|

#2

November 9th, 2017, 04:18 PM

| |||

| |||

| Re: State Bank of India Two Wheeler Loan Calculator

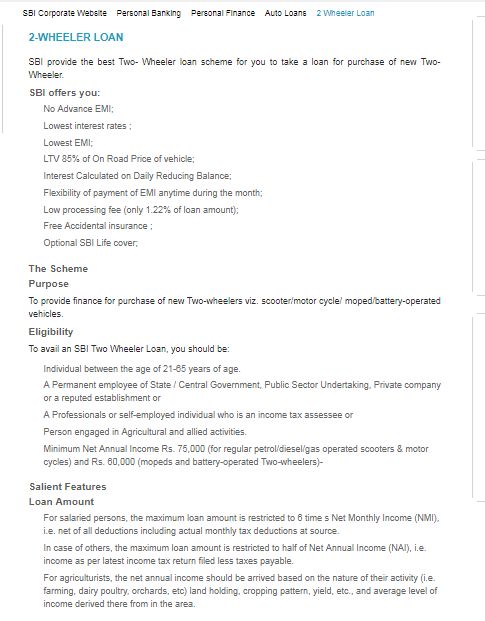

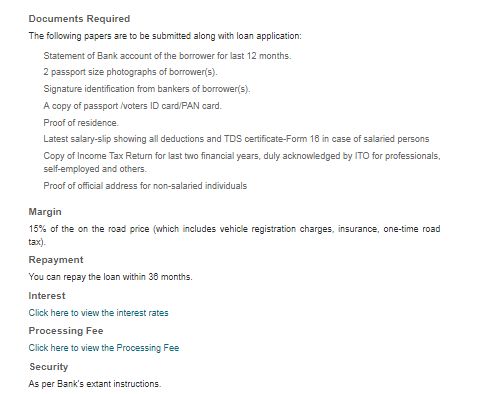

SBI (State Bank of India) provide the best Two- Wheeler loan scheme to take a loan for purchase of new Two- Wheeler. The scheme provides finance for purchase of new Two-wheelers viz. scooter/motor cycle/ moped/battery-operated vehicles. Eligibility To avail an SBI Two Wheeler Loan, one should be: • Individual between the ages of 21-65 years of age. • A Permanent employee of State / Central Government, Public Sector Undertaking, Private company or a reputed establishment or • A Professionals or self-employed individual who is an income tax assessed or • One engaged in Agricultural and allied activities. • Minimum Net Annual Income Rs. 75,000 (for regular petrol/diesel/gas operated scooters & motor cycles) and Rs. 60,000 (mopeds and battery-operated Two-wheelers)- Margin 15% of the on the road price (which includes vehicle registration charges, insurance, one-time road tax). Repayment One can repay the loan within 36 months. Documents Required • Statement of Bank account of the borrower for last 1 year. • 2 passport size photographs of borrower. • Signature identification from bankers of borrower. • A copy of passport /voters ID card/PAN card. • Proof of residence. • Latest salary-slip showing all deductions and TDS certificate-Form 16 in case of salaried persons • Copy of Income Tax Return for last 2 financial years, duly acknowledged by ITO for professionals, self-employed and others. • Proof of official address for non-salaried individuals State Bank of India Two Wheeler Loan Details   |