|

#2

January 18th, 2018, 01:48 PM

| |||

| |||

| Re: IDBI Agriculture Loan Interest Rate

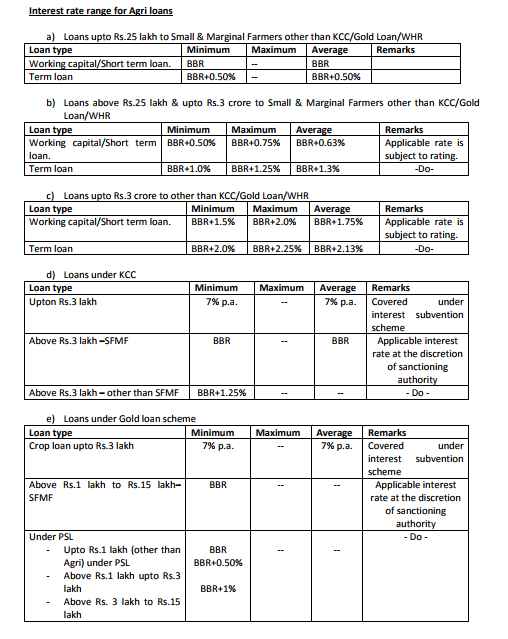

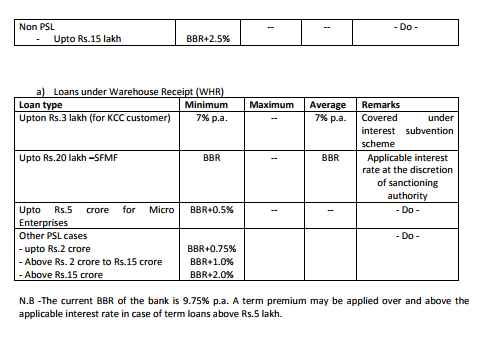

IDBI Bank constantly emphasizes on lending to Agricultural sector. The Bank has several Agri products viz. Crop Loan/Kisan Credit Card, Finance against Warehouse receipt, Investment Credit, Agri Gold Loan, Financing of Allied activities such as dairy, poultry etc., Contract farming etc. to uplift the socio–economic status of rural population. Interest rate range for Agri loans a) Loans upto Rs.25 lakh to Small & Marginal Farmers other than KCC/Gold Loan/WHR Loan type Minimum Maximum Average Working capital/Short term loan. BBR -- BBR Term loan BBR+0.50% -- BBR+0.50% b) Loans above Rs.25 lakh & upto Rs.3 crore to Small & Marginal Farmers other than KCC/Gold Loan/WHR Loan type Minimum Maximum Average Working capital/Short term loan. BBR+0.50% BBR+0.75% BBR+0.63% Term loan BBR+1.0% BBR+1.25% BBR+1.3% -Do c) Loans upto Rs.3 crore to other than KCC/Gold Loan/WHR Loan type Minimum Maximum Average Working capital/Short term loan. BBR+1.5% BBR+2.0% BBR+1.75% Term loan BBR+2.0% BBR+2.25% BBR+2.13% -Do   Contact- Registered Office: IDBI Bank Ltd. IDBI Tower, WTC Complex, Cuffe Parade, Colaba, Mumbai 400005. Customers can contact our 24 X 7 Phone Banking numbers from any Landline / Mobile number, our Toll free numbers are as follows: 1800-200-1947 1800-22-1070 |