|

#1

July 9th, 2014, 02:08 PM

| |||

| |||

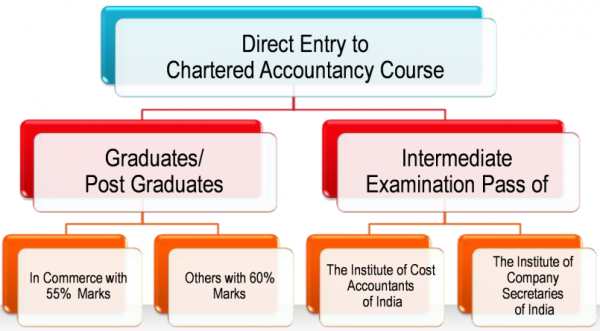

| Will I be able to become Chartered Accountant after B.Com?

I have passed B.Com and now I want to become Chartered Accountant and for that I want to get the details that will I be able to become Chartered Accountant after B.Com so can you provide me that? As you want to get the details that will you be able to become Chartered Accountant after B.Com so here it is for you: I want to tell you that yes you can become Charted Accountant As you have passed B.Com now you can get admission in IPCC but you must have passed graduation with minimum of 55% in Commerce IPCC: This course is also known as CA inter Candidates will have to fill the application form and pay the prescribed fee through Demand Draft drawn in favour of The Secretary, Institute of Chartered Accountants of India payable at New Delhi, Mumbai, Kolkata, Chennai, Kanpur as the case may be. Group-I consists of following paper/subjects:- Paper 1: Accounting (100 Marks) Paper 2: Business Laws, Ethics and Communication (100 Marks) Law (60 Marks), Business Laws (30 Marks), Company Law (30 Marks) Business Ethics (20 Marks) Business Communication (20 Marks) Paper 3: Cost Accounting and Financial Management Cost Accounting (50 Marks) Financial Management (50 Marks) Paper 4: Taxation Income-tax (50 Marks) Service Tax (25 Marks) and VAT (25 marks) Group-II consists of following paper/subjects:- Paper 5: Advanced Accounting (100 Marks) Paper 6: Auditing and Assurance (100 Marks) Paper 7: Information Technology and Strategic Management Information Technology (50 Marks) Strategic Management (50 Marks) CA Final: After passing IPCC candidates will have to get enrolled for the CA final Group -I consists of following subjects/papers Paper 1: Financial Reporting (100 Marks) Paper 2: Strategic Financial Management (100 Marks) Paper 3: Advanced Auditing and Professional Ethics (100 Marks) Paper 4: Corporate and Allied Laws (100 Marks) Company Law (70 Marks) Allied Laws (30 Marks) Group -II consists of following subject/papers Paper 5: Advanced Management Accounting (100 Marks) Paper 6: Information Systems Control and Audit (100 Marks) Paper 7: Direct Tax Laws (100 Marks) Paper 8: Indirect Tax Laws (100 Marks) Central Excise (40 Marks) Service Tax & VAT (40 Marks) Customs (20 Marks) For passing this examination a student needs:- To obtain at one sitting a minimum of 40% marks in each paper. A minimum of 50% of the total marks of all the papers. Paper with 60% marks is exempted.    Last edited by Neelurk; February 10th, 2020 at 09:18 AM. |