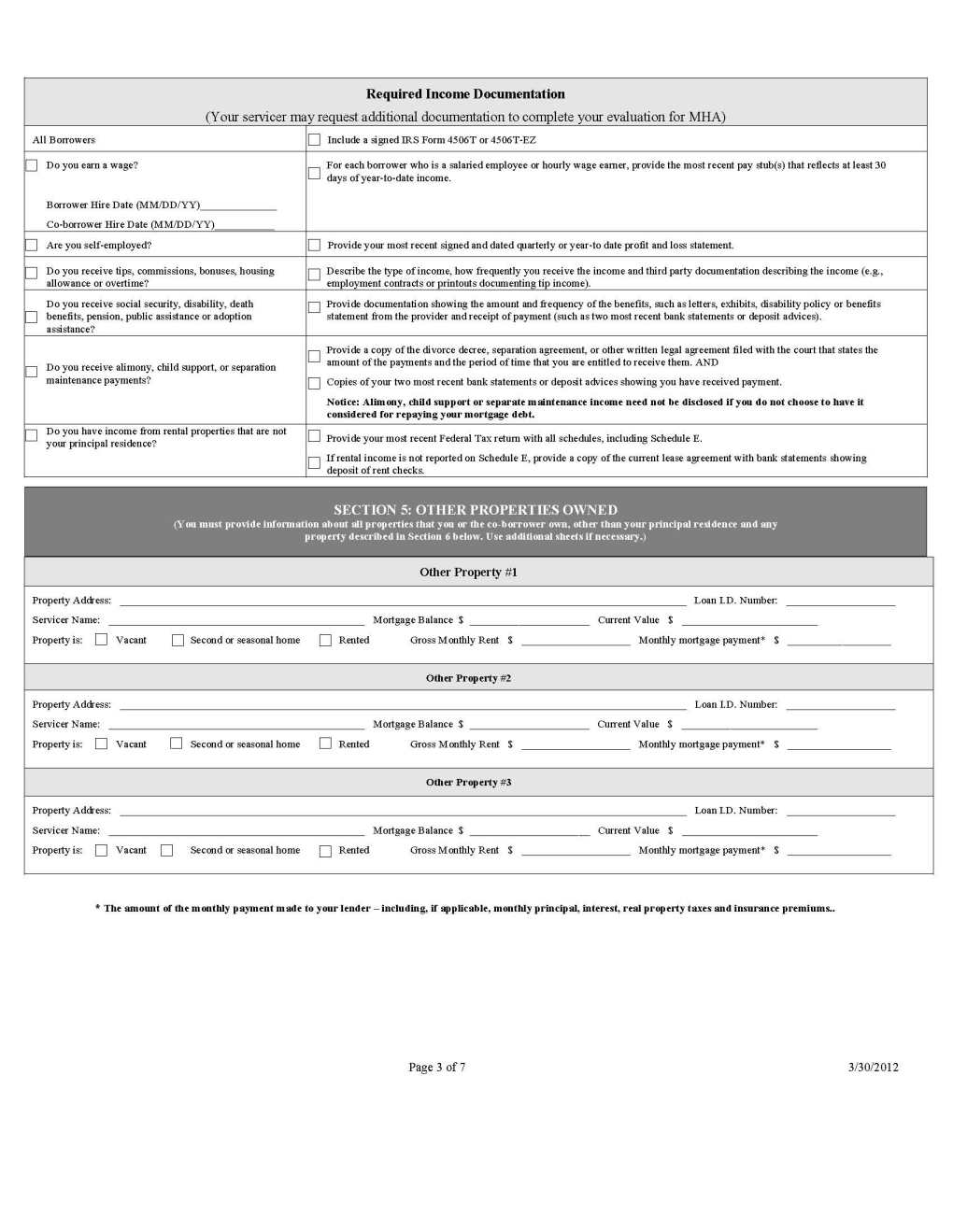

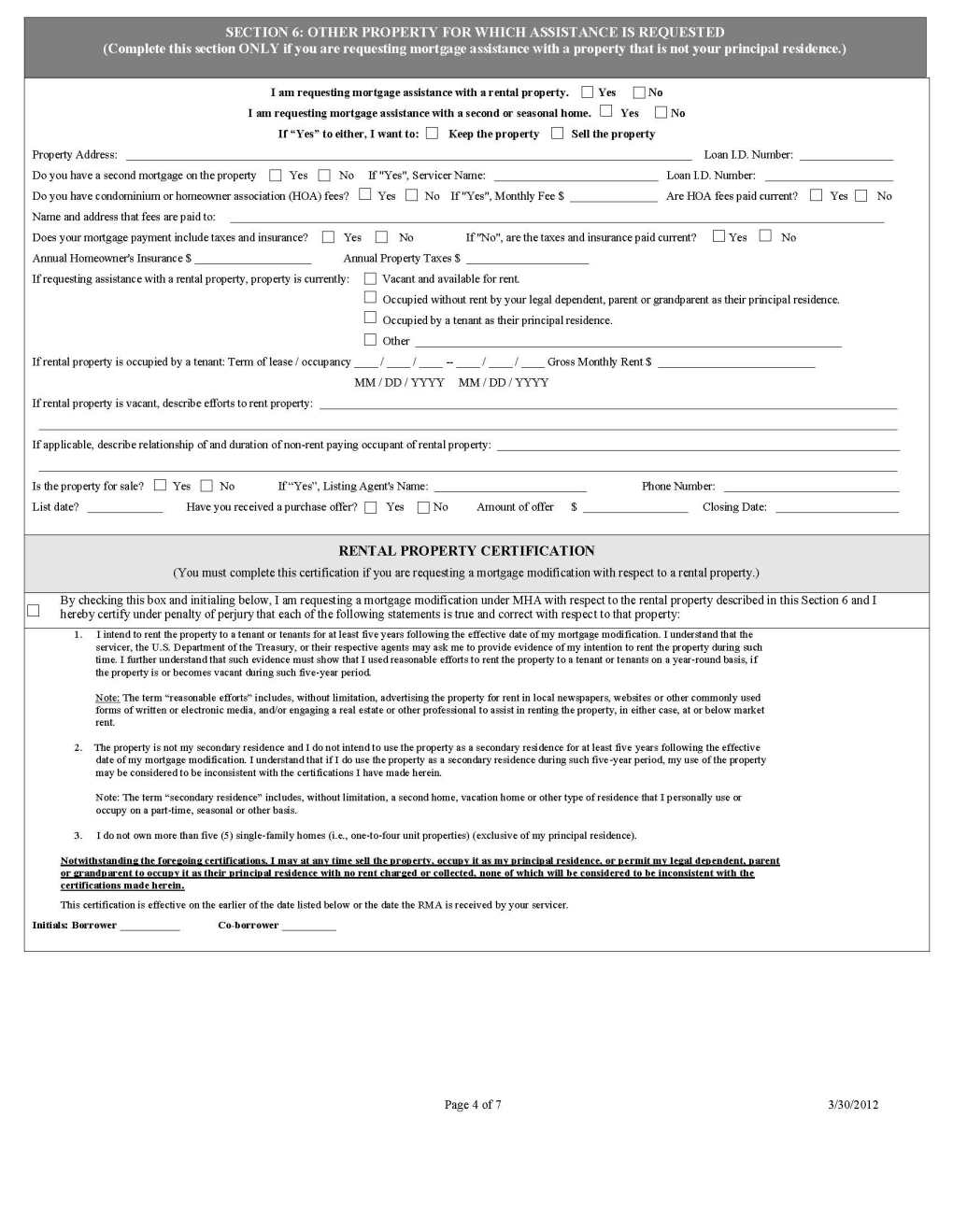

Home Affordable Modification is one of the government's Making Home Affordable projects. The administration's objective for changing your advance is to help you get a more moderate and practical month to month contract installment. Qualification You might be qualified to change your home advance under the Home Affordable Modification Program (HAMP), if: The sum you owe on your first home loan is equivalent to or not exactly: - $729,750 for a solitary family home - $934,200 for a 2-unit property - $1,129,250 for a 3-unit property - $1,403,400 for a 4-unit property You're encountering a money related hardship, for example, decreased wage or restorative costs Your present home loan was taken out before January 1, 2009 Submit Documents: As quickly as time permits, finish, sign and send us the structures in your budgetary data bundle, alongside some other reports that might be required. Inside five business days of accepting your parcel, we'll send you a letter to fill you in regarding whether any records are fragmented or missing. Home Affordable Modification Form:        |