|

#2

January 18th, 2016, 02:38 PM

| |||

| |||

| Re: Which Credit Card Is Best In India

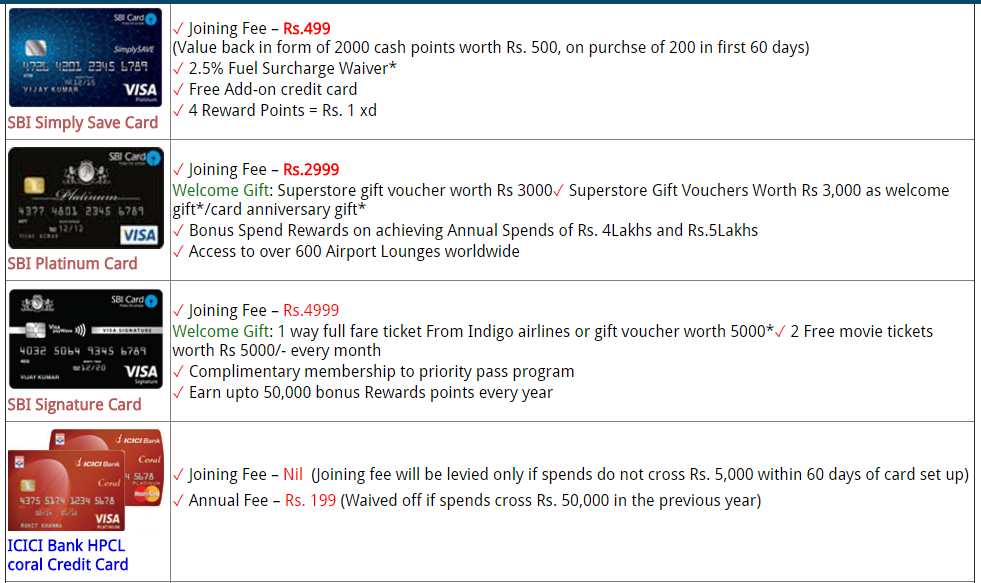

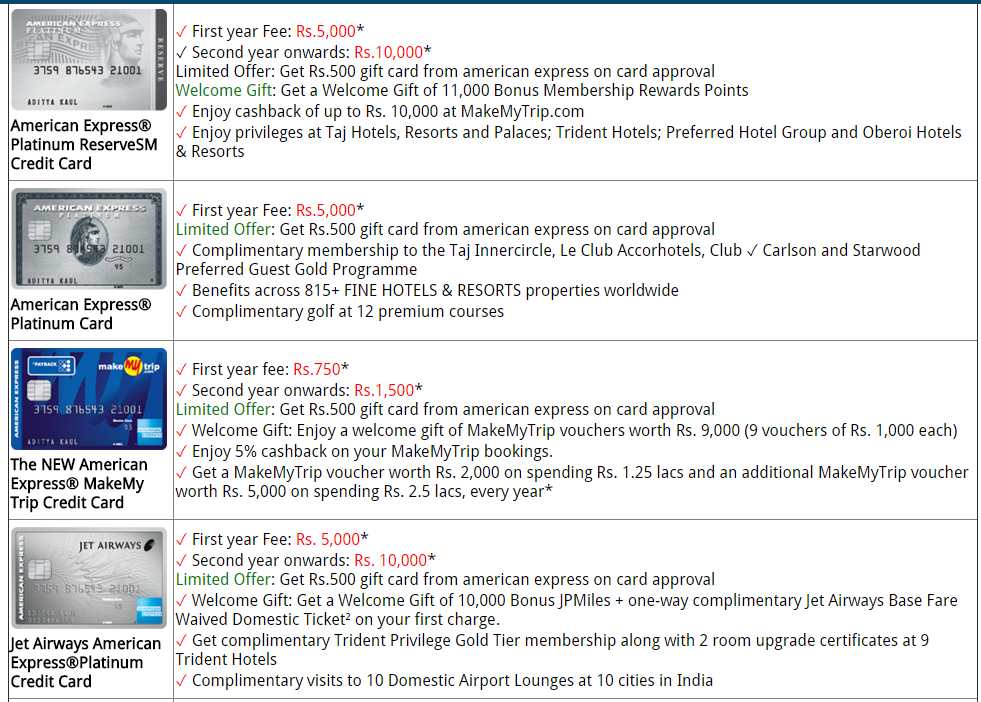

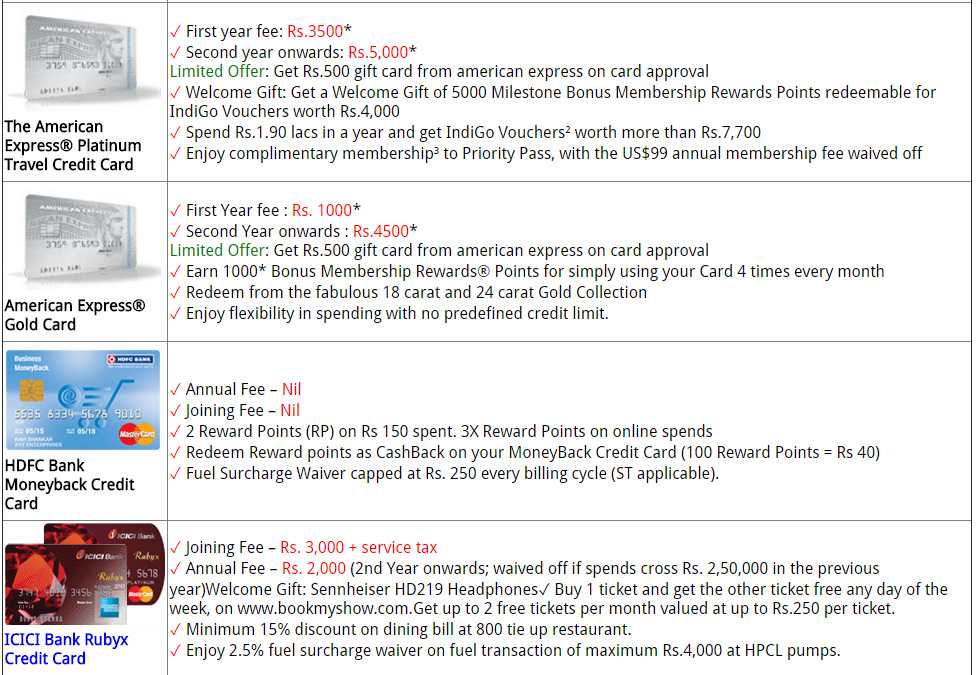

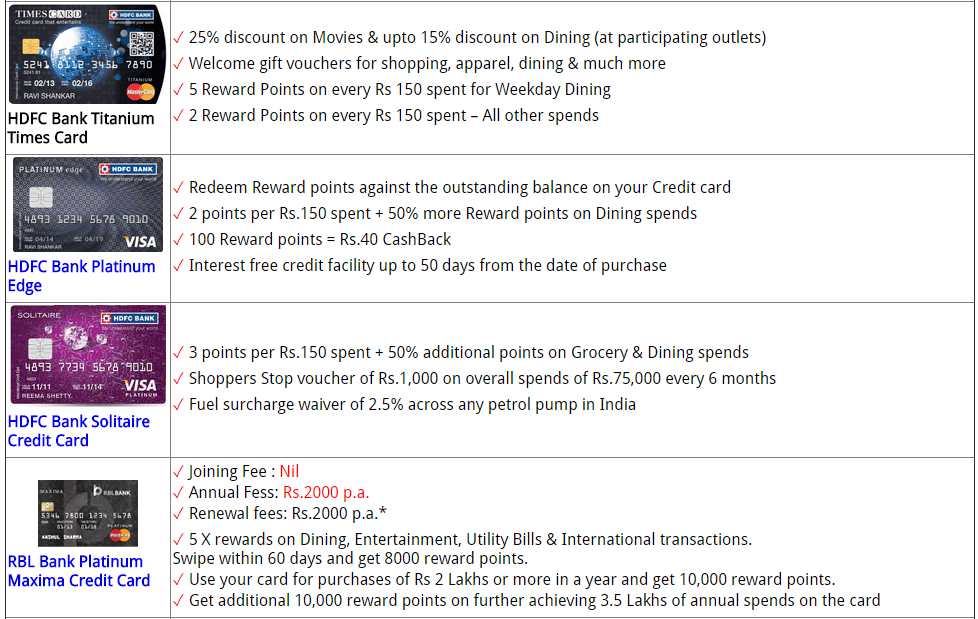

I have knowledge about that, Which Credit Card Is Best in India. So here I am providing you information about it along with Advantages and disadvantages of ICICI, SBI Gold Credit Card. 6 top credit cards in India are – ICICI Bank Credit Card CitiBank Credit Card SBI bank Credit Card HDFC bank Credit Card Standard Chartered Credit Card HSBC Credit Card Advantages of ICICI Credit Card No Joining Fees No Annual Fees Get 100 discount on up to 2 movie tickets per month at BookMyShow 2.5% fuel surcharge waiver on fuel transaction of maximum 4,000 at HPCL pumps Extra Layer of Security with Chip & Pin Card Instant Approval even without any credit history Helpful in building credit history Disadvantages of ICICI Credit Card Money will be blocked in fixed deposit Low credit limit on credit card Interest rate of 2.49% per month on outstanding amount SBI Gold Credit Card – Good card for paying utility bills Advantages; – SBI Gold Card is accepted worldwide and can be used in over 24 million outlets. – You can withdraw cash at VISA/MasterCard ATMs. You can withdraw 2.5% of withdrawal amount or 300/- (WIH) per transaction. – Good credit card for paying bills on a regular basis. – You can book your railway or airline tickets online or at the counter using SBI Gold Card. – Bill payments can be done online but you can also opt for cheque drop box facility.To locate nearest drop box you can sms “PIN” < space > your 6 digit pin code xxxxxx to 56767 and it send you list of nearby places where it is located. Disadvantages; – The SBI Gold card has a joining fee of 299 Rs and an annual charge of 299 Rs. – Card replacement will cost Rs 100. – Interest is 3.35% per month and annual charges is 40.2%. – Cheque pick up charges is Rs 90 and for cheque dishonor the fee is Rs 350 and can go up to Rs 500. Here is a list of the best Credit cards in India as per customer choice     |