|

#2

August 1st, 2016, 07:52 AM

| |||

| |||

| Re: Sbi ppf

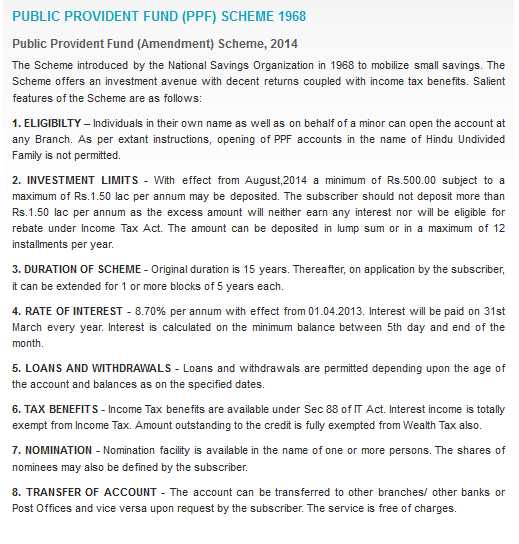

The Public Provident Fund (Amendment) Scheme, 2014 was introduced by the National Savings Organization in 1968 to mobilize small savings. It offers an investment path with decent returns tied with income tax benefits. Salient Features Eligibility – Individuals in their own name and on behalf of a minor can open the account at any Branch. As per existing instructions, opening this account in the name of Hindu Undivided Family is not permitted. Investment Limits – With effect from August,2014 a minimum of Rs.500.00 subject to a maximum of Rs.1.50 lac per annum may be deposited. One can not deposit more than Rs.1.50 lac per annum as the excess amount neither earn any interest nor eligible for rebate under Income Tax Act. The amount can be deposited in lump sum or in a maximum of 12 instalments yearly. Duration of Scheme – Original duration is 15 years. Afterwards, on application by the subscriber, it can be extended for 1 or more blocks of 5 years each. Rate of Interest – 8.70% per annum with effect from 01.04.2013 Interest is paid on 31st March every year. Interest is calculated on the minimum balance between 5th day and end of the month. Loans and Withdrawals – Loans and withdrawals are legalized depending upon the age of the account and balances as on the specified dates. Tax Benefits – Income Tax benefits are available under Sec 88 of IT Act. Interest income is totally exempt from Income Tax. Amount outstanding to the credit is fully exempted from Wealth Tax also. Nomination – Nomination facility is available in the name of one or more persons. The shares of nominees are defined by the subscriber. Transfer of Account – The account is transferred to other branches/ other banks or Post Offices and vice versa upon request by the subscriber. The service is free of charges. SBI PPF  |