|

#2

October 27th, 2017, 09:40 AM

| |||

| |||

| Re: State Bank of Mysore RTGS Charges

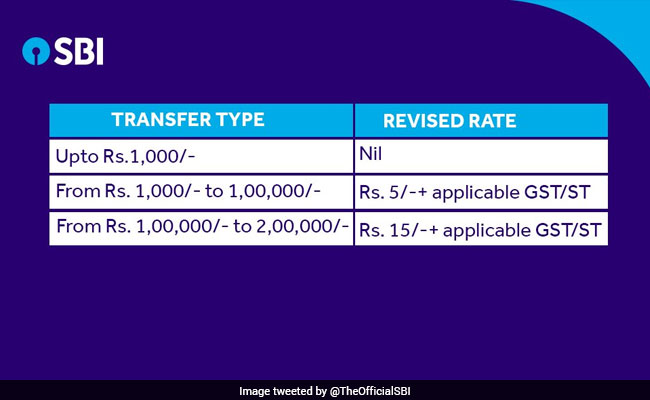

As of 1st April 2017 Sate Bank of Mysore as well as other associate banks have been merged with State Bank of India and the details provided would be for State Bank of India. From July 15 onwards, clients of State Bank of India or SBI will pay up to 75 for every penny less for online cash exchange administrations - NEFT (national electronic assets exchange) and RTGS (constant gross settlement) exchanges done through web saving money or versatile managing an account offered by the bank. NEFT and RTGS are electronic installment frameworks, which permit subsidize exchange between two records of various banks in the nation. In a move to advance computerized exchanges, State Bank of India or SBI has lessened its charges for online cash exchange benefits, the general population division loan specialist said. Prior, SBI charged Rs. 2 for subsidize exchanges up to Rs. 10,000 through NEFT utilizing web or portable saving money modes. Since has been diminished to Rs. 1 (barring GST of 18 for every penny). For NEFT exchanges from Rs. 10,000 to Rs. 1 lakh, the charge has been diminished to Rs. 2 from Rs. 4 prior. Additionally, SBI has changed its charges for subsidize exchanges between Rs. 2 lakh and Rs. 5 lakh through RTGS on its net and versatile keeping money stage, to Rs. 5 from Rs. 20 prior, a lessening of 75 for each penny. "Digitalization and magnificence in operations is one of our center procedures in giving comfort to clients. It has brought about diminishing turnaround time alongside stretched out advantages to the clients.," said Rajnish Kumar, overseeing executive (NBG) at SBI. "In sync with the methodology and supplementing the concentration of Government of India to make an advanced economy, we have made one more move to advance utilization of web managing an account and mobile banking and RTGS exchanges by lessening of the charges," he included. SBI had before deferred charges for subsidize exchanges of up to Rs. 1,000 through Immediate Payment Service or IMPS powerful July 1, 2017. IMPS is a cash exchange benefit that can be done however cell phones or web managing an account. The IMPS benefit exchanges cash to the recipient's record quickly when a store exchange ask for is made through cell phone or web keeping money. The IMPS benefit is accessible 24x7, including occasions.  |