|

#2

December 16th, 2017, 10:47 AM

| |||

| |||

| Re: SBI MF Tax Saver

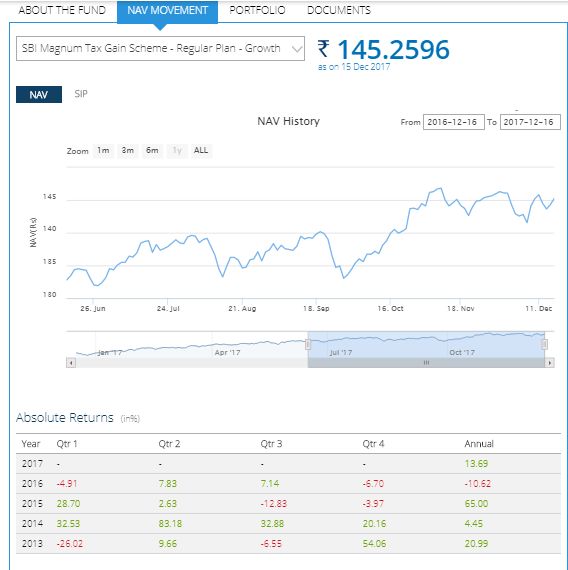

Tax planning is an essential but challenging process to undertake. In the sea of tax saving instruments available for investors, mutual funds through equity linked savings scheme (ELSS) provide an option to gain from the growth potential of equity markets while getting tax benefits. SBI Magnum Tax Gain Scheme SBI Magnum Tax Gain Scheme aims to deliver the benefit of investment in a portfolio of equity shares, while offering tax deduction on such investments made in the scheme under section 80C of the Income-tax Act, 1961. It also seeks to distribute income periodically depending on availability of distributable surplus. Investments in this scheme would be subject to a statutory lock-in of 3 years from the date of investment to avail benefit of Section 80C of Income Tax Act. Category: EQUITY AAUM: 6238.34 Cr as on 31 Oct 2017 Investment Options: Dividend , Growth Inception: March 31, 1993 S&P BSE 100 Index ELSS investments are eligible for tax deduction up to Rs. 1,50,000 per year from gross total income under Section 80C of Income Tax Act, 1961. Investors looking at dual advantage of saving taxes along with exposure to equity markets may invest in this fund. This portfolio is ideal for investors who would like to invest for long-term capital appreciation. NAV Movement  Customer Service. 1800 425 5425 / 1800 209 3333 (Toll Free No) |