|

#3

November 28th, 2019, 08:15 AM

| |||

| |||

| Re: Loan from Corporation Bank

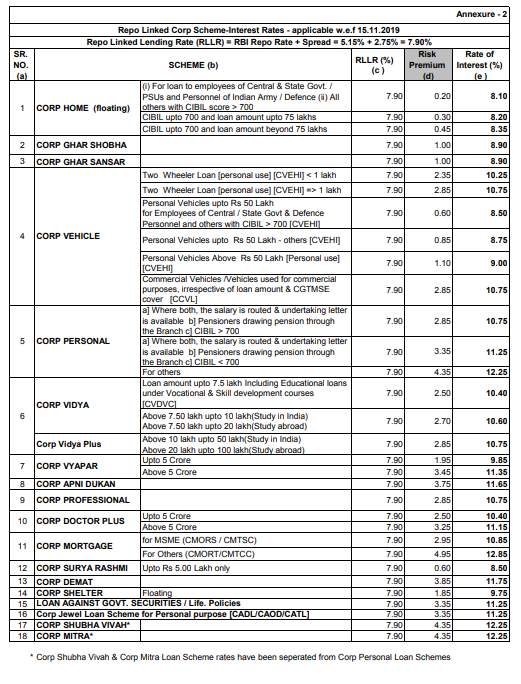

Corp Vidya Scheme [Education Loan] offered by Corporation Bank is to meet expenditures related to pursuing studies in India and abroad. Eligibility One should be an Indian national. One should have passed previous qualifying exam. One should have secured at least 60% marks [55% for one belonging to SC/ST category ] in the previous qualifying exam. One should have secured admission to a higher education course in recognized institutions in India or Abroad through Entrance test / Merit based selection process/through Management quota after completion of HSC [10+2 or equivalent] Loan Amount Study in India – up to Rs.10 lakhs Study Abroad- up to Rs. 20 lakhs Margin Loan up to Rs. 4 lakhs : Nil Loan above Rs.4 lakhs: Studies in India: 5% , Studies Abroad: 15% Security Upto Rs.7.50 Lakh : Co-obligation of Parent/s, Grand Parent/s (if parents are dead) No other security Above Rs.7.50 Lakh : Co- obligation of Parents/ Grand Parent/s (if parents are deceased) together with concrete collateral security along with the assignment of future income of the student for payment of instalments Loan shall be fully secured after maintaining prescribed margin on respective securities offered. In case of married person, co obligate can be either spouse, or the parents or parents -in-law. Prepayment Charges -NIL- Repayment Uniform repayment tenor of 15 years irrespective of loan amount. The repayment tenor is after completion of moratorium/Initial Repayment Holiday Initial Repayment Holiday/Moratorium is Course Period + 1 year Rate of Interest Floating Rate of Interest is linked to MCLR and subject to annual reset Simple interest will be charged during repayment holiday period Concession in rate of interest at 25 bps below the applicable card rate is extended to SC/ST/Women beneficiaries for fresh loans sanctioned/ disbursed on or after 15.08.2008. Concession in rate of interest at 50 bps (inclusive of 25 bps available for SC/ST/Women) below the applicable card rate for girl students for new loans sanctioned/ disbursed w.e.f. 04.03.2009 Interest concession of 0.50% is extended to Physically Challenged students for loans initially disbursed on or after 20.09.2010 Rate of Interest  |