|

#2

November 10th, 2017, 10:38 AM

| |||

| |||

| Re: Standard Chartered ICAAP

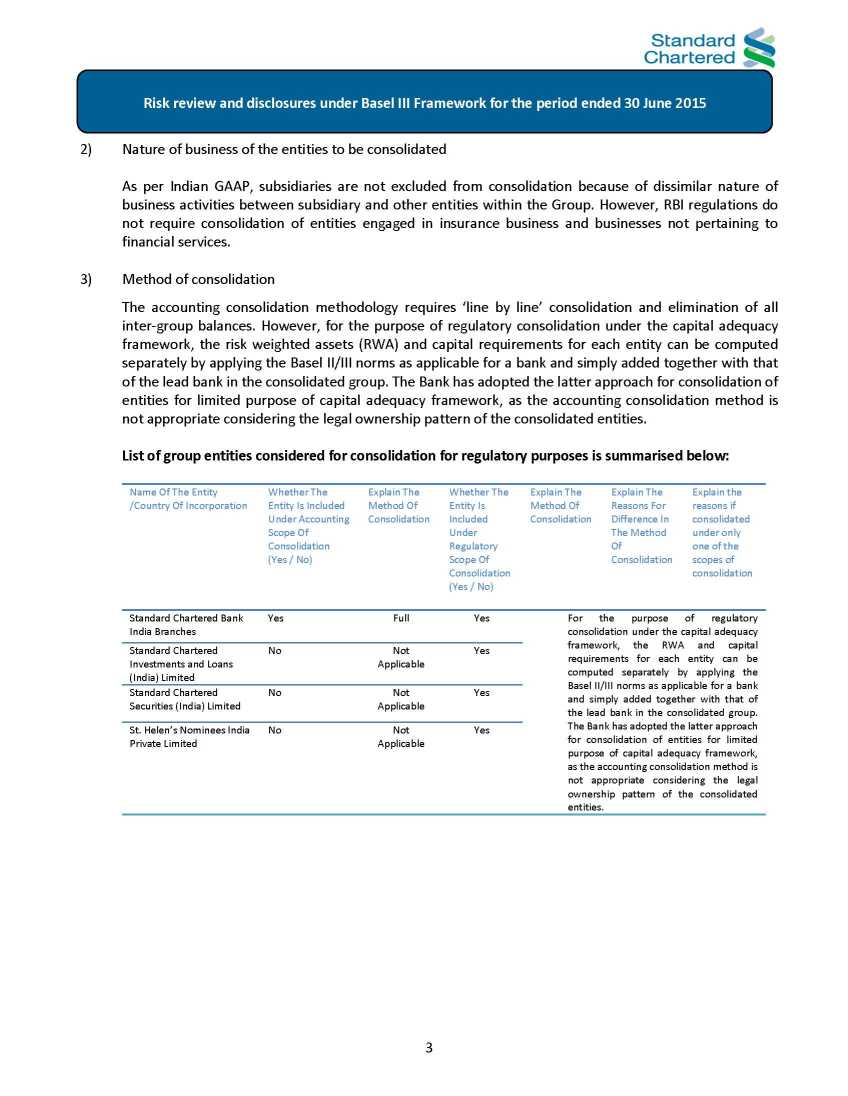

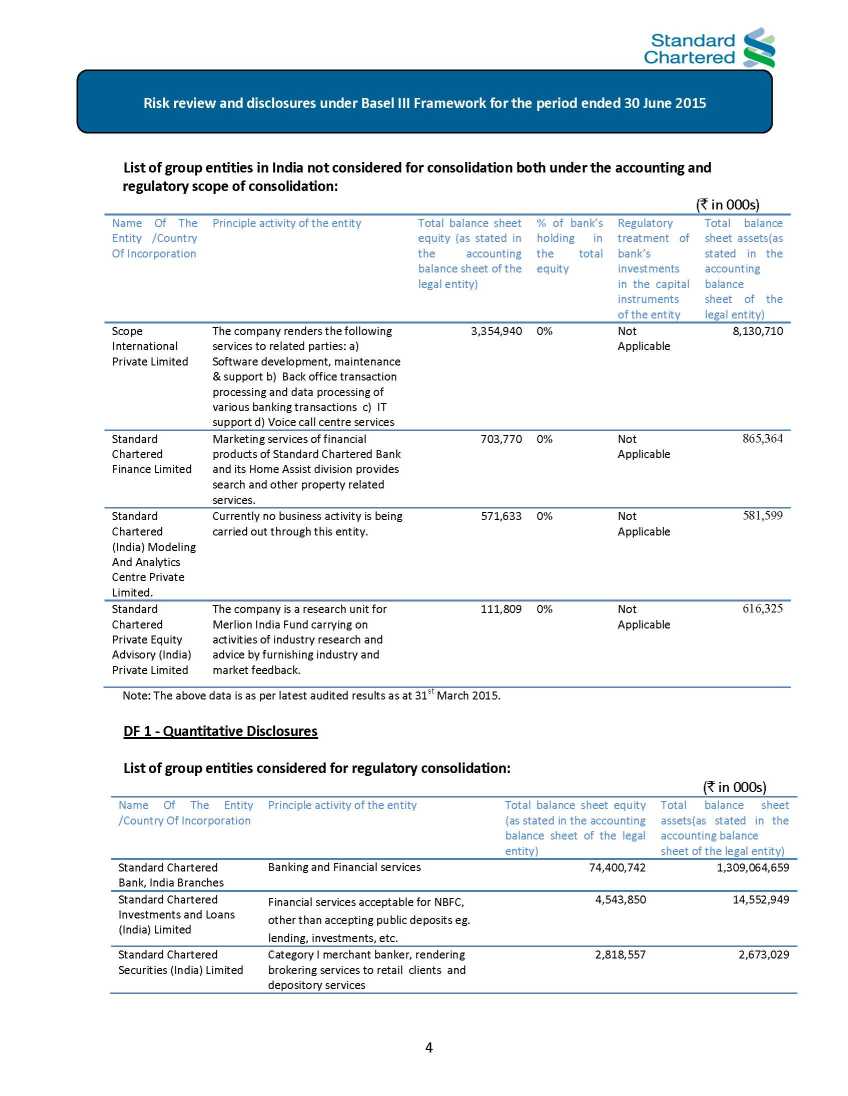

The Standard Chartered Group (SCB Group or the Group) is a universal managing an account and money related administrations assemble especially centered around the business sectors of Asia, Africa and the Middle East. Standard Chartered Bank is managed by the Financial Conduct Authority and Prudential Regulation Authority in the United Kingdom (UK). SCB India (SCBI or the Bank) is a branch of Standard Chartered Bank UK, which is a piece of the SCB Group. A definitive parent organization of the Bank is Standard Chartered PLC, which is recorded on the London Stock Exchange. Review The Basel Committee on Banking Supervision distributed a structure for International Convergence of Capital Measurement and Capital Standards (normally alluded to as Basel II), which supplanted the first 1988 Basel I Accord. The RBI received the same in March 2008. The Basel III execution plan for India has initiated from 1 April 2013 and is staged in through to 31 March 2019. As needs be, for 30 June 2015 announcing purposes, the Bank has figured its Pillar 1 capital necessity in light of Basel III standards. Scope of Application Pillar 1 The SCB Group and nearby administration of the Indian operations perceive that Basel II/III is a driver for consistent change of hazard administration rehearses and trust that selection of driving danger administration hones are basic for accomplishing its vital goal. Pillar 2 Pillar 2 expects banks to attempt a thorough appraisal of their dangers and to decide the proper measures of cash-flow to be held against these dangers where other reasonable mitigants are not accessible. This hazard and capital evaluation is generally alluded to as an Internal Capital Adequacy Assessment Process (ICAAP). The scope of dangers that should be secured by the ICAAP is substantially more extensive than Pillar 1, which covers just credit chance, showcase chance or potentially. The Group has built up an ICAAP system which nearly incorporates the hazard administration and capital appraisal forms and guarantees that satisfactory levels of capital are kept up to help the present and anticipated interest for capital under expected and focused on conditions. The ICAAP system has been intended to be connected reliably over the association to meet the Pillar 2 necessities of nearby controllers. As a branch of a remote bank in India, the India ICAAP is to a great extent in view of the Group ICAAP system, in order to keep up consistency in revealing of the hazard and capital administration viewpoints. Be that as it may, wherever essential, neighborhood customisation has been joined to line up with the RBI necessities. Risk review and disclosures under Basel III Framework Details     |