|

#1

February 7th, 2016, 01:18 PM

| |||

| |||

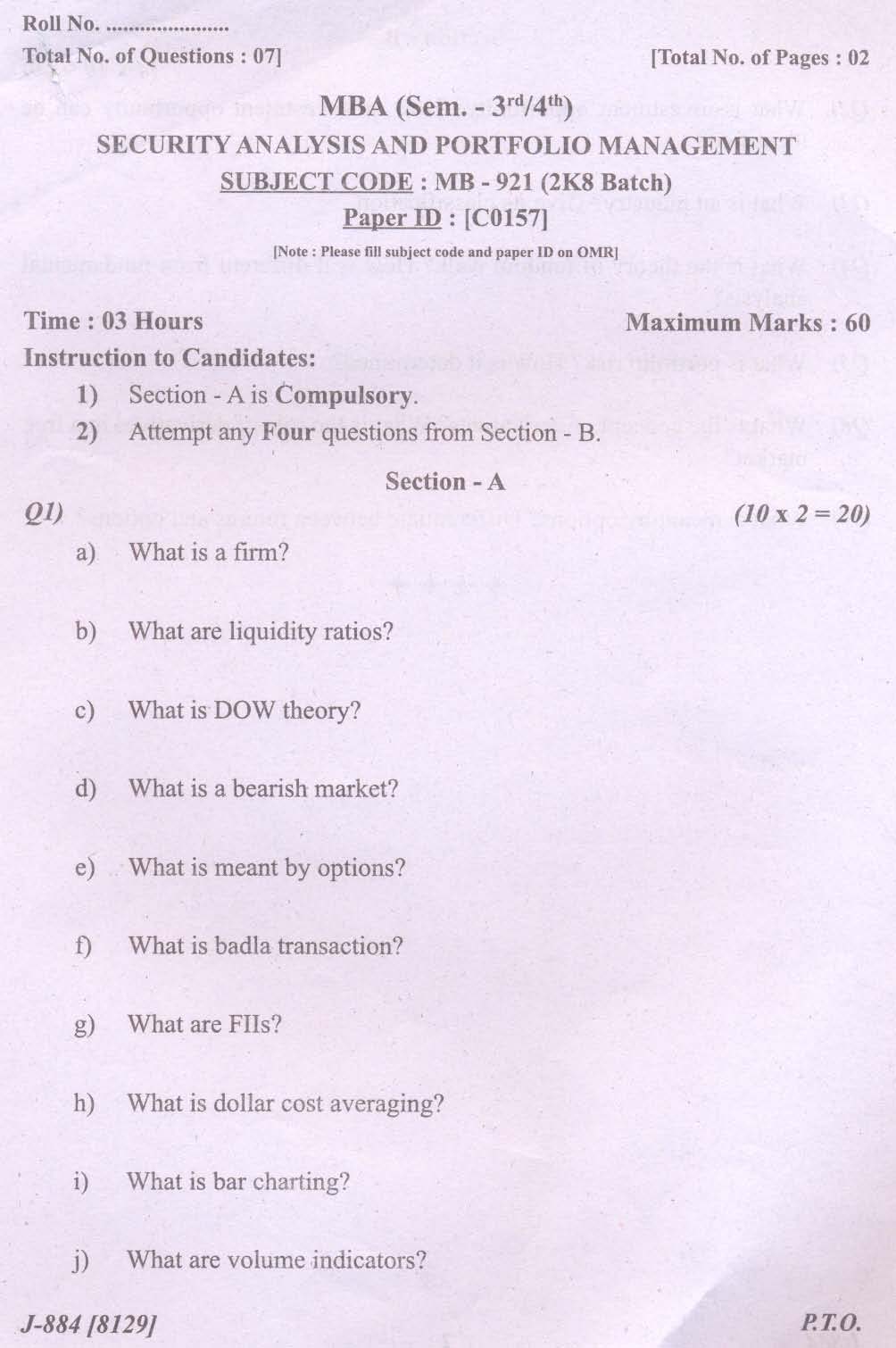

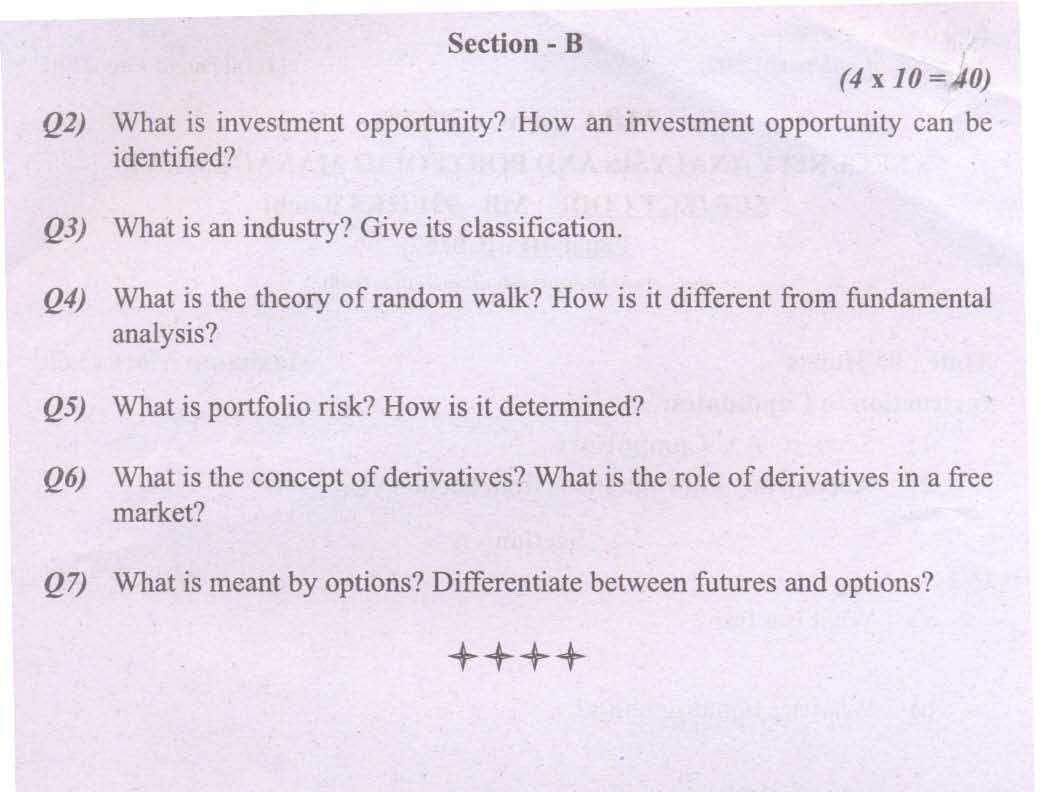

| SAPM Notes MBA

Will you please give here syllabus / notes for Security Analysis and Portfolio Management (SAPM) subject of MBA program of SMU? As you want I am here giving you syllabus / notes for Security Analysis and Portfolio Management (SAPM) subject of MBA program of SMU. SAPM Subject Syllabus : MBA program Unit 1 Investment – A Conceptual Framework: Investment process, risks of investment and the common mistakes made in investment management Unit 2 Investment Environment: Features and composition of money market and capital market, money market, capital market instruments and financial derivatives Unit 3 Risk and Return: Concepts of risk and return, how risk is measured in terms of standard deviation and variance, the relationship between risk and return Unit 4 Fundamental Analysis: Economy analysis, industry analysis and company analysis, weaknesses of fundamental analysis Unit 5 Technical Analysis: Tools of technical analysis, important chart formations or price patterns and technical indicators Unit 6 Efficient Market Hypothesis: Concept of ‘Efficient Market’ and its implications for security analysis and portfolio management. Unit 7 Behavioral Finance: Meaning of Behavioral finance, deals with when, how and why psychology influences investment decisions Unit 8 Valuation of bonds and shares: Elements of investment, bond features and prices, call provisions on corporate bonds, convertible bonds and valuation of bonds Unit 9 Portfolio Management – Risks and Returns: Concept of portfolio and portfolio management, concept of risk, types of portfolio management Unit 10 Markowitz Portfolio Selection Model: Concept of portfolio analysis and diversification of risk. Also discusses Markowitz Model and Efficient Frontier Unit 11 Capital Asset Pricing Model (CAPM): Deals with the assumptions of CAPM and the inputs required for applying CAPM and the limitations of this Model Unit 12 Sharpe-The Single Index Model: Measurement of return on an individual stock, measurement of portfolio return and measurement of individual stock risk Unit 13 Factor Models and Arbitrage Pricing Theory: Arbitrage Pricing Theory and its principles, Comparison of Arbitrage Pricing Theory with the Capital Asset Pricing Model. Unit 14 International Portfolio Investments: Investment avenues for foreign portfolio investors, risks and returns associated with such investment. Unit 15 Mutual Fund Operations: Mutual funds as a key financial intermediary, mobilizing savings and investing them in capital markets. Here is the attachment. SAPM MBA Sample paper   Address: Sikkim Manipal University – Directorate of Distance Education 5th Mile, Tadong, Gangtok, Sikkim – 737102 | Last edited by Neelurk; March 26th, 2020 at 01:29 PM. |