|

#3

November 28th, 2019, 08:21 AM

| |||

| |||

| Re: Bank of Baroda Loan Calculator

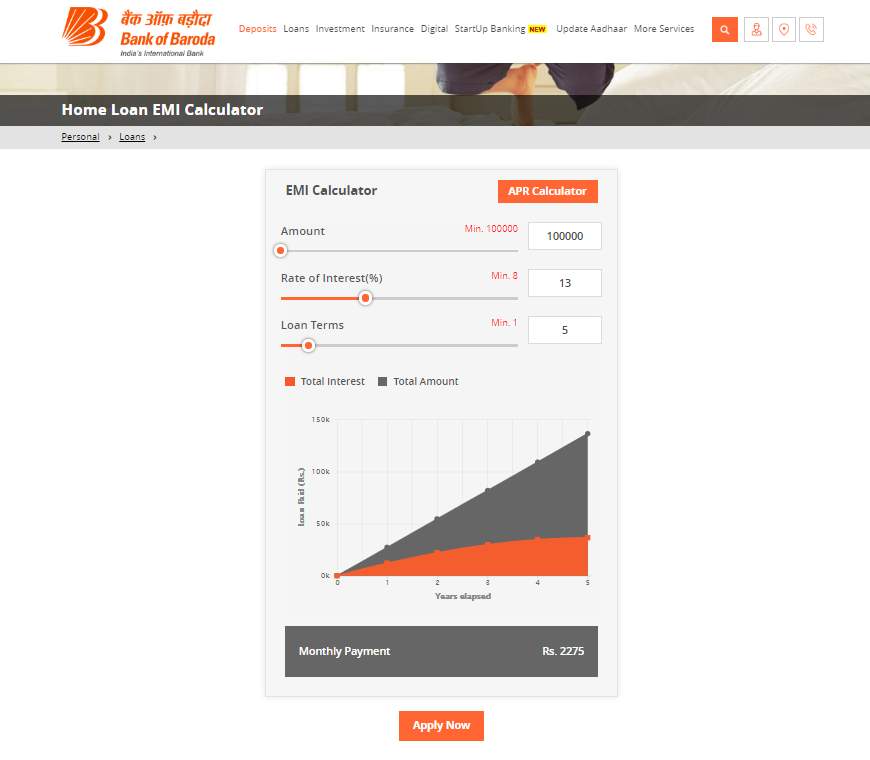

The process to calculate the Equated Monthly Instalment (EMI) through Calculator of BOB (Bank of Baroda) for Home Loan is as follows: Visit the official website of Bank of Baroda Click to Personal on the top of the home page Click to Home Loan Click to EMI Calc under Baroda Home Loan On the new page, fill in all the required details and submit That page will look like this:  Bank of Baroda Personal Home Loan Details All resident and non-resident Indians between 21 and 70 years are eligible for home loans offered by Bank of Baroda for: Purchase of new / old dwelling unit. Construction of house Purchase of plot of land for construction of a house. Repaying a loan already taken from other Housing Finance Company / Bank Repayment period up to 30 years (floating rate option) Reimbursement of cost of plot of land (purchased within 24 months) Loan Amount: The approved home loan amount varies according to location and income of the applicants. Generally, in semi-urban and rural areas the maximum amount is Rs. 1 crore, while in metros the maximum home loan amount can range from Rs. 5 crore to Rs. 10 crore. Interest Rate: The Bank offers attractive interest rate on home loans. The interest rate is linked to the one-year marginal cost of funds-based lending rate (MCLR) of the bank and is reset annually. Tenure and Moratorium: The tenure on home loan varies based on the loan amount and the income of the borrower, and the maximum tenure is 30 years. There is also a moratorium period on home loans, which can be a maximum of up to 36 months after the loan amount is disbursed. Collateral: Bank requires collateral against home loans. Generally, it accept mortgage of the constructed or purchased property as collateral. Sometimes security for home loans can be accepted in the form of insurance policies, government promissory notes, shares and debentures, gold ornaments etc. |