|

#2

December 9th, 2017, 08:03 AM

| |||

| |||

| Re: State Bank of Bikaner and Jaipur Annual Report

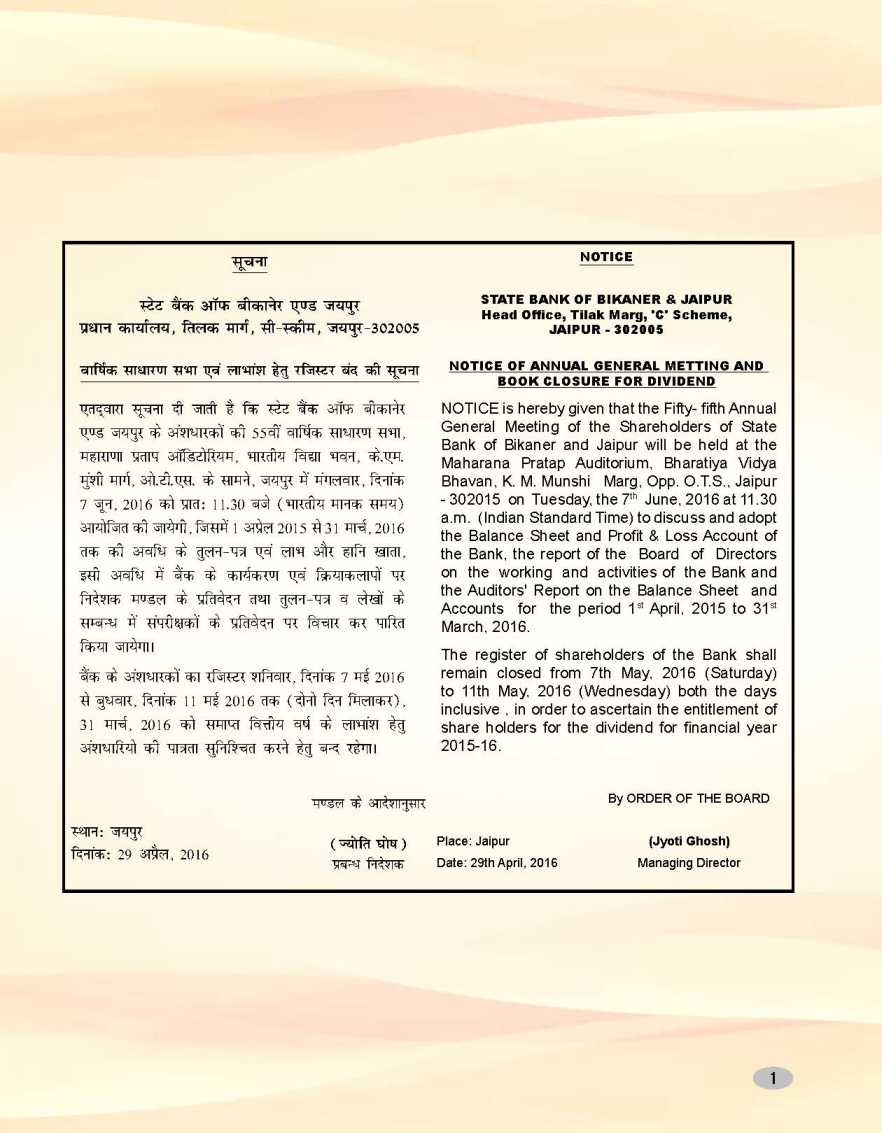

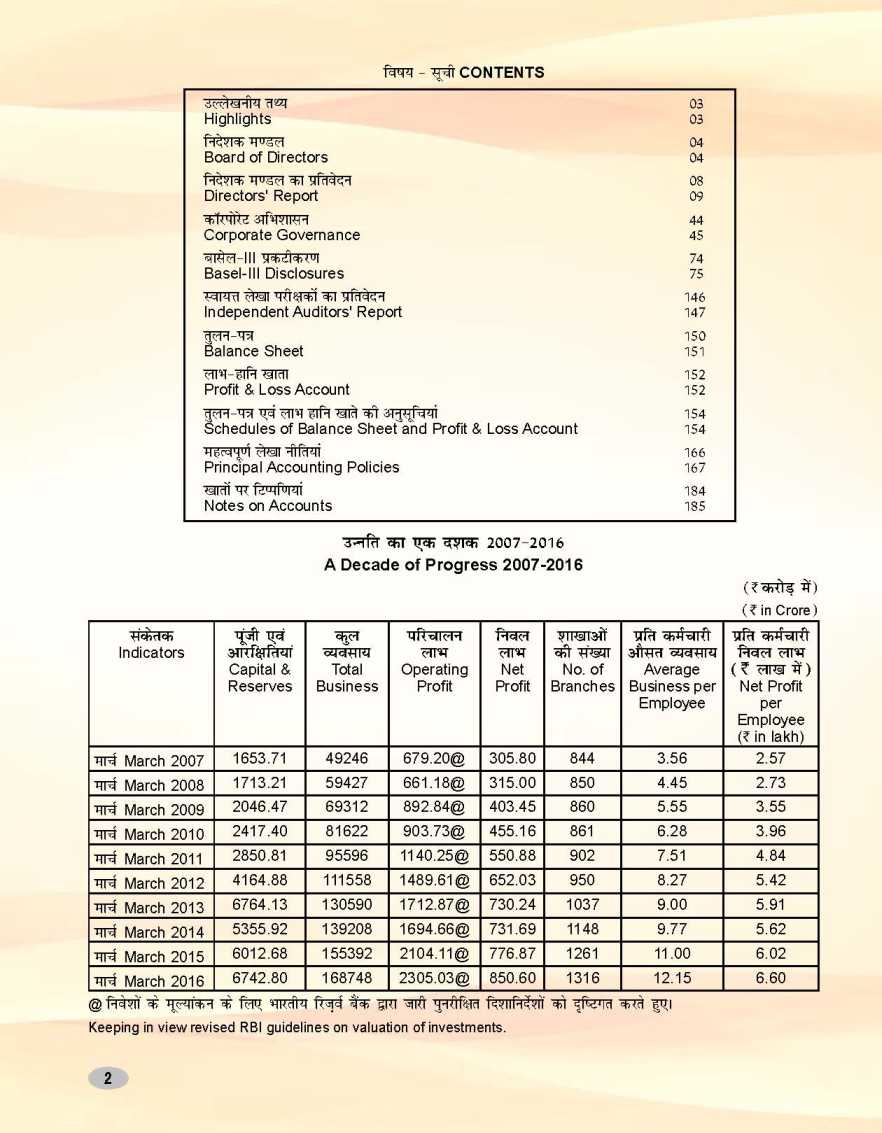

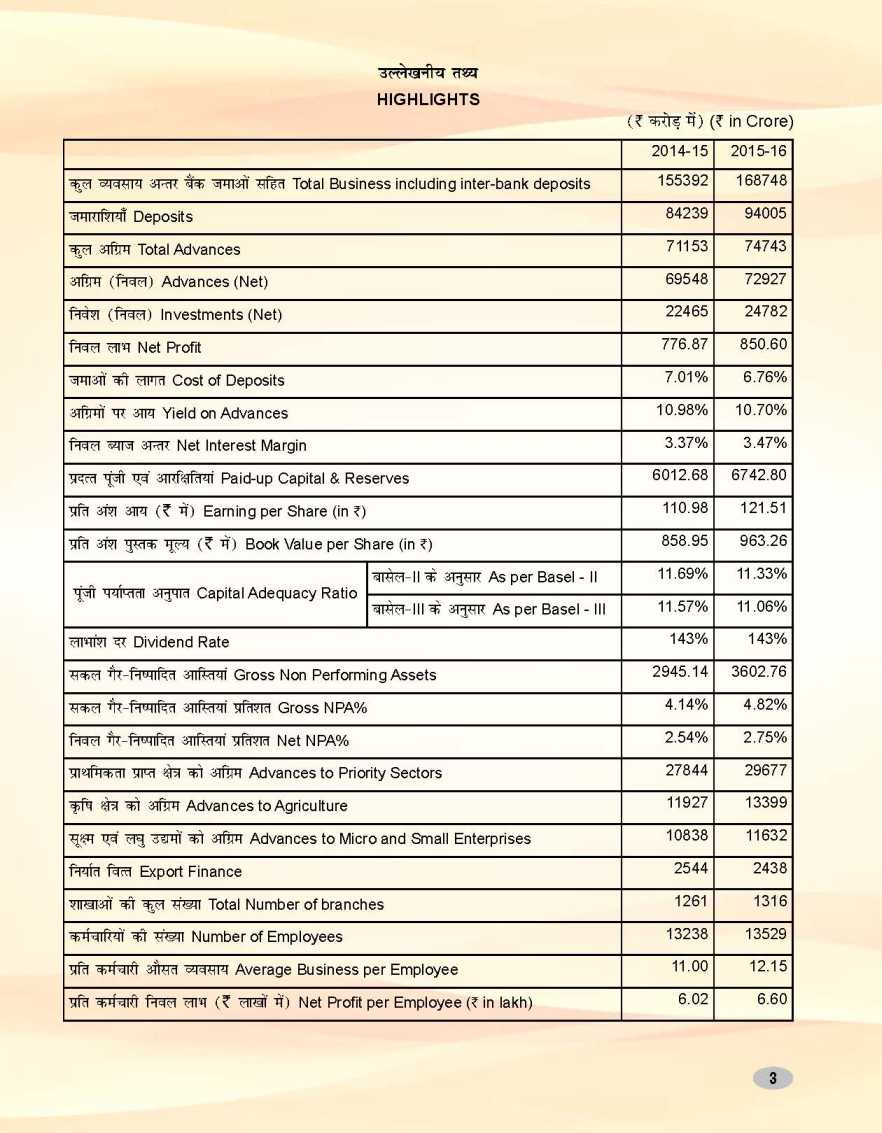

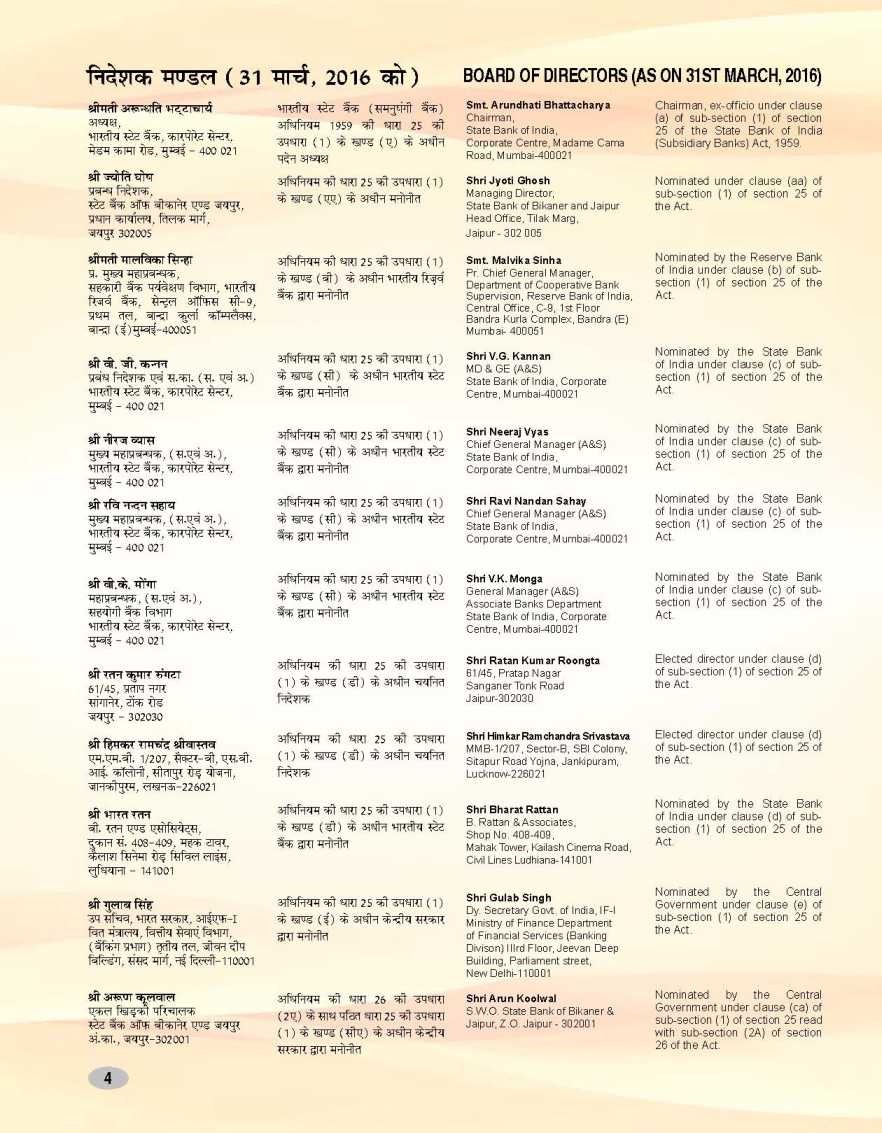

The Board of Directors of State Bank of Bikaner and Jaipur have joy in showing this Annual Report together with the reviewed Balance Sheet and Profit and Loss Account of the Bank for the year finished 31st March 2016. Management Discussion and Analysis Banking Industry 2015-16 was the nonstop second year seeing low credit offtake and expanding focused on resources for the banks. One of the fundamental purposes behind the quieted propels development was quelled worldwide interest for the fare merchandise bringing about low utilization and lower limit usage. The low credit development situation may likewise be ascribed to the corporates selecting gathering pledges through the business paper showcase and abroad sources, where rates are lower than base rate of Indian banks. Indeed, even in this time of corporate anxiety, retail acknowledge development according to sectoral sending of credit kept the banks at agreeable position with a development of more than 15% and moderately low NPAs. Viewpoint In the current financial, RBI gave the economy a reprieve of 75 premise focuses as key rate cuts. In any case, out of the aggregate 125 bps cut given by the Central Bank over the most recent one year, Indian banks could cut down the normal Base rate slice by 70 bps because of crushing overall revenue. For FY 2016-17, RBI anticipates that the development will reinforce step by step on the setting of ordinary rainstorm, positive terms of exchange increases, enhancing family unit wages and lower input expenses of firms and anticipated the GDP development at 7.6%. Toward the start of FY 2016-17, advertise is expecting a rate slice of 25 to 50 bps on the scenery of monetary solidification measures of the present government. In the present spending plan, government has kept the financial deficiency for 2016-17 at 3.5% giving RBI headroom to cut key rates. The present year may witness some recovery in credit request on the background of trickledown impact of freedom of slowed down tasks and expanded interest in framework by the administration. Corporate Operations Business Performance The general business of the Bank (stores in addition to net advances) achieved a level of 168748 crore as at end-March 2016 as against 155392 crore as at end March 2015, recording a development of 13356 crore (8.59%). The aggregate stores expanded by 9766 crore (11.59%) to achieve a level of 94005 crore while net advances expanded by 3590 crore (5.05%) to achieve a level of 74743 crore by end-March 2016. The cost of stores of the Bank diminished from 7.01% out of 2014-15 to 6.76% of every 201516, while the yield on progresses additionally diminished from 10.98% to 10.70%. CASA stores recorded a development of 11.17% yet the CASA proportion was at 38.70% when contrasted with 38.85% as at Mar'15. Money related Highlights Net Interest Income The Bank's aggregate premium pay expanded from 9005.45 crore amid 2014-15 to 9592.47 crore amid 2015-16, recording a development of 6.52%. Intrigue use expanded by 3.70% to 6288.13 crore, as against 6064.02 crore in the earlier year. The net intrigue pay recorded a development of 12.34% to 3304.34 crore, as against 2941.43 crore in 2014-15. The net intrigue edge (NIM) remained at 3.47% toward the finish of March 2016. Non Interest Income The non-premium salary of the Bank has expanded by 14.10% from 926.39 crore of 2014-15 to 1057.05 crore amid 2015-16. The expansion amid the year when contrasted with the most recent year is chiefly by virtue of increment in other commission by 131.77 crores and benefit at a bargain of Investment by 54.02 crore. Working Expenses The working costs of the Bank has expanded by 16.59% from 1763.71 crore in 2014-15 to 2056.36 crore amid 2015-16. Of this, worker costs expanded by 19.26% to 904.00 crore, while add up to other working consumption expanded by 23.92% to 930.37 crore. Benefit Amid 2015-16, the working benefit expanded to 2305.03 crore (by 9.55%) as against 2104.11 crore in the earlier year. The net benefit additionally recorded a development of 9.49% from 776.87 crore in 201415 to 850.60 crore in 2015-16. Profit For the year 2015-16, the Bank pronounced Dividend of 143% i.e. 14.30 for each value share (confront estimation of 10/ - per share). For ascertainment of qualification of investors for Dividend, investors enlist will be shut from 07.05.2016 to 11.05.2016 (both days comprehensive). Key Financial Indicators The arrival on resources of the Bank remained at 0.83% amid 2015-16 as against 0.84% in the earlier year. The arrival on value (ROE) remained at 12.61% toward the finish of March, 2016. The income per share expanded from 110.98 out of 2014-15 to 121.51 of every 2015-16, while the book esteem per share enhanced from 858.95 of every 2014-15 to 963.26 of every 2015-16. As at end-March 2016, the capital sufficiency proportion of the Bank remained at 11.33% and 11.06% according to Basel-II and Basel III standards individually, as against 11.69% and 11.57% according to Basel-II and Basel III standards separately, as at end-March 2015. This was well over the RBI benchmark of 9.625%. Because of ascend in NPAs by virtue of proceeded with push confronted by the mechanical division, the Bank's Gross NPA proportion and Net NPA proportion expanded from 4.14% and 2.54% as at end-March 2015 to 4.82% and 2.75% individually, as at end-March 2016. The normal business per representative expanded to 12.15 crores amid 2015-16 as against 11.00 crores in the earlier year. The net benefit per representative enhanced to 6.60 lakh amid 2015-16, contrasted with 6.02 lakh amid 2014-15. The normal business per branch expanded to 128.23 crore amid 2015-16, as against 123.22 crore in the earlier year. Financial Report of State Bank of Bikaner and Jaipur for 2015-2016      |