|

#3

January 2nd, 2020, 08:29 PM

| |||

| |||

| Re: State Bank of India Wealth Builder

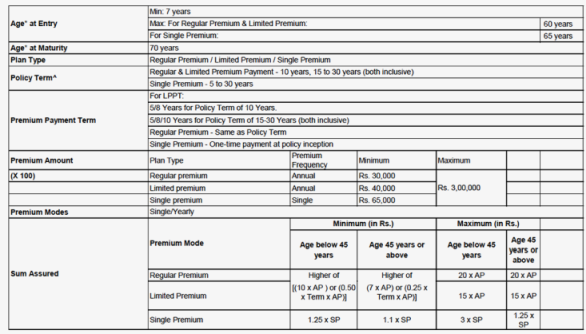

SBI Life – Smart Wealth Builder, avail the benefit of enhanced investment opportunity by investing in one or many investment funds. About SBI LIFE – SMART WEALTH BUILDER This plan offers – Security – to financially protect your family in the case of an eventuality Reliability – through periodic assured additions# Flexibility – to manage the invested money as per your choice Liquidity – through partial withdrawals from 6th policy year or 18 years of age Features Life coverage Assured additions (Conditions Apply#)up to 125% of one annual regular premium,or a longer term. Options to increase or decrease the sum assured, premium payment frequencies from 6th policy year onwards Enhanced investment opportunity through 7 varied funds and the flexibility for switching and redirection Partial withdrawals from 6th policy year or 18 years of age Also below I am providing you other details of SBI LIFE – SMART WEALTH BUILDER: SBI LIFE – SMART WEALTH BUILDER details  Contact: REGISTERED & CORPORATE OFFICE: SBI Life Insurance Co. Ltd Natraj, M.V. Road & Western Express Highway Junction, Andheri (East), Mumbai - 400 069. CIN: L99999MH2000PLC129113 |