|

#2

December 14th, 2017, 11:25 AM

| |||

| |||

| Re: Sources of Funds of IDBI

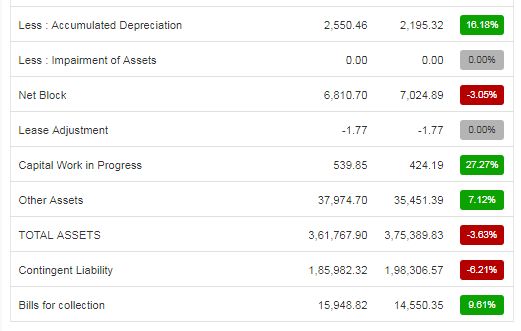

The Industrial Development Bank of India or IDBI was built up on first July, 1964 as a peak bank (the partner of Reserve Bank) in the field of mechanical fund and capital market. Nonetheless, it was de-connected from Reserve Bank on sixteenth February, 1976 and was given a different free element under Central Government. It has finished 35 years on 30th June, 1999. Objectives It is the peak organization to co-ordinate, supplement, and coordinate the exercises of all current particular budgetary establishments. It is a re-financing and re-reducing organization working in the capital market to re-fund term advances and fare credits. It is accountable for leading lechno-financial investigations. It offers credits intentionally and not only on the security of property as home loan or vow. The IDBI attempts: Renegotiating of advances conceded by other exceptional money related organizations, banks and cooperatives. Giving of credits to mechanical units. Rediscounting of bills of trade. Ensuring of advances and conceded installments. Arranging and advancing businesses. Interest in other money related organizations. Endorsing the issue of offers and debentures of modern units. Review of Progress (Operations) IDBI has given exceptional consideration regarding better provincial improvement and innovational and special exercises. It has directed overviews of in reverse locales. It has given unique help to in reverse areas on concessional terms. IDBI is assuming a more unique part in advancing development of businesses as a trailblazer in the zone of mechanical fund. The money related assets are being redirected into socially more alluring channels. Accentuation is being put on help to little and new business people and units situated in immature districts in the nation. IDBI is the real wellspring of modern back. Its endorsed and dispensed sum is 37% and 40% individually of the aggregate segmented and dispensed measure of all the term-loaning organizations. Critical Evaluation The IDBI, amid 35 years of its working has done estimable employment in various ranges. It has given exceptional thoughtfulness regarding better local advancement and innovational and limited time exercises. The monetary assets of IDBI are being coordinated into socially more alluring channels, renegotiate of fare credit is offered at the lower rate of intrigue. It endorsed and dispensed sums are almost 37% and 40% individually of the aggregate authorized and dispensed measure of all the term loaning organizations of India. IDBI's Financial Summary   |