|

#2

November 18th, 2017, 04:18 PM

| |||

| |||

| Re: SBI Contra Fund

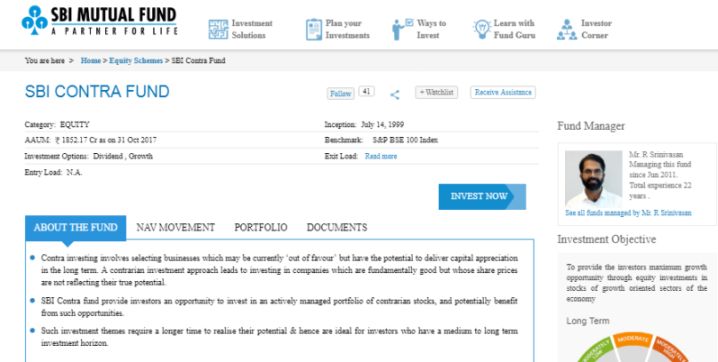

Contra investing includes choosing organizations which might be presently 'out of support' however can possibly convey capital gratefulness in the long haul. A contrarian venture approach prompts putting resources into organizations which are in a general sense great yet whose offer costs are not mirroring their actual potential. SBI Contra support give financial specialists a chance to put resources into an effectively oversaw arrangement of contrarian stocks, and possibly advantage from such open doors. Such venture topics require a more extended time to understand their potential and consequently are perfect for financial specialists who have a medium to long haul speculation skyline. Objective: The plan expects to put resources into underestimated scrips, which are out of flavor yet can possibly demonstrate alluring development in long haul. SBI CONTRA FUND Category: Equity AAUM: 1837.82 Cr as on 30 Jul 2017 Investment Options: Dividend , Growth Entry Load: N.A. Inception: July 14, 1999 Benchmark: S&P BSE 100 Index SBI Contra Fund NAV Details  Portfolio Holdings Stock Name (%) of Total AUM STATE BANK OF INDIA 7.98 HDFC BANK LTD. 7.66 PROCTER & GAMBLE HYGIENE AND HEALTH CARE LTD. 5.68 ICICI BANK LTD. 5.43 CCIL-CLEARING CORPORATION OF INDIA LTD (CBLO) 4.69 DIVI'S LABORATORIES LTD. 4.44 ELGI EQUIPMENTS LTD. 4.24 COGNIZANT TECHNOLOGY SOLUTIONS CORPORATION 4.10 KOTAK MAHINDRA BANK LTD. 3.89 RELIANCE INDUSTRIES LTD. 3.51 Sectoral Breakdown (in %) Industry Ratio FINANCIAL SERVICES 37.51 CONSTRUCTION 7.83 CONSUMER GOODS 7.57 IT 7.50 PHARMA 7.45 SERVICES 6.96 AUTOMOBILE 6.20 INDUSTRIAL MANUFACTURING 4.24 ENERGY 3.51 TELECOM 2.50 |