|

#2

November 28th, 2017, 03:16 PM

| |||

| |||

| Re: SBIMF Tax Gain Magnum

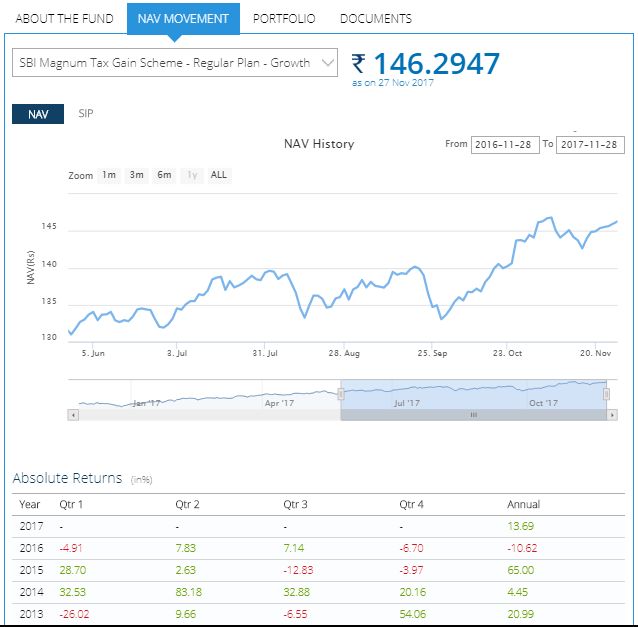

The SBI Mutual Fund offers SBI Magnum Taxgain Scheme SBI Magnum Taxgain Scheme Category: EQUITY AAUM: 5794.9 Cr as on 30 Sep 2017 Investment Options: Dividend , Growth Entry Load: N.A. Inception: March 31, 1993 Benchmark: S&P BSE 100 Index Tax planning is an essential but challenging process to undertake. In the sea of tax saving instruments available for investors, mutual funds through equity linked savings scheme (ELSS) provide an option to gain from the growth potential of equity markets while getting tax benefits. ELSS investments are eligible for tax deduction up to Rs. 1,50,000 per year from gross total income under Section 80C of Income Tax Act, 1961. SBI Magnum Tax Gain Scheme aims to deliver the benefit of investment in a portfolio of equity shares, while offering tax deduction on such investments made in the scheme under section 80C of the Income-tax Act, 1961. It also seeks to distribute income periodically depending on availability of distributable surplus.  Contact- Corporate Office Address SBI Funds Management Pvt Ltd. 9th Floor, Crescenzo, C-38 & 39, G Block, Bandra-Kurla Complex, Bandra (East), Mumbai-400051 Board Line: +9122 61793000 Customer Service 1800 425 5425 / 1800 209 3333 (Toll Free No) 022 27786551 / 022 27786501 To get a call back from us give a missed call to 1800 270 0060 From 8:00 AM to 8:00 PM (Monday to Saturday) Email: customer.delight@sbimf.com |