|

#2

November 4th, 2017, 03:49 PM

| |||

| |||

| Re: SBBJ Vehicle Loan

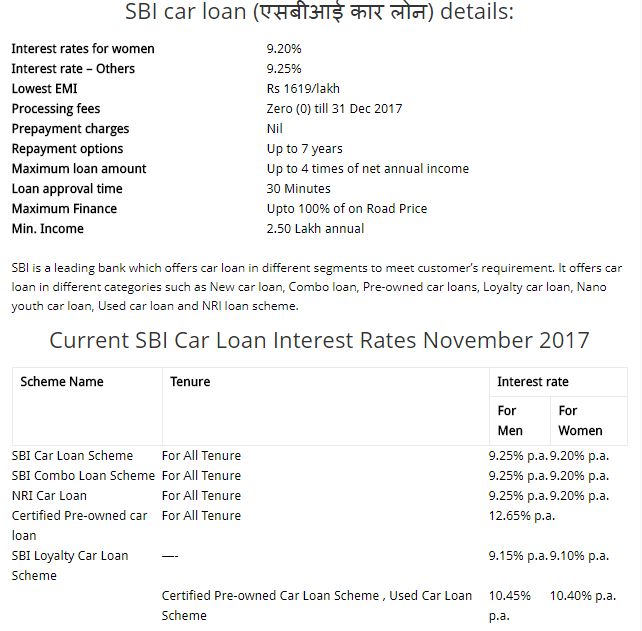

Firstly please note that since 1st April 2017 all the associate Banks of SBI including State bank of Bikaner and Jaipur have been merged with SBI and there remain one entity name State Bank of India. So the details provided for Car Loan is of State Bank of India. SBI is a main bank which offers auto credit in various fragments to meet client's prerequisite. It offers auto advance in various classifications, for example, New auto advance, Combo credit, Pre-claimed auto advances, Loyalty auto advance, Nano youth auto advance, Used auto advance and NRI advance plan. Qualification for SBI Car Loan Candidate ought to be in the vicinity of 21 and 65 years old to profit an auto advance. Category Income Criteria Max. Credit Amount Regular worker of State/Central Government, Public Sector Undertaking, Private Company or a presumed establishment. Net Annual Income of candidate or potentially co-candidate assuming any, together ought to be at least Rs. 2,50,000/ - 48 times of the Net Monthly Income Experts, independently employed, representatives, exclusive/association firms who are pay charge assesses. Net Profit or Gross Taxable pay of Rs. 4,00,000/ - p.a. (pay of co-candidate can be clubbed together) 4 times Net Profit or Gross Taxable wage according to ITR in the wake of including back devaluation and reimbursement of every current credit Individual occupied with rural and partnered activities. Net Annual salary of candidate or potentially co candidate together ought to be at least Rs. 4,00,000/ - 3 times of Net Annual Income SBI 4 Wheeler Loan Processing Fees New Car Loan Scheme = bank has deferred 100 for every penny preparing charge on auto advances till December 31, 2017 Some Important highlights: Financing 'On-Road cost'. (Counting enrollment, protection and service agreement/add up to benefit bundle/Annual support contract/cost of frill.) No Pre-Payment Penalty or Foreclosure Charges No Advance EMI Discretionary SBI Life Insurance cover accessible Overdraft office accessible No preparing expense for new autos 0.51% preparing expense for utilized autos Document checklist for SBI car loan 1. Bank account statement of last six months. 2. Two passport size photographs 3. Copy of passport, voter ID card or PAN. 4. Address proof 5. Salary slip mentioning all deductions 6. Form 16 (income tax return) of the last two years if you belong to salaried class and three years if you are a professional, self-employed person or a businessmen. The form should be duly accepted by the ITO. 7. If you are a non-salaried individual, you will also have to submit proof of official address. SBI Car Loan Interest Rates September 2017  |