|

#1

July 9th, 2014, 02:05 PM

| |||

| |||

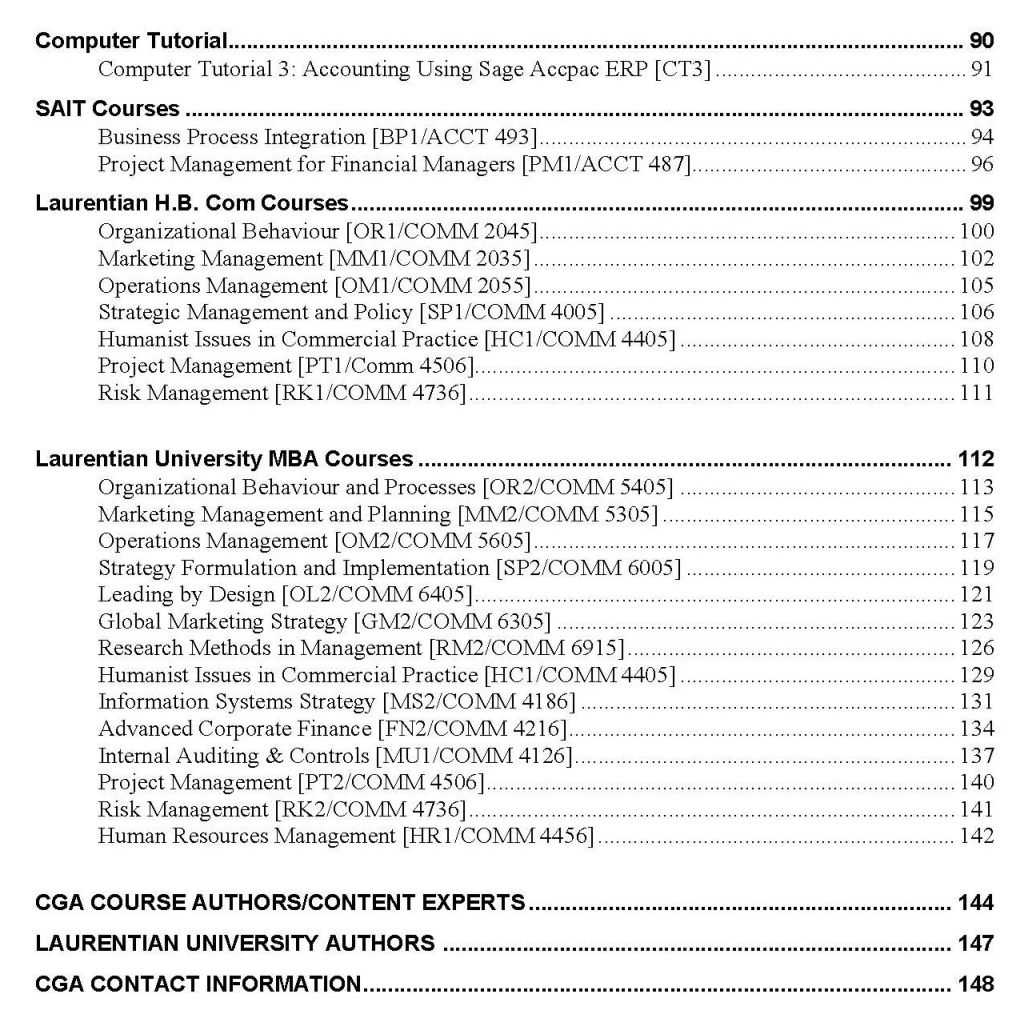

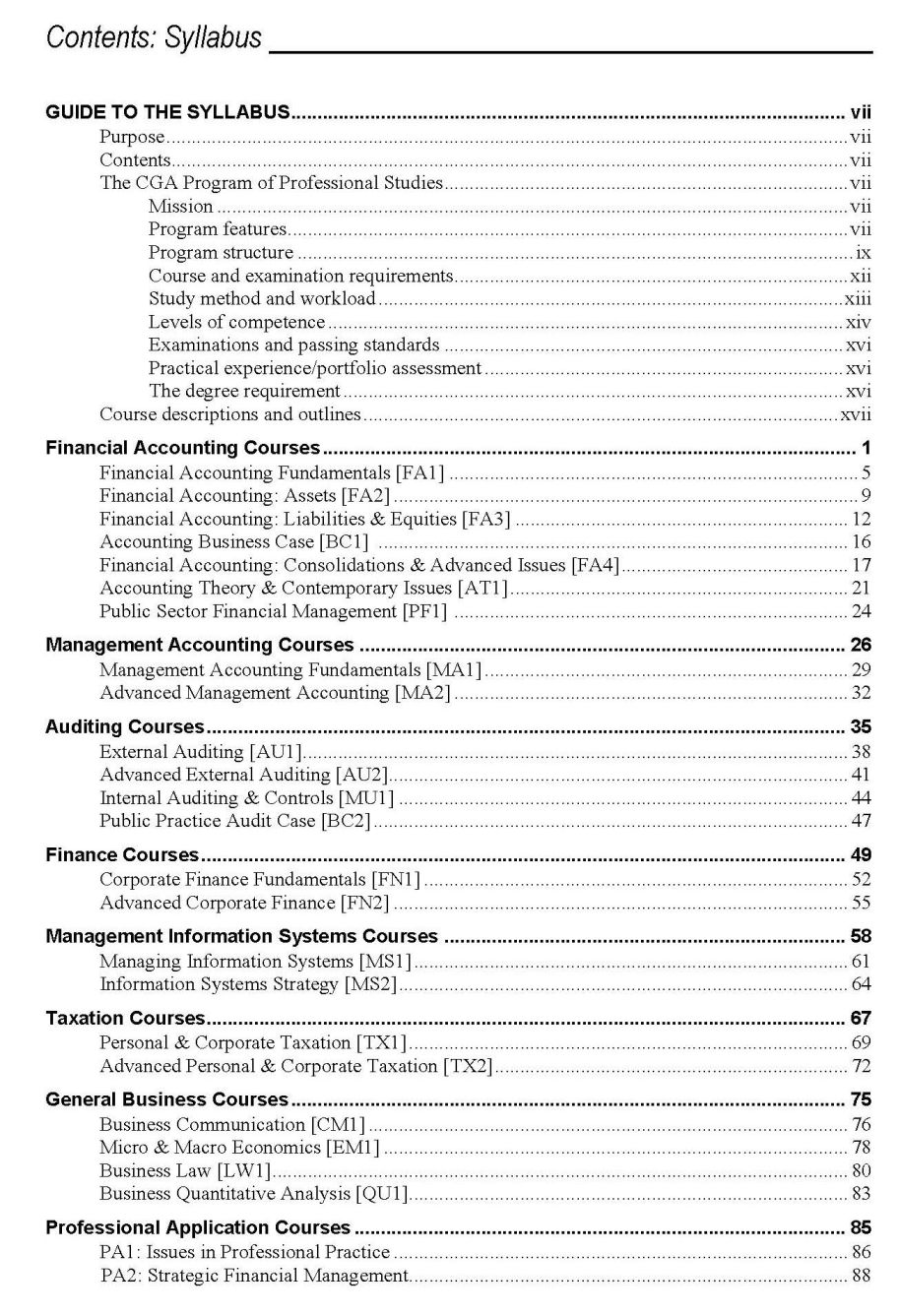

| CGA Courses In BC

Please give me information about CGA course description and syllabus? Can you do it for me. CGA is Certified General Accountants Association of British Columbia, Founded in 1951, responsible for the training and certification of B.C.’s. Course Description: Accounting Theory & Contemporary Issues [AT1] External Auditing [AU1] Advanced External Auditing [AU2] Accounting Business Case [BC1] Public Practice Audit Case [BC2] Business Communication [CM1] Micro & Macro Economics [EM1] Corporate Finance Fundamentals [FN1] Advanced Corporate Finance [FN2] Financial Accounting Fundamentals [FA1] Financial Accounting Assets [FA2] Financial Accounting Liabilities [FA3] Financial Accounting Consolidations & Advanced Issues [FA4] Business Law [LW1] Management Accounting Fundamentals [MA1] Advanced Management Accounting [MA2] Internal Auditing Controls [MU1] Managing Information Systems [MS1] Information Systems Strategy [MS2] Issues in Professional Practice [PA1] Strategic Financial Management [PA2] Public Sector Financial Management [PF1] Public Speaking [001] Business Quantitative Analysis [QU1] Personal & Corporate Taxation [TX1] Advanced Personal & Corporate Taxation [TX2] CGA course description Accounting Theory & Contemporary Issues [AT1] This advanced course in financial accounting includes in-depth treatment of current issues and problems in the field. Topics cover the contributions of economics, finance, and other disciplines to accounting theory; the practical and theoretical problems of the present value model; foreign exchange accounting; hedging; the process and issues of standard-setting; agency theory; and other topics related to specific industries or sectors of the economy. External Auditing [AU1] This introductory course covers the auditing principles and procedures applicable to both internal and external auditing. Topics include reporting; professional standards and ethics; legal liability; audit objectives; audit evidence; planning and analysis; materiality and risk; internal control; audit sampling; and EDP auditing. The functions and procedures related to the revenue and collection cycle, acquisition and expenditure cycle, production and payroll cycle, as well as finance and investment cycle are also studied. Advanced External Auditing [AU2] This course offers in-depth coverage of the concepts and procedures of external auditing and other assurance engagement. Topics include the professional, legal, and ethical environment of analysing and assessing risk factors, planning and performing engagement, interpreting and documenting results. AU2 helps to develop competencies related to evaluating and advising on accounting policies and procedures, in accordance with professional standards, through tasks such as evaluating and reporting on internal controls systems; ; computer-assisted auditing techniques; substantive testing and evidence;. AU2 also covers audits for special circumstances such as consolidated financial statements, not-for-profit and public sector audits, and introduces the changes that the auditing profession is facing and the reasons for these changes. Accounting Business Case [BC1] This is an accounting based Business Case. It provides students with an opportunity to apply and integrate knowledge from various subject areas. Concepts covered include Financial Accounting, Management Information Systems, Management Accounting, Communications, and Finance. Public Practice Audit Case [BC2] Public Practice Audit Case provides students with hands-on experience in preparing audit working papers and performing audit programs in public practice. Audit working papers are required to support the audit opinion reached by the auditor. In this real-life simulation exercise, students take on the role of an audit assistant and complete a year-end audit file for review by a partner. The case requires students to work through and develop expertise in the following four key phases of an audit: Planning and design, Testing internal control, Directly testing the financial balances and Completing the audit and issuing the auditor’s report. BC2 also provides students with the opportunity to exercise professional judgment and in learning Caseware. Business Communication [CM1] This course is intended to develop the writing skills professionals need to succeed in business communications and academic studies. CM1 introduces a three-stage writing process (planning, drafting and revising), leads students through the often complex process of creating and revising documents, and encourages critical thinking about written and spoken communication. Basic grammar, spelling, and usage are reviewed. Writing assignments include typical business communications: memos, letters, and a formal report. Micro & Macro Economics [EM1] This is a principles course in the issues, concepts, and theories of microeconomics and macroeconomics. It provides practice in applying economic reasoning to decision and forecasting problems in business, industry, and government. Students gain understanding of how the Canadian economy functions and interacts with the global economy. Topics include supply, demand, price; elasticity and price regulation; production costs and decisions; market structures and pricing; national economic indicators, issues, performance, and policy; money, banking, and interest; unemployment and inflation; and the global environment of trade and finance. Corporate Finance Fundamentals [FN1] This course is a comprehensive introduction to corporate finance, and focuses on the major decisions made by the financial executive. Content includes analysis of the financial environment and its components; security valuation; the determinants of interest rates; strategic decisions in capital budgeting, cash flow estimation, and the cost of capital; working capital management; dividend policy; leasing versus purchasing decisions; introduction to derivatives and financial planning. Computer spreadsheets are used to demonstrate concepts and provide practice in basic financial analysis. Advanced Corporate Finance [FN2] This advanced finance course provides an in-depth study of issues and tools that assist financial managers in making decisions. Topics include capital budgeting under uncertainty; long-term sources of funds; capital structure; dividend policy; special financing and investment decisions; futures, forwards, options, and swaps; treasury risk management; financial planning; and long-term planning and strategic issues. Financial Accounting Fundamentals [FA1] This introductory course in financial accounting reviews the accounting cycle and the preparation of financial statements. Topics include accounting for merchandising activities, internal control and accounting for cash, temporary investments and accounts receivable, inventories and cost of goods sold, capital assets, current and long-term liabilities, partnership accounting and accounting for corporations, as well as the cash flow statement. Financial Accounting Assets [FA2] This intermediate financial accounting course focuses on the asset side of the balance sheet. The first part of the course covers financial reporting and accounting concepts, income statement and balance sheet presentation, the cash flow statement, and revenue and expense recognition. The valuation of notes receivable, investment in debt securities, and leases are studied. The second half of the course covers current monetary balances, inventory and cost of goods sold, temporary and long-term investments, and capital assets. Computer software is used to demonstrate accounting concepts and procedures and to provide hands-on experience. Financial Accounting Liabilities [FA3] This intermediate financial accounting course emphasizes liabilities and equities. Topics include legal and financial aspects of partnerships and corporations; current and long term liabilities; shareholder equity; complex debt and equity instruments; leases; accounting for income taxes; pension costs and obligations; accounting changes; cash flow statement; and the analysis of financial statements. Computer software is used to illustrate concepts and provide hands-on experience. Financial Accounting Consolidations & Advanced Issues [FA4] This advanced financial accounting course provides an in-depth study of six major areas of advanced financial accounting: standard setting in Canada and internationally, financial instruments, income tax allocation, long-term intercorporate investments, foreign currency translation and the consolidation of foreign operations, and not-for-profit and public sector accounting. Computer spreadsheets are used to demonstrate concepts and provide practice in advanced financial accounting. Business Law [LW1] This course introduces the Canadian legal system; tort law and professional liability; the principles of contract law; the law governing specific kinds of commercial contracts, including sales, insurance, and employment; debtor and creditor relations; and forms of business organization - agency, sole proprietorship, partnership, and incorporation. Students learn to avoid potential legal problems, to recognize those situations calling for legal expertise, and to communicate more effectively with legal counsel. Management Accounting Fundamentals [MA1] This course introduces the main concepts and practices of management accounting. The main topics are cost accounting fundamentals, job and process costing, cost-volume-profit analysis, budgeting and control, inventory costing, and information for management control and decision analysis. Computer spreadsheets are used to illustrate concepts and provide hands-on experience. Advanced Management Accounting [MA2] This course introduces the important and increasing role of management accountants in guiding the organization towards achieving its objectives. The management control system and techniques to support the organization’s strategies and risk management needs are core components of the course. It also deals with topics relating to corporate governance, controls, performance measurement, and evaluation. Agency theory and ethical considerations are integrated into these topics to provide a deeper understanding of behaviour and moral management. The assessment material in this course is developed to prepare the student for the Professional Applications and Competence Evaluation (PACE) certification courses and exams in the CGA program. The focus is on using critical thinking skills and application of knowledge to real situations through the use of case analysis. Internal Auditing Controls [MU1] This course covers objectives, concepts, principles, and techniques of internal auditing. Students who take MU1 will be well prepared to play a senior role in the internal auditing team of a private or public organization. Topics include the role of the internal auditor; types of audits; enterprise risk management; planning the internal audit; the examination phase of internal auditing; reporting audit observations and monitoring; the impact of information technology on internal auditing; internal audit of purchasing, human resources management, marketing, and financial management; and internal auditing in the public-sector and non-profit organizations. Computer software is used to illustrate concepts and offer students practical, hands-on experience. Managing Information Systems [MS1] This is an introductory course in the use of computer-based information systems in management and accounting. Topics surveyed include the hardware and software of computer systems; file and database organization; networks and telecommunications; the systems development process; designing information systems solutions; systems security and controls; data and knowledge workers; artificial intelligence; and the management of information systems. Information Systems Strategy [MS2] This advanced course in analysis, design, and implementation of computer-based information systems is presented from a management end-user perspective. Topics include major components of a computerized system; identifying systems requirements; the systems development life cycle; detailed systems analysis; detailed systems design, implementation, and management. Issues in Professional Practice [PA1] PA1 provides an overview of the real-world problems faced by external auditors and professionals providing assurance, tax, or business advisory services. The course emphasizes competencies in financial accounting, taxation, assurance, general business, and information technology. Strategic Financial Management [PA2] PA2 provides an overview of strategic financial management. Students take on the role of the strategic financial manager within the organization. The course emphasizes competencies in management accounting, finance, and management information systems. Public Sector Financial Management [PF1] This is an introductory course on the financial management concepts, methods, and standards used in the public sector. Students review and analyze government annual reports and budget documents; critically analyze public sector performance information; review, evaluate, and/or recommend cost management and control practices in public sector enterprises; and identify and manage risk. Public Speaking [001] To assist students in the Greater Vancouver area, the Association offers a public speaking course in each Session. This course takes place over two consecutive weekends. The purpose of this course is to provide a mutually supportive, interactive and positive learning environment in which every student has the opportunity to develop oral communication skills, which in turn foster self-confidence and personal growth. Business Quantitative Analysis [QU1] Topics covered in this course include data description and presentation; summary measures; probability; decision analysis; sampling distributions; applications of sampling and risk analysis; statistical estimation; hypothesis testing; regression and correlation; multiple regression, index numbers and time series; statistical decision theory; and an introduction to linear programming. Computer software is used to illustrate statistical concepts. Personal & Corporate Taxation [TX1] This course covers the fundamental principles, concepts, and application of Canadian federal income tax legislation. Topics include the concepts of income and liability for tax; income from employment, business, and property; shareholder benefits; deductions; capital gains and losses; computation of taxable income for individuals and corporations; an introduction to tax planning; and international taxation. The course emphasizes understanding of the conceptual structure of the Income Tax Act and the application of its rules to practical cases. The course also integrates the use of tax preparation software. Advanced Personal & Corporate Taxation [TX2] This advanced course covers corporate reorganizations, tax planning, and the application of tax principles and concepts to complex tax situations of individuals, trusts, partnerships, and corporations. Topics include shareholder benefits; transfer of property to corporations; anti-avoidance and other rules; purchase or sale of a business; partnerships; death; trusts; and intra-family property transfers. CGA course syllabus      Contact Detail: Certified General Accountants Association of British Columbia 300-1867 West Broadway, Vancouver, BC V6J 5L4 Tel: 604.732.1211 or 1.800.565.1211 Fax: 604.732.1252 Map: Last edited by Neelurk; March 28th, 2020 at 04:37 PM. |